The 300 leading pension funds in the world have reached a record volume of 24.4 trillion dollars in assets under management as of the end of 2024, according to the Top 300 Pension Funds report prepared by the Thinking Ahead Institute of WTW, in collaboration with Pensions & Investments.

According to the authors of the report, this figure represents a new milestone for the sector, surpassing the previous peak recorded in 2021, which was 23.6 trillion, and marking three consecutive years of recovery following the 2022 market correction. Even so, they explain that the growth rate has slowed: assets increased by 7.8% in 2024, compared to the 10% rise recorded in 2023.

Asset Concentration and New Priorities

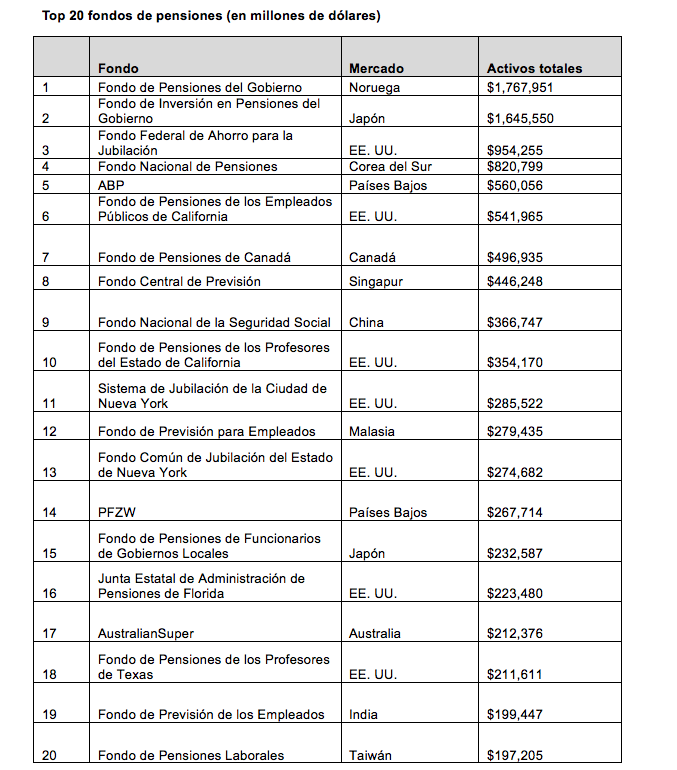

The report also highlights an increase in concentration: for the first time, the 20 largest funds collectively manage more than 10.3 trillion dollars, representing 42.4% of the Top 300 total. “This subgroup grew 8.5% year-over-year, outpacing the growth rate of the overall ranking,” the report concludes.

Among the emerging strategic priorities, the document notes a greater focus on artificial intelligence: 10 funds are strengthening their AI capabilities, and 9 already consider it a priority pillar of their portfolio management. Likewise, volatility, macroeconomic uncertainty, and inflation are consolidating as the main concerns for these institutional investors.

Shift in Global Leadership

Norway’s sovereign fund, the Government Pension Fund, has become the largest fund in the world with 1.77 trillion dollars, overtaking for the first time in over 20 years Japan’s Government Pension Investment Fund (GPIF).

By region, North America consolidates its leadership, accounting for 47.2% of total assets in 2024. Although Europe slightly reduces its share to 23.7%, it continues to play a strategic role in shaping more sustainable pension models and in the adoption of ESG criteria in institutional investment. In countries such as the Netherlands and the United Kingdom, advanced practices in governance and portfolio diversification are observed. Asia-Pacific, for its part, represents 25.5%, also showing a slight decline.

According to Juan Díez, Investments Associate at WTW Spain, large pension funds are facing an increasingly complex landscape. “In an environment of rising macroeconomic volatility and growing geopolitical tension, high market concentration has catalyzed this effect, even impacting well-diversified portfolios,” he argues.

On the other hand, Díez emphasizes that the conclusions of the Top 300 report are clear: “The importance of these investment vehicles for public bodies, private companies, and individuals is at a historic high, as demonstrated by the record volume of assets under management. Faced with the growing complexity and importance of their role, funds are responding. More and more, they seek to raise governance standards, focus on long-term outcomes, and improve decision-making by exploring more innovative approaches such as the Total Portfolio Approach.”