In the opinion of Mobeen Tahir, Director of Macroeconomic Research & Tactical Solutions at WisdomTree, this has been a year of acronyms in the financial markets.

“Everything started with MAGA: Make America Great Again. Occasionally, some have given it a satirical twist with MAGA: Make America Go Away, or MEGA: Make Europe Great Again. In fact, this year, the largest investment flows into European rather than U.S. assets have often accompanied this satirical view. In this list, of course, one must include DOGE: the Department of Government Efficiency. And, more recently, TACO,” notes Tahir.

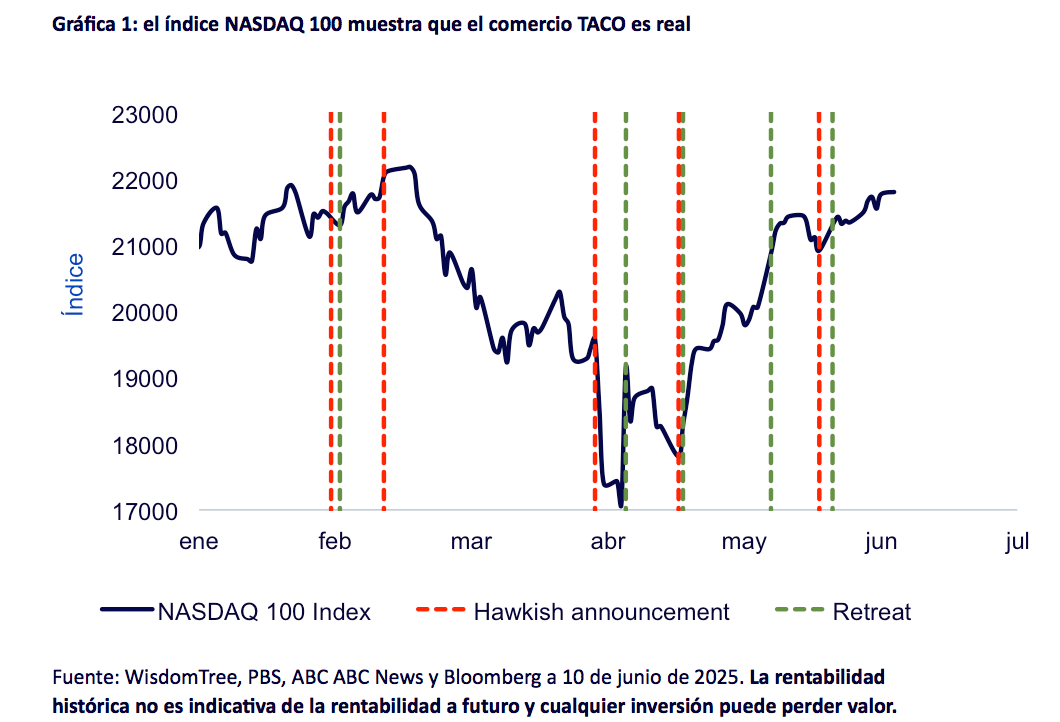

According to him, this last term has been coined by Financial Times contributor Robert Armstrong, and it means Trump Always Chickens Out. And the acronym does not refer to Mexico, although that country does have some ties to it, but rather describes President Trump’s pattern of making bold political announcements, such as imposing tariffs or threatening the U.S. Federal Reserve, only to later backtrack and soften. For the WisdomTree expert, this has, of course, translated into significant market volatility.

“For Nasdaq 100 investors, TACO has meant a roller coaster, as can be seen in the chart below. For those inclined to trade tactically around these sharp market swings, there have been many opportunities to take positions in one direction or the other,” points out Tahir.