The U.S. Federal Reserve (Fed) held its final meeting of 2025 yesterday and announced a 25 basis point cut, in line with market expectations. Thus, the year ends with interest rates in the target range of 3.5% to 3.75%. In the opinion of international asset managers, the fact that the Fed continues to lean toward lower rates, even as the U.S. records stronger inflation and growth, highlights a disconnect in global monetary policy.

“Available data suggest that economic activity has expanded at a moderate pace. Employment growth has slowed this year, and the unemployment rate has slightly increased through September. The most recent indicators confirm this trend. Inflation has been rising since the beginning of the year and remains at elevated levels,” the Fed stated.

According to Gordon Shannon, portfolio manager at TwentyFour Asset Management (a boutique of Vontobel), this is an aggressive cut, as the FOMC has signaled a higher bar for monetary policy easing in 2026. “Investors are lowering their expectations for the number of rate cuts the Fed might implement. However, with the highest number of dissenters since 2019, even before the arrival of the new chair, the committee appears fractured,” Shannon notes.

From the FOMC’s Perspective

Experts from asset management firms agree that the monetary institution faces a delicate balancing act: curbing inflation while supporting the labor market so that households feel economically secure. During the meeting, Powell warned that there is no risk-free path and pointed out that a reasonable reference is that tariff-driven inflation effects—essentially a one-time shift in price levels—are likely to ease, highlighting notable progress this year in non-tariff-related inflation.

Additionally, the Fed emphasized that future measures will depend on the data, shifting to a firm meeting-by-meeting approach. As highlighted by Daniel Siluk, portfolio manager and Head of Global Short Duration and Liquidity at Janus Henderson, Powell reinforced this stance during his press conference, stating that the Committee views today’s cut as a “prudent adjustment” and not the beginning of a new cycle.

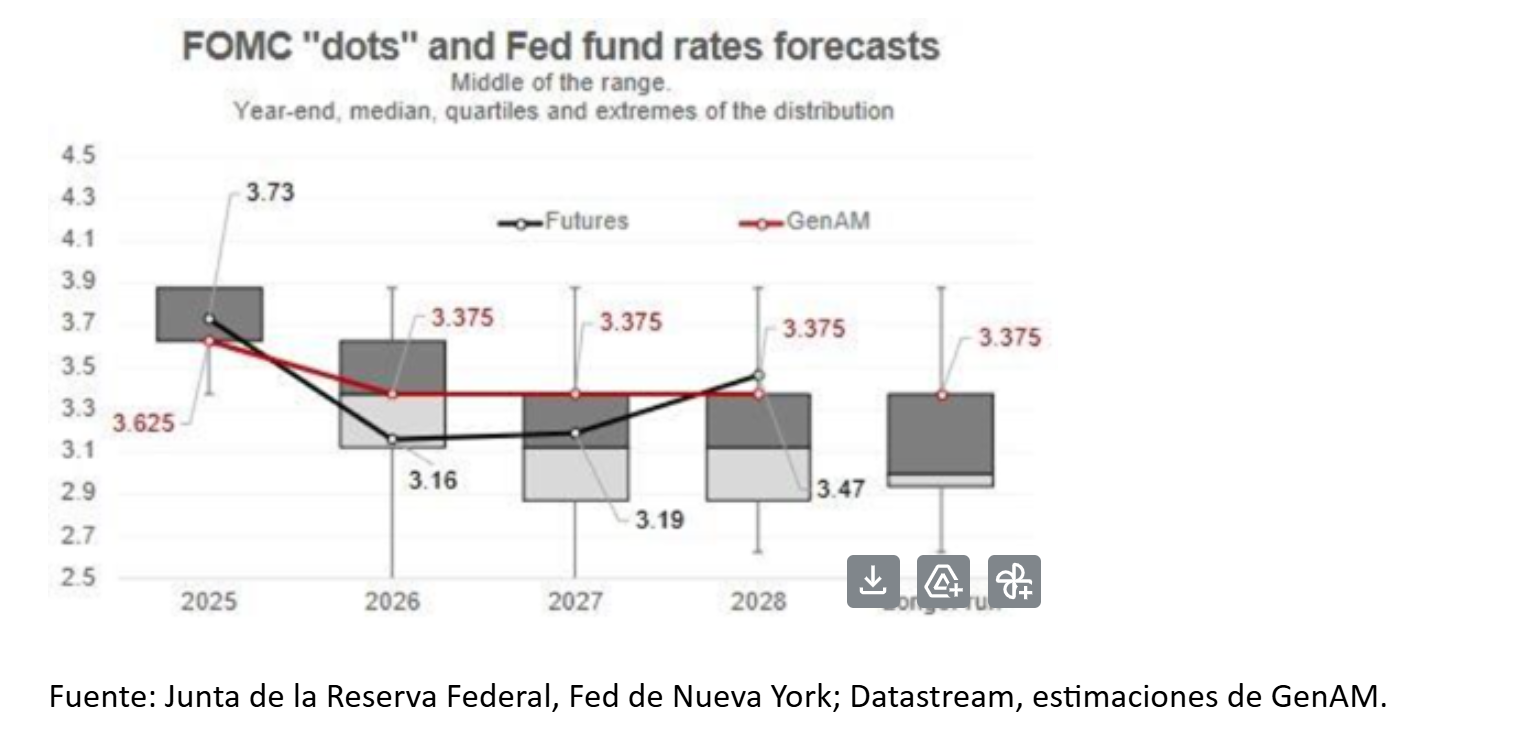

“The Summary of Economic Projections (SEP) echoed that hawkish tone. Growth forecasts for 2026 and 2027 were revised slightly upward, inflation slightly downward for 2026, and unemployment remained stable over the medium term—hardly a context conducive to aggressive easing. The median dot plot for official interest rates remained unchanged at 3.6% for 2025 and 3.4% for 2026, indicating just one cut per year. Long-term expectations remain anchored at 3.0%,” Siluk explains.

Looking Toward 2026

That covers the Fed’s reasoning—but what does this decision mean looking ahead to 2026? In the short term, Ray Sharma-Ong, Deputy Global Head of Multi-Asset Bespoke Solutions at Aberdeen Investments, believes the Fed’s decision justifies a relief rally in the markets. “Markets went into the FOMC meeting concerned about a possible discussion of a rate hike. Powell’s comment that a hike was ‘not the base case’ removed that risk for now. Additionally, markets will be relieved by the Fed’s decision to address tension in repo and funding markets through the purchase of $40 billion in bills via the OMO, which will serve as a temporary short-term liquidity measure,” explains Sharma-Ong.

Beyond this immediate relief, the Aberdeen Investments expert adds that Fed monetary policy is no longer a catalyst for markets. “The long-term neutral rate remained at 3%. Now that the federal funds rate sits between 3.5% and 3.75%, the Committee views monetary policy as within the effective neutral range. The bar for further cuts is very high, suggesting the monetary policy landscape is likely to remain static for some time,” he argues.

Looking ahead to next year, Tiffany Wilding and Allison Boxer, economists at PIMCO, maintain that the Fed enters 2026 in a wait-and-see mode, shifting from cuts to caution. With the interest rate in neutral territory, the Fed turns to data dependency and faces a delicate balancing act in 2026. “Barring an economic shock, we are unlikely to see another rate cut until the second half of next year. Our outlook is largely aligned with that of the Fed and current market pricing: we expect the Fed to keep rates steady in the 3.5% to 3.75% range for the remainder of Powell’s term as chair, which extends through May, before gradually resuming rate cuts later in the year under new Fed leadership,” the PIMCO economists argue.

Disagreements

One of the conclusions from this latest Fed meeting is that the decision taken did not have unanimous support from FOMC members, as Stephen Miran advocated for a 50 basis point cut, contrary to the majority. On the other hand, Jeffrey Schmid, Governor of the Kansas Fed, and Austan Goolsbee, Governor of the Chicago Fed, argued in favor of keeping rates unchanged.

“The Fed’s decision to cut rates came with three dissenting votes—the highest number since 2019. This highlights growing disagreement within the Fed in recent months regarding the next steps on interest rates, reinforcing a point we already made in October: the rate-setting committee now faces more complex decision-making dynamics,” notes Jean Boivin, Head of the BlackRock Investment Institute.

In this regard, for Max Stainton, Senior Global Macro Strategist at Fidelity International, the trajectory of interest rates in the market will increasingly be determined by speculation surrounding Donald Trump’s choice of the new Fed chair, rather than by the data.

“In our base case for 2026, we anticipate that the Trump Administration will appoint a dovish and non-traditional chair, whose main objective will be to further lower rates. This dynamic will likely distort the forward rate curve around the date the new chair takes office, in May 2026, with a new cutting cycle being priced in if this scenario materializes. Although the market has already begun to price in this possibility, there is still room for this to extend across both the short and long ends of the curve, with the arrival of a non-conventional dovish chair representing an underappreciated risk for the long end,” states Stainton.