The political tension from Donald Trump, President of the U.S., toward Jerome Powell, head of the U.S. Federal Reserve (Fed), regained prominence after Treasury Secretary Scott Bessent avoided confirming whether Powell will be removed. According to experts, this is a new chapter in a story we’ve been hearing for just over a month. Just last week, these same rumors disrupted the markets.

“Despite the tense backdrop with the Fed, Bessent avoided giving opinions on the possible dismissal of Chairman Jerome Powell, whose term ends next May, hinting that the final decision lies solely with President Trump. However, recent reports from The Wall Street Journal stated that Bessent had privately warned Trump about the negative impact on markets if Powell were removed—something the president emphatically denied through his official account on X, insisting that ‘no one explains anything to him’ and taking personal credit for the market’s record highs,” says Felipe Mendoza, financial markets analyst at ATFX LATAM.

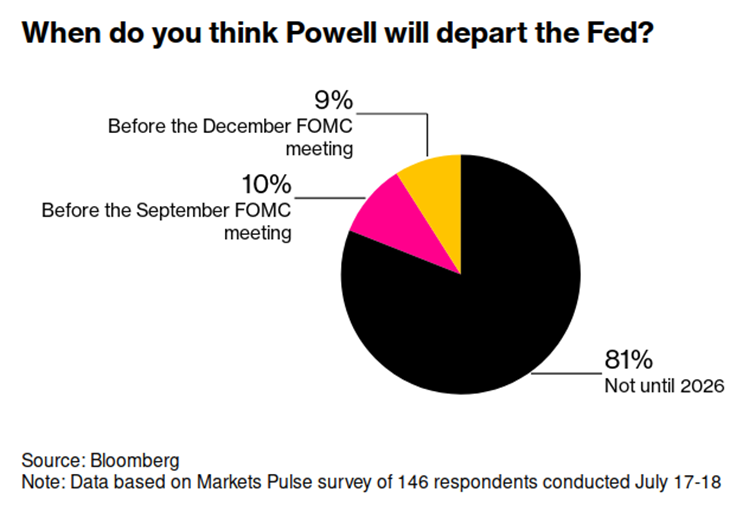

In this context of pressure on the Fed, financial markets tend to react initially to headlines by taking refuge in defensive assets such as U.S. Treasury bonds and gold, while the U.S. dollar weakened and stocks experienced brief volatility before stabilizing following Trump’s clarification. According to UBS, prediction markets assigned a probability of approximately 21% that Powell will not continue in his position in 2025. Furthermore, the dollar has recently reached its lowest level in three years, weakened by headlines about a potential early leadership change at the Fed.

“While we continue to consider the probability of a change in Fed leadership to be low, recent events have drawn increased attention from policymakers and investors. Although the situation remains speculative, global investors should take into account the possible implications of a challenge to the Fed’s independence, the legal considerations for removing its chair, and the political implications for monetary policy,” UBS states in its report.

The Consequences

According to the document, a move to dismiss the Fed chair could raise doubts about the long-term credibility of U.S. monetary policy and about the Fed’s independence, which has historically been considered a fundamental pillar of the financial system. “This comes at a time when there are already concerns about the U.S.’s fiscal sustainability, inflation, and the dollar as a store of value. Such an event could lead investors to demand higher risk premiums on U.S. public debt, especially if it generates greater uncertainty about inflation or interest rate policy. Aggressive rate cuts under political pressure might not translate into lower yields across the curve, as investors could begin to anticipate greater inflationary risks. These developments could also negatively affect the U.S. dollar’s role as a global reserve currency,” warns UBS.

In the opinion of Deborah Cunningham, Chief Investment Officer for Global Liquidity at Federated Hermes, one of the many costs of President Trump’s attacks on Fed Chair Powell is presenting monetary policy as black or white, with no middle ground. “It might have seemed that way decades ago. Before Chair Bernanke opened it up to the public, the Federal Reserve was a black box. It communicated mainly through Federal Open Market Committee (FOMC) statements and daily market operations, rather than through speeches, press conferences, and congressional testimony. But monetary policy is as gray as anything in economics, involving both opinion and data,” she explains.

In her view, Trump’s tirades also drain healthy debate about the central bank. “Had he not issued a rant after the FOMC held rates steady last month, the main story could have been a growing unease among officials. It actually should be. No participant dissented from the decision, but the June Statement of Economic Projections (SEP) changed subtly compared to March’s, suggesting a possible split. While the median federal funds rate remained at 3.9%—implying two quarter-point cuts this year—seven voters indicated zero cuts, compared to four in March,” Cunningham adds.

Their Different Points of View

According to the Market Flash from Edmond de Rothschild AM, beyond the pretext of poor management of the bank’s renewal plans, the episode illustrated two radically opposing views on U.S. inflation and growth. “On the ‘rear-view mirror’ side, we find Donald Trump and the candidates to succeed Jerome Powell as Fed Chair. With inflation trending toward 2%, they advocate for urgent rate cuts to halt the economic slowdown and deteriorating labor market. The ‘windshield’ side, which includes Adriana Kugler, a Powell supporter and member of the Fed’s Board of Governors, encourages the bank to keep rates where they are, as tariffs should push inflation above 3% by the end of 2025,” they explain in their report.

The financial institution is anchored in a “wait-and-see” stance pending the impact of the new trade policy of the Trump Administration. According to Edmond de Rothschild AM experts, the Fed had expected the trade war to have only a fleeting effect on inflation, but Donald Trump’s recent announcements—delaying the 200% tariffs on pharmaceuticals until 2026—could prolong the impact and cause a de-anchoring of long-term inflation expectations.

“The data seem to suggest that Jerome Powell’s side is right: weekly jobless claims, excluding seasonal effects, indicate that the economy is at a cyclical high, yet showing resilience. Consumer spending remains strong: retail sales have rebounded sharply after a disappointing start to the year. The latest CPI reading revealed a significant increase in goods inflation, particularly in areas sensitive to tariffs like electronics, although overall inflation still appears to be under control thanks to shelter trends. Donald Trump expected that the tariff hikes would be absorbed by exporters to the U.S., but the fact that import prices have only fallen slightly suggests that U.S. businesses are bearing most of the increases,” they note.