In presenting their outlooks for 2026, all international asset managers have devoted significant attention to artificial intelligence, both as an investment opportunity and as a key driver of economies and global growth.

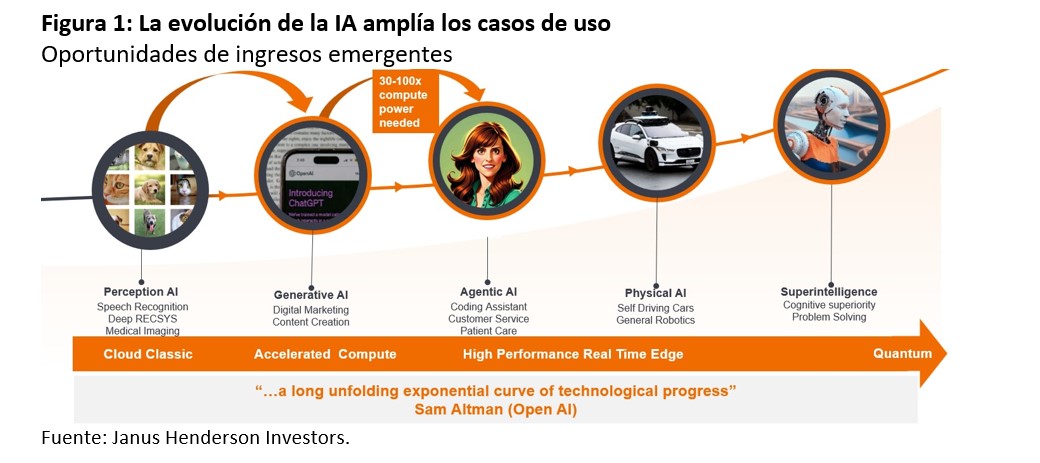

“AI is a long-term wave, not just a theme. A technological wave—AI is the fourth wave after mainframes, personal computers connected to the Internet, and the mobile cloud—is defined by the fact that it affects all aspects of the economy. It requires investment across every layer of the tech stack, from silicon—semiconductors—to platforms, devices, and models, and every company becomes, in some way, a user of AI. These waves take several years to evolve, and in the case of AI, the pace of capacity development is constrained by deglobalization, permitting, energy availability, construction limitations, and availability within the computing supply chain,” emphasize Alison Porter, Graeme Clark, and Richard Clode, portfolio managers at Janus Henderson.

According to Janus Henderson portfolio managers, there is a circular problem, as the limiting factor for demand in computing power has been the available capacity to train and develop new models. “As we move from generative AI to agentic AI, more reasoning and memory capacity is needed to provide greater context. This requires significantly more computing power to increase token generation (units of data processed by AI models). We are seeing areas such as physical AI rapidly developing, with the expansion of autonomous driving and robotics testing worldwide. In short, looking ahead to 2026 and 2027, we believe demand for computing power will continue to outpace supply,” they argue.

Are We in an AI Bubble?

In contrast to this highly positive scenario, investors remain attentive to the ongoing debate over whether we are currently in an AI bubble. According to Karen Watkin, multi-asset portfolio manager at AllianceBernstein, the defining feature of this bull market is its narrow leadership. “AI-driven technology companies have delivered extraordinary gains, creating a K-shaped market: a few large winners while many are left behind. This concentration drives index returns but introduces fragility. The U.S. economy is asymmetrically exposed: wealthier households hold most of the equity and sustain consumption, so an AI correction could impact spending and potentially lead the economy into a recession,” she explains.

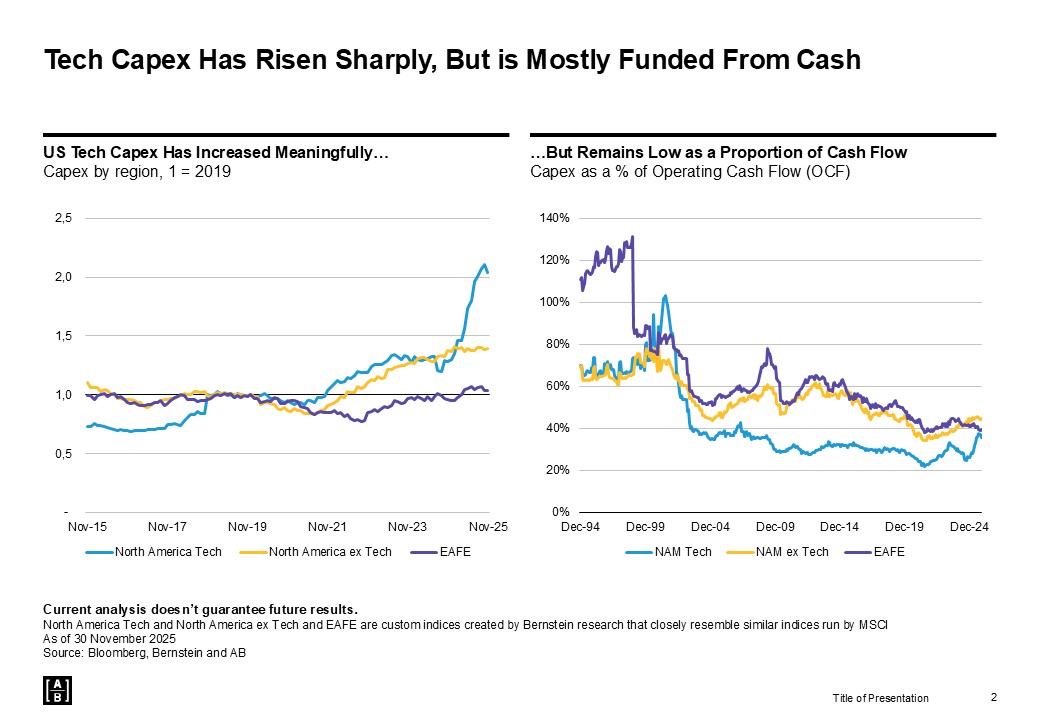

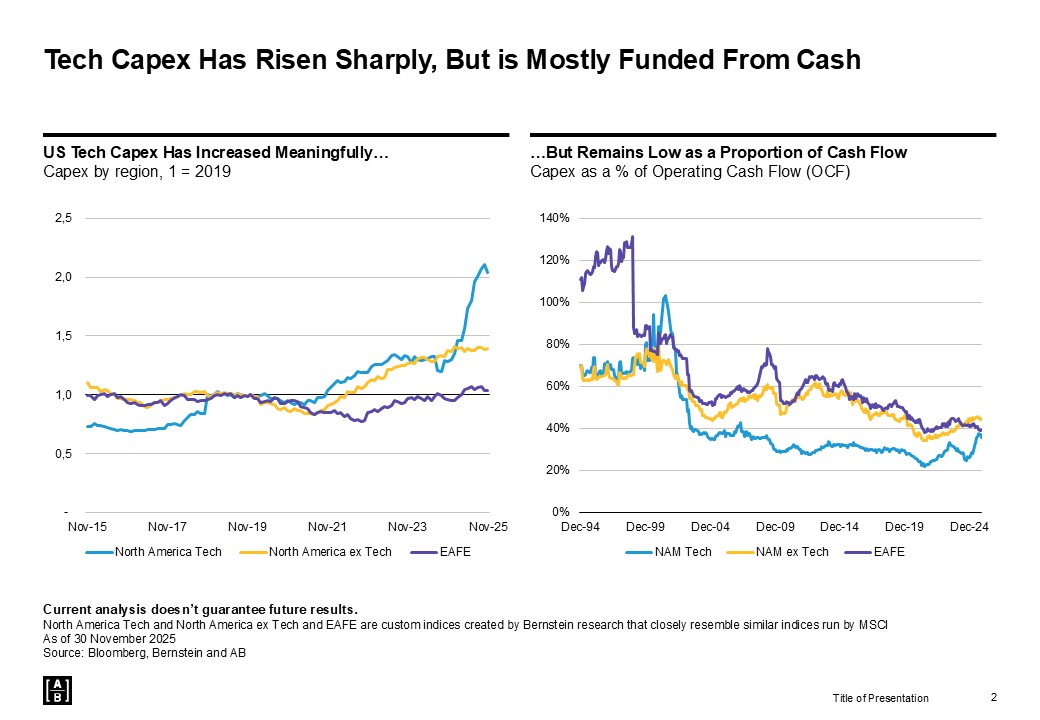

Watkin believes that, for now, fundamentals offer some reassurance: earnings growth—not just multiple expansion—has driven returns. According to her analysis, hyperscaler capex—though extraordinarily high—is largely funded by strong cash flows rather than debt, but signs of increasing leverage and debt issuance are being monitored. “We also observe more structural risks: circular funding patterns, such as repeated cross-investments and successive corporate transactions, which can introduce fragility. And while adoption trends are promising, imbalances between supply and demand, energy bottlenecks, and the risk of obsolescence could challenge the AI-driven economy,” she states.