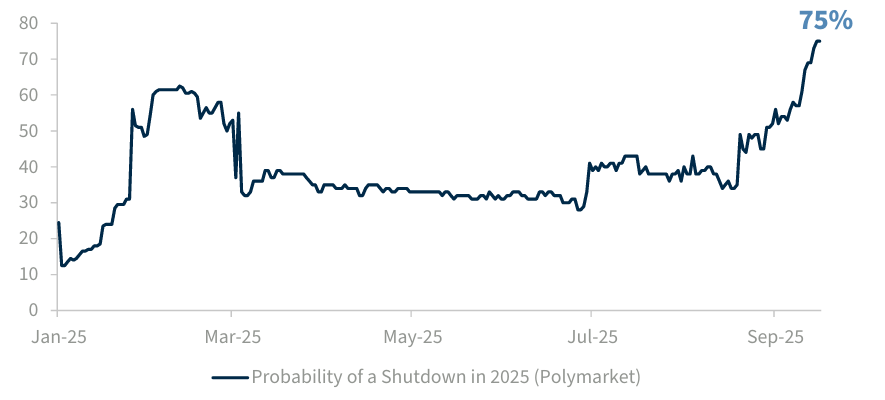

Since 1976, there have been 20 partial shutdowns with an average duration of one week, although the longest lasted 35 days. Throughout history, only four of these shutdowns extended beyond a single business day. The most recent was the 35-day standoff between late 2018 and early 2019—the longest shutdown in U.S. history—which occurred during President Trump’s first term. A new actual shutdown will now be added to that list as of October 1. What do investors need to know about this shutdown?

First, that shutdowns are not uncommon; and second, historically, Treasury bonds have served as a safe-haven asset during these periods—though it will be interesting to see if that remains the case given the recent challenges observed.

“The S&P 500 has shown little movement during shutdowns, but stocks and bonds typically fall before shutdowns and rebound once they begin, as expectations of a resolution increase. Prolonged shutdowns, like the 35-day one in 2018–19, can affect GDP and unemployment, although these effects tend to reverse once the crisis ends,” says Benoit Anne, Senior Managing Director and Head of the Market Intelligence Group at MFS Investment Management.