However, a sharp shift in the growth outlook or a negative ruling by the Supreme Court regarding the use of tariffs could put pressure on yields and affect risk assets through:

Increased rate volatility

Less room for Fed rate cuts

Repricing of valuations

For this reason, we maintain a neutral view on equities, awaiting the right moment to increase positions.

Severe Correction in Software Within the Tech Sector

The week was also marked by a sharp correction in the technology sector, particularly in software. Despite the structural strength of the AI investment cycle, software companies experienced a capitulation session on Tuesday, with market capitalization losses exceeding $300 billion.

The decline was triggered by:

New functionalities announced by Anthropic CoWork

Comparisons to the impact of DeepSeek in 2025

Fears of disruption to SaaS models and per-user licensing

Initial drops concentrated in firms such as RELX, S&P Global, Thomson Reuters, and Legalzoom.com, later spreading across the sector and to private equity firms with significant exposure

However, the mass selloff appears to be driven more by panic than objective analysis. Disruption risk is real, but many stocks are already trading at decade-low multiples after a roughly 40% valuation compression. At these levels, much of the potential impact appears to be already priced in.

AI and CapEx: The Cycle Continues

Our view that 2026 will not be the year the AI bubble bursts is further reinforced. Hyperscalers are not only continuing to expand their computational capacity but are also significantly revising their investment plans upward. Alphabet now targets $180 billion, up from the previously expected $116 billion, while Amazon raises its estimate to $200 billion from the previous $150 billion. Altogether, AI investment could exceed $700 billion in 2026.

Toward a Less Concentrated Market

With more dynamic economic growth, the door opens to a more balanced market, where returns are no longer so heavily concentrated in technology and communications. The growing divergence in performance, and valuation, between winners and losers within the AI universe points to increased market selectivity.

The recent decline in software may have been the first step toward a broader rotation: from defensive growth to cyclicals, and from thematic concentration to structural diversification.

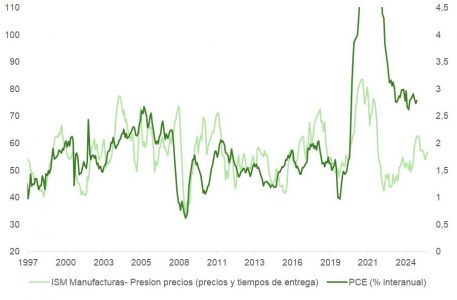

In conclusion, the ISM data signals the beginning of a new phase in the economic cycle, with manufacturing emerging from contraction and AI investment far from exhausted. However, concerns around inflationary pressure could resurface, requiring tactical caution and balanced portfolio construction. The key for 2026 will be clearly distinguishing between real opportunities and speculative noise surrounding disruptive technology.