The U.S. dollar is experiencing its weakest year in over a decade. As of September 2025, the dollar index, which measures its value against other major currencies, had fallen by nearly 10%. In other words, the currency declined even further against the euro, Swiss franc, and yen, and dropped 5.6% against major emerging markets. This is according to Morningstar’s 2026 Global Outlook Report, prepared by Hong Cheng, Mike Coop, and Michael Malseed.

According to Morningstar analysts, this weakness stems from a combination of structural and cyclical factors. Among them are fiscal concerns, with sustained debt growth and the impact of the so-called “Big Beautiful Bill,” as well as reduced confidence in U.S. economic growth relative to other regions. In addition, political uncertainty—which affects perceptions of the Fed’s independence and the country’s trade decisions—has also influenced investor confidence. Changes in global capital flows and increased hedging of dollar-denominated assets have added pressure on the currency.

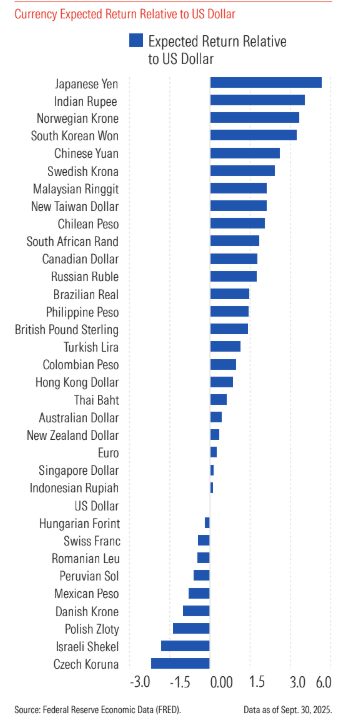

Despite these declines, experts stress that this does not represent a structural collapse. “The dollar remains the dominant international reserve and settlement currency and retains its appeal as a safe haven in times of stress. In fact, only nine of the 34 major developed and emerging market currencies analyzed are currently more overvalued than the dollar, indicating that it still holds relevant value for investors,” they explain.

For those investing from the U.S., Morningstar recommends taking advantage of this phase to increase exposure to international markets. “This not only allows for portfolio diversification but also offers the possibility of benefiting from the appreciation of other currencies against the dollar. For investors outside the U.S., maintaining exposure to the dollar remains relevant, especially in portfolios with a high weighting in U.S. equities. Currency hedging management can help stabilize returns, although the costs of this strategy vary: they are nearly zero in the United Kingdom, around 4% annually in Japan or Switzerland, and positive in countries with high interest rates, such as South Africa,” the document states.

Finally, the analysts agree that the weakness observed in 2025 marks a turning point in the long cycle of dollar strength, but not its structural decline. For investors, this phase represents an opportunity to strengthen global diversification and consider an increasingly relevant role for other currencies and regions in future returns. The general recommendation is to maintain a balanced approach, combining dollar exposure with international investments, to optimize the risk-return profile of portfolios.