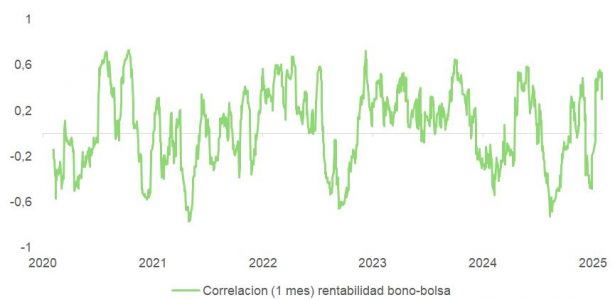

The market continues to price in an accommodative Fed: the yield curve projects a terminal rate below 3% by December 2026. This has limited the downside in the 10-year bond yield, currently anchored around 4%.

The key to rate direction lies in labor data. Differences within the FOMC over whether to implement one or two additional cuts before year-end will be resolved—if inflation expectations remain stable—based on employment trends.

Labor Outlook: Mixed Data, Mixed Reactions

The decline in immigration and the slow normalization of the labor market after the pandemic complicate projections. This structural disruption makes it difficult to apply historical models reliably.

The market is particularly sensitive to any data that could disrupt the current balance. Statistics such as those released this Thursday will be key, as they could trigger volatility in the short end of the curve and define its steepening.

A deterioration in the labor market, if interpreted by the Fed as structural rather than cyclical, could prompt more aggressive cuts in the short term. This scenario would benefit tech stocks, which have historically thrived in environments with negative real rates and moderate but sustained growth expectations.