Looking back on 2025 in the Latin American region, we see that the main economies of Latin America successfully navigated a period marked by rising trade tensions and global uncertainty. According to experts’ views, the main takeaway from the year is that, except for Brazil, the impact of tariffs imposed by the Trump Administration has been much better than expected.

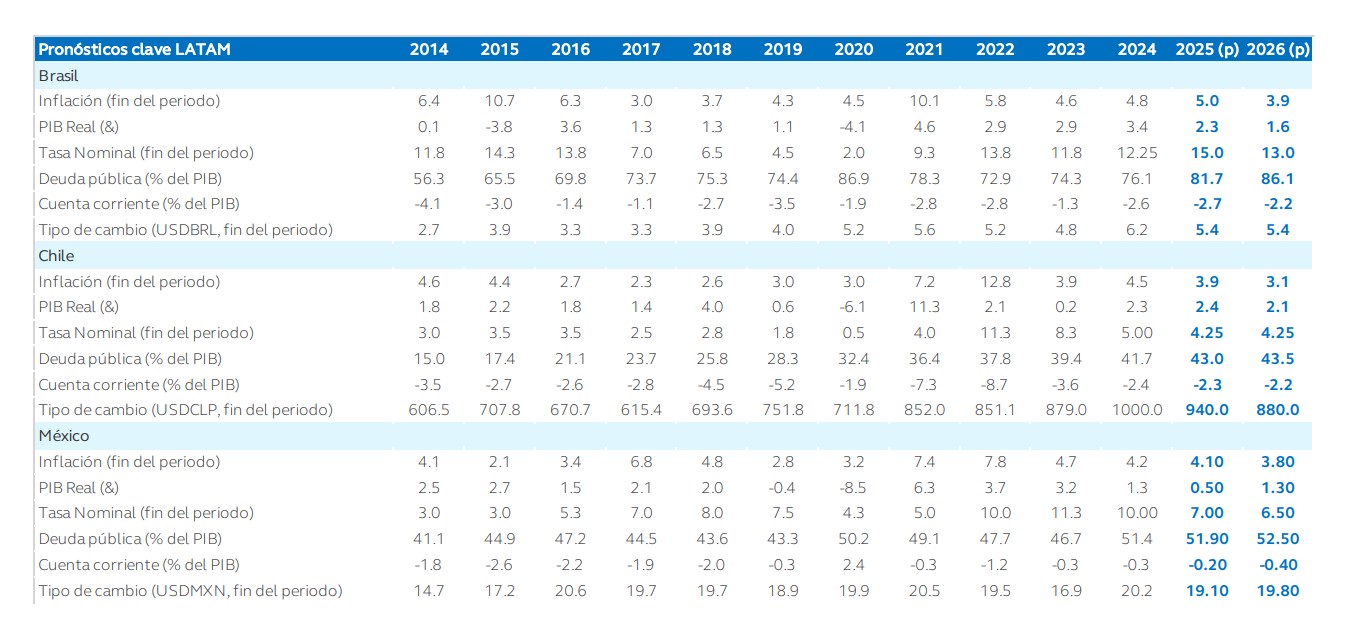

“Beyond the fact that the region remained largely unaffected by the direct impact of U.S. tariff pressures, favorable terms of trade and a still-tight labor market sustained consumption and explain the resilience of economic activity throughout the year. The most relevant countries are expected to grow by more than 2% in 2025 and, although Mexico would grow by only 0.5%, it avoided a recession and has seen upward revisions in recent months,” highlight the authors of the outlook report prepared by Principal Asset Management LATAM, including Marcela Rocha, chief economist, who presents the 2026 Economic Outlook.

Monetary and Fiscal Policy

One of the defining features of the region’s economy is that, while the rest of the world continued to struggle to control inflation, Latin American countries have mostly benefited from a synchronized cycle of global monetary easing and a weaker dollar, which strengthened local currencies and supported a significant disinflation trend in recent months. In fact, with the exception of Brazil, most central banks had room to cut policy interest rates.

“In 2026, the outlook changes. While Mexico’s GDP is expected to accelerate, most of the region will face slower growth. With economic activity projected below potential, Brazil stands out as the only country with significant room for further rate cuts. In the rest of the region, the persistence of core inflation limits the scope for further monetary easing, and Mexico’s trajectory will largely depend on the policy decisions of the Federal Reserve,” note analysts from Principal AM.

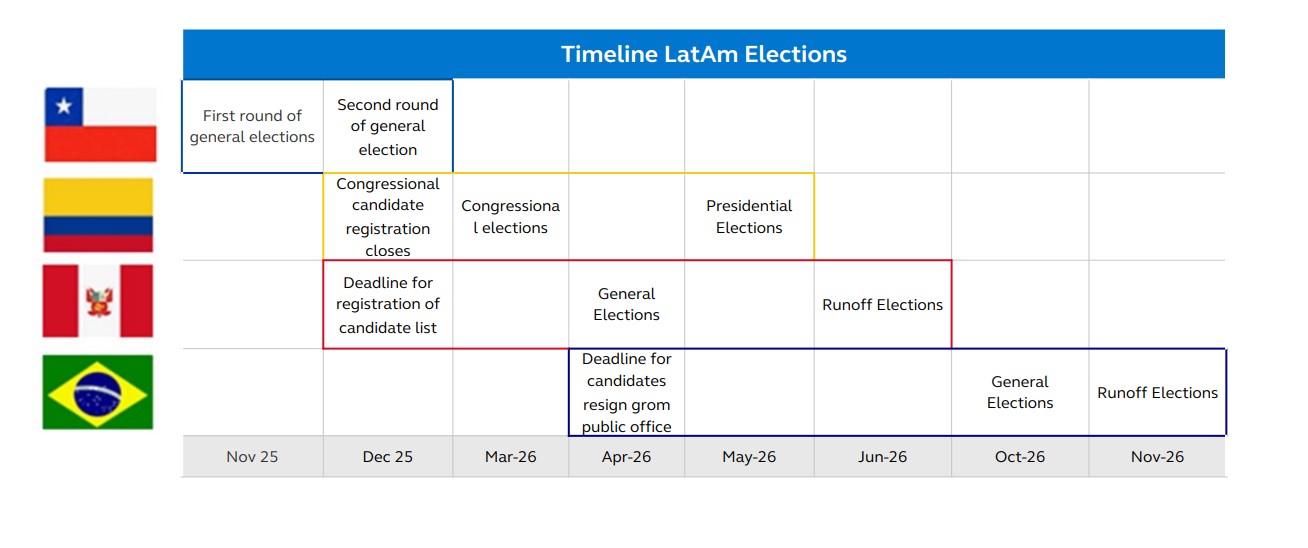

The second conclusion presented in the asset manager’s report is that long-standing concerns persist regarding the sustainability of public finances. However, they explain that “a packed electoral calendar in the coming quarters opens the door to advance the much-needed policy changes, particularly in structural reforms and fiscal management. Chile, Peru, Colombia, and Brazil will hold elections in the next 12 months, which will shape part of the outlook. In Mexico, the scenario will also depend on the outcome and timing of the USMCA negotiations.”

Brazil and Mexico: The Protagonists

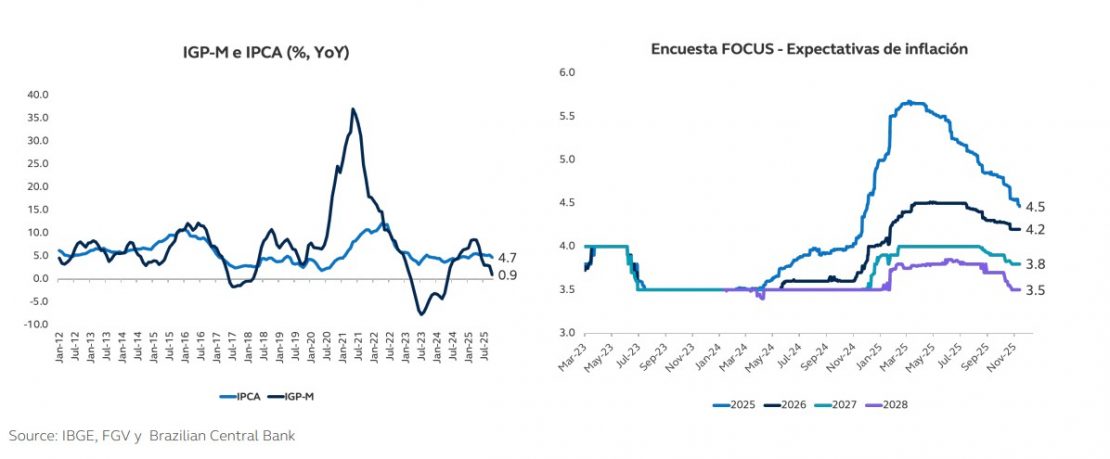

As the asset manager points out, Brazil and Mexico will play a particularly prominent role in the coming year. According to their estimates, the Central Bank of Brazil would be ready to begin a rate-cutting cycle, but the elections will shape the outlook. “In 2025, Brazil’s economic landscape was defined by high volatility and uncertainty, with the first part of the year marked by the lingering effects of the 2024 fiscal debate. Additionally, as inflation expectations also moved upward, well above the 3% target, the Central Bank was forced to halt its rate-cutting cycle and resume tightening, bringing the benchmark rate to 15%. However, more recently, the effects of higher rates have begun to appear in domestic data, with early signs of economic slowdown in credit and confidence indicators,” summarizes the asset manager.

According to their analysis, heading into 2026, “we expect the economic outlook to be determined by the balance between the pace of economic slowdown and the timing of the Central Bank’s monetary easing cycle.” They also see it as likely that the political environment will gain relevance throughout the year, with the presidential election positioned as the key event toward the end of 2026.

“In terms of growth, after several years in which GDP consistently surprised to the upside and operated above potential, we anticipate a moderate slowdown in the Brazilian economy. Given the significant monetary tightening already implemented, we expect GDP to slow from 2.3% in 2025 to 1.6% in 2026. On the inflation front, given the recent string of positive surprises in the short term, the balance of risks for 2026 appears slightly tilted to the downside,” they note.

Regarding Mexico, the asset manager warns that the review of the USMCA will be key to boosting investment and unlocking potential. In its year-end assessment, it acknowledges that the country enters 2026 having avoided the recession that, at the beginning of 2025, seemed almost inevitable. “The economy faced a combination of shocks: the slowdown at the end of 2024, increased uncertainty surrounding the new government, the need for fiscal consolidation, and a weaker external environment marked by the U.S. slowdown and the resurgence of trade tensions under President Trump. Despite this challenging scenario, the Mexican economy showed resilience,” the report summarizes.

In this context, the USMCA review takes on particular relevance. According to the asset manager, “USMCA exemptions shielded Mexican exports from the tariff shock that hit other trading partners, allowing Mexican goods—particularly non-automotive manufactured goods—to gain market share in the U.S. This boost in external demand generated a positive surprise in activity at the beginning of 2025, helping the economy avoid falling into recession even as domestic demand remained weak.”

Although the report notes that its forecast for 2026 is for a moderate rebound in economic activity, it also states that the main risk to this scenario is the upcoming USMCA review, as it introduces an additional layer of political uncertainty that could temporarily weigh on investment and markets. “Mexico has already taken visible steps to demonstrate its commitment to the North American framework, including preparing negotiation materials and selectively imposing tariffs on Asian—especially Chinese—goods. We expect a favorable trilateral outcome, though with episodes of volatility as negotiations progress. A constructive resolution with the United States remains the most important catalyst to reduce uncertainty and trigger increased investment in 2026,” the asset manager concludes.