Aegon Asset Management hosted a Day of presentations in Miami for Latin American and US Offshore investors. The day opened with a macro review and was followed by presentations on global bonds, high yield and dividend investing. In this article we addess the macro review and how should portfolios position themselves given the outlook for inflation, rates and the economy.

According to Frank Rybinski, CFA – Head of Macro Advisory, Aegon AM, inflation in the US is coming down faster than nominal wage growth, creating a gap that boosts real spending power and fuels consumption. He discussed charts showing accelerating real wage growth supporting consumption. However, this “sweet spot” is finite as nominal wages will continue falling. The Fed will need to cut rates to provide monetary support as inflation comes down and consumers become more price sensitive.

Sectors or Industries Most at Risk if the Labor Market Weakens Further

The sectors or industries that are most at risk if the US labor market weakens further would be the cyclical parts of the economy that make up over 70% of non-farm payrolls, excluding the smaller non-cyclical government and healthcare sectors that are currently leading job growth. Frank Rabinski noted that growth in the rest of the cyclical economy, which includes industries like manufacturing, retail, transportation and construction, is only around 1% annually. These cyclical sectors would be more vulnerable to slowing further or contracting if unemployment rises from current levels.

Impact of Divided Government on Fiscal Policy and the Federal Budget Deficit

A divided government following the midterm elections will result in less substantial changes to fiscal policy and reductions in the federal budget deficit. It means you won’t get massive spending bills passed or significant policy changes, as it will be difficult for either party to push their agenda alone. Rabynski also mentioned the current spending sequester will help curb the growth of spending over the next year. Overall, divided control of Congress and the White House is seen as a positive that would limit large fiscal programs and associated deficits going forward.

Credit Sectors Most/Least Attractive Given Corporate Borrowing Trends

Most attractive: Investment grade credit, as companies with stronger balance sheets still have access to debt markets. Technical support from lack of supply could also boost prices. Secured credit such as leveraged loans, as these have higher priority of repayment over unsecured bonds.

Least attractive: Lower-rated high yield bonds (CCC-rated or below), as these companies are more vulnerable to an economic slowdown or rising rates. Unsecured high yield bonds, which have lower recovery rates than secured loans in the event of default.

Rabynski also cautioned against overexposure to private credit markets given recent signs of weakness in underlying fundamentals that are less transparent than public debt markets.

Supply Chain Changes and Trade Policies Influence on Specific Industries

Manufacturing sectors in the US may see boosts as companies onshore production or diversify suppliers globally. Industries like semiconductors are already seeing large investments. Export-oriented industries could be impacted depending on how individual countries are positioned within new trade blocs forming between the US/Europe and Russia/China. Commodity producers may benefit if trade tensions increase demand for non-Chinese/Russian sources. Industries like metals and energy could see pricing support. Transportation and logistics will likely play a crucial role in adjusting to “global fractionalization” of supply chains. Shipping and warehousing demand could increase. Consumer goods that rely heavily on Chinese/other Asian imports may face headwinds or costs rises as companies reconfigure supply chains and inventory management.

How Should Investors Position Portfolios Given the Outlook for Rates, Inflation and the Economy?

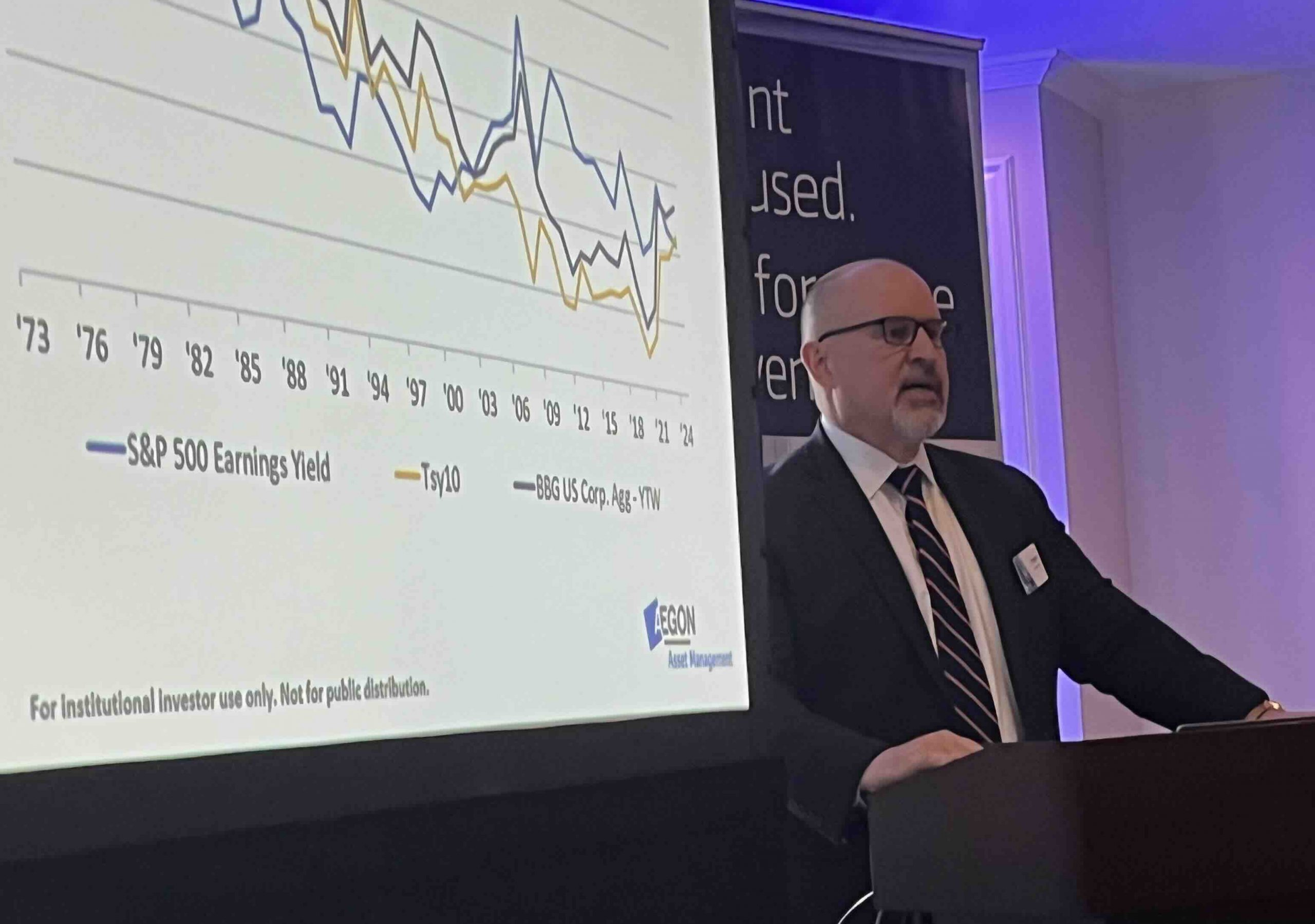

Investors should maintain some exposure to equities given expectations for moderate economic growth and rate cuts supporting markets. They should also increase allocations to fixed income as yields have risen, offering more attractive alternatives than in recent years for yield and diversification. Favoring credit over sovereign bonds to pick up extra yield, but taking a cautious approach to lower-rated segments of the market, is also recommended. Consider overweighting high-yield bonds where spreads have widened significantly from a few years ago. Emphasizing diversification across asset classes now that the “fixed income buffet” has more options than the recent low yield environment is also important.