Once Again, UBS AM Gets Into the Minds of Top Central Bank Leaders With a New Edition of Its UBS Annual Reserve Manager Survey

After gathering the views of 40 monetary institutions, the main conclusion of the report is that geopolitics has displaced monetary policy as one of the most relevant issues of the moment.

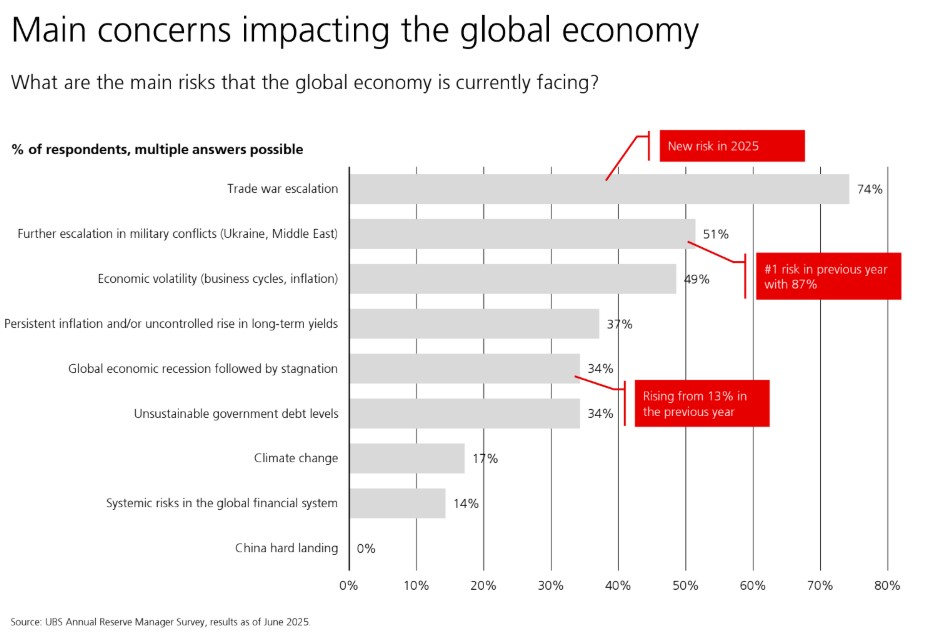

“This year, the shift from monetary policy to geopolitics was palpable. There was much less talk about inflation or interest rate paths, and much more about scenario planning for global disruptions. The widespread concern over a possible resumption of the trade war under a second Trump administration stood out most. Nearly three-quarters of reserve managers identified this as the main global risk, ahead of inflation or rate volatility. That says a lot about current sentiment,” says Max Castelli, Head of Strategy and Advice for Global Sovereign Markets at UBS Asset Management.

According to Castelli, this year’s conversations felt less like forecasting and more like “contingency planning.” “Reserve managers know the playbook has changed: they’re not just reacting to volatility—they’re repositioning for a world where fragmentation is the norm, not the exception,” he notes.

He also acknowledges that what struck him most was the “quiet urgency” with which they are acting. “Reserve managers aren’t panicking, but they are preparing. From FX hedging strategies to liquidity buffers, there’s a clear sense that the coming years won’t look like the last ten. In a context of high uncertainty, there is a marked rise in pessimism among central banks; for instance, they now consider stagflation to be just as likely as the soft landing that was generally expected in last year’s survey,” he states.

Key Findings

In this context, it is notable that 86% of respondents expect that the MAGA agenda (tariffs, deregulation, lower taxes, cheap energy, and DOGE-style cost cutting) will not succeed in boosting the U.S. economy in the long term. Instead, reserve managers believe that several key factors that made the U.S. the preferred destination for international asset allocators may be at risk:

65% believe that the independence of the Federal Reserve is at risk.

47% think there could be a deterioration in the rule of law significant enough to influence reserve managers’ asset allocation decisions.

29% see a risk to the openness of U.S. capital markets.