France: Political Instability Raises Concerns, but Market Impact Remains Contained

French Prime Minister François Bayrou gambled everything on a single move—a vote of confidence—and lost. According to experts, France is entering a new political crisis, beginning with the challenge of addressing a €44 billion fiscal adjustment. Although this scenario had already been anticipated by some investors, the coming days will be crucial to assess the country’s ability to stabilize its political outlook and reassure markets regarding its fiscal trajectory.

“The preferred alternative for President Macron is now the swift appointment of a new prime minister, who will attempt to reach an agreement in the tense budget negotiations. Early elections remain a possibility if this fails. In any case, current developments reflect a challenge with limited room for an easy solution: fragile governments in a fragmented political landscape. Thus, uncertainty remains high, although we do not expect bond markets to derail from here,” comments Dario Messi, Head of Fixed Income Research at Julius Baer.

Experts agree that the chaos in French politics does add more volatility. Peter Goves, Head of Developed Market Sovereign Research at MFS Investment Management, sees it likely that spreads will remain wide, with episodes of short covering; however, political instability is undoubtedly here to stay. “Macron will likely rush to appoint a new prime minister as a first reaction, before considering calling new parliamentary elections. The situation is highly fluid, and how events unfold will likely dictate the market tone in the coming days. So far, the market reaction has been relatively contained, but we take into account the strikes scheduled for Wednesday and the imminent risk of a potential downgrade. Meanwhile, France still needs to pass a budget,” says Goves.

Contained Impact

According to Raphaël Thuin, Head of Capital Markets Strategies at Tikehau Capital, for now, the economic impact is uneven. “The CAC 40 companies, mostly multinationals, exporters, and with low levels of debt, appear relatively protected from political turbulence and rising interest rates. Their limited exposure to public procurement reduces their sensitivity to budget swings. Furthermore, the excess of private savings in France continues to finance part of the deficits, which mitigates external vulnerabilities,” he points out.

However, he acknowledges that two areas of concern are emerging: “In the short term, corporate taxation could become a critical issue, as several parties are considering specific reforms. In the long term, political instability and chronic deficits could gradually erode investor confidence, private investment, and the country’s attractiveness. This evolution could ultimately weigh on consumption and economic growth.”

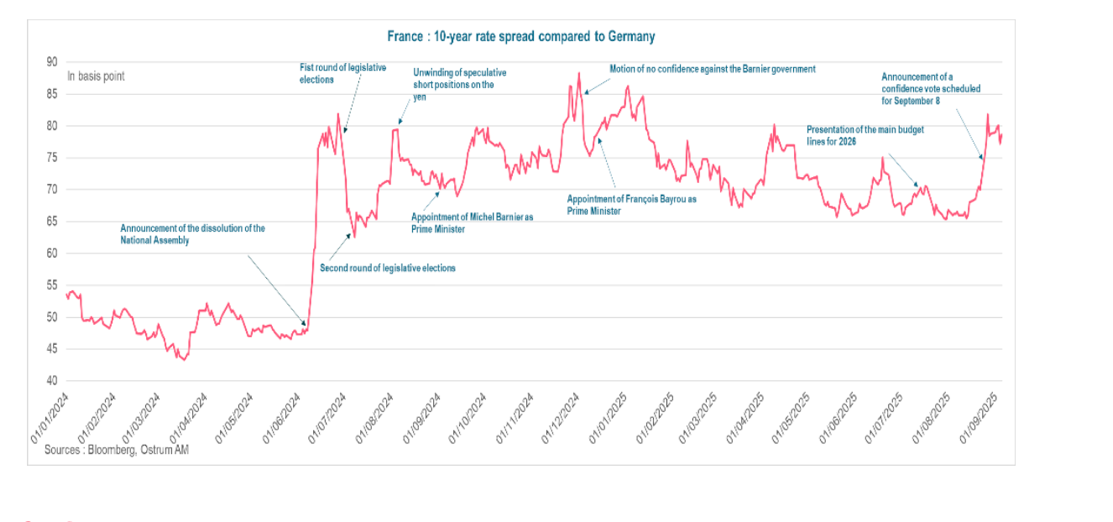

Michael Browne, Global Investment Strategist at the Franklin Templeton Institute, notes that France has the backing of the EU, the ECB, and the euro—and it’s not going anywhere. “Its financial system is solid. It’s true that it’s the only country in Europe where spreads have widened against Germany, but only to 80 basis points. There will be no currency or funding crisis. So, whoever takes office won’t matter. Nothing is expected of them—just to weather the situation until 2027 and hope that economic improvement in Europe, driven by German Chancellor Mertz, generates enough growth to offset the risk of going two years without a new budget. The bond market remains calm, while equities have suffered more from weakness in luxury goods sales than from political turmoil. An operational government is, clearly, a luxury France will not be allowed; and when it finally gets one in 2027, markets will be ready with their verdict,” argues Browne.

France’s Risk Premium

In a context of persistent deficits and rising interest rates, Thuin considers that the issue of France’s risk premium remains key. “Although it varies by asset class, it currently seems to offer limited compensation when taking political and fiscal tensions into account. The main transmission channel of risk continues to be interest rates, in an international environment marked by a general increase in financing costs,” he explains.

According to the Julius Baer expert, political risk is already reflected in asset prices. “Before the confidence vote, the spread between 10-year government bonds of Germany and France once again approached 80 basis points, having already remained elevated for some time compared to other eurozone countries. Although primary deficits are considered unsustainable, we believe France’s current capacity to handle its debt remains relatively high, given that the country benefited for a long period from exceptionally low financing costs. In other words, early elections (or, in the worst-case scenario, Macron’s resignation) could lead to a further widening of spreads, but we expect the impact to be limited in magnitude and do not anticipate bond markets to derail from here,” he notes.

“The risk of a new dissolution of the National Assembly seems the highest to us, which would lead to a widening of the spread between French and German 10-year yields. In that case, tensions on peripheral country spreads should be more limited, not justifying ECB intervention. In the extreme scenario of President Emmanuel Macron’s resignation, the French spread would exceed 100 basis points, justifying ECB intervention to limit contagion,” says Aline Goupil-Raguénès, Developed Markets Strategist at Ostrum AM (Natixis IM), when discussing possible scenarios.

France’s Political Deadlock Deepens Fiscal Concerns, but ECB Intervention Remains Unlikely—for Now

This dynamic is part of a global trend, where inflation and growing doubts about the sustainability of public deficits are putting upward pressure on interest rates. Asset management experts acknowledge that France is not an isolated case, but its political instability could worsen its position compared to more stable partners.

“The ECB could intervene only in the case of significant tensions on interest rates that pose a risk to financial stability or to the transmission of monetary policy—which is currently not the case. It could also intervene in the event of the president’s resignation to contain spread tensions among peripheral countries triggered by contagion effects. It could activate the TPI. Announced in July 2022 and never used, its goal is ‘to counter disorderly market dynamics that pose a serious threat to the transmission of monetary policy within the eurozone,’” adds the strategist from Ostrum AM.

Possible Scenarios

Looking ahead, France faces three possible options: the appointment of a new prime minister, the dissolution of the National Assembly and the calling of new elections, or the resignation of its president, Emmanuel Macron. According to Goupil-Raguénès, the most likely scenario is the dissolution of the National Assembly, given the inability to find a new prime minister capable of broadening the government’s support in Parliament.

“New legislative elections would have to be held within 20 to 40 days of the dissolution. The outcome would likely result once again in a deeply divided National Assembly, with a probable increase in seats won by the far right, according to recent polls, though without a majority. The risk of social unrest—already present with protests planned for September 10 and 18—would be heightened. Uncertainty would rise along with the risk of an insufficient fiscal adjustment, which could keep the deficit elevated and lead to an increase in the public debt-to-GDP ratio. The risk of confrontation with Brussels would grow,” she adds.

According to the multi-asset team at Edmond de Rothschild AM, regardless of the outcome of the current political crisis, the likelihood of a meaningful reform of public finances will remain low—“to the point that financial markets themselves appear resigned and may settle for a scenario in which the budget deficit simply doesn’t deteriorate further.”

However, they note that while the situation is not catastrophic, it is worrisome, as France stands apart from the rest of the eurozone with the highest budget deficit and public debt on an upward trajectory (113% in 2024 and 117% forecast for 2025). “This deterioration in fiscal balances is mainly due to the decline in tax revenues, resulting from tax cuts granted to households (-1.6 percentage points since 2017) and companies (-0.8 points), which has not been offset by a reduction in public spending (which returned to 2017 levels after the pandemic peak). Although many parties agree on the need to cut public spending—which currently represents 57% of GDP (compared to an average of 50% in the eurozone)—it remains difficult to form a majority to adopt measures that would bring the primary deficit below the debt-stabilizing level,” they explain. They add that the status quo is likely to remain unless pressure from the European Commission—and especially from financial markets—increases, in which case tougher decisions will have to be made, likely after new legislative or presidential elections.

Finally, Alex Everett, Senior Investment Director at Aberdeen Investments, notes that while the political situation unfolds, the urgent financial need is to pass a prudent budget that reduces the deficit, no matter how unlikely that seems. “At this point, even a small reduction would be better than nothing. Confidence in the French economy is already low, and the longer this situation drags on, the bigger the problem becomes. It’s clear that France’s political gridlock won’t be resolved this year, and perhaps not even until the presidential elections in 2027. This will likely keep French government bond spreads—known as OATs (Obligations assimilables du Trésor)—elevated, at least around current levels, over the coming months. We continue to favor short positions in OATs versus their peers,” concludes Everett.