The start of 2026 confirms the resilience of the economic cycle despite geopolitical noise (Greenland, Iran, Venezuela) and political uncertainty (Fed independence, ICE, and a potential shutdown).

Rather than weakening, the baseline scenario is solidifying into a disinflationary expansion, closely resembling the 1995–1999 period. The delayed transmission of the Fed’s three rate cuts in Q4 2025 is beginning to show, just as the fiscal impulse (OBBBA, stimulus checks, tax refunds, and fiscal measures in Japan and Germany) shifts from being a drag to becoming a tailwind for cyclical activity.

Monetary policy: Powell relies on price dynamics

The Fed’s first meeting of 2026 was widely anticipated by markets. Powell delivered a more constructive outlook on growth and the labor market. While his assessment could be read as slightly hawkish, the overall tone was dovish. The focus of his remarks shifted from labor market conditions to price dynamics.

Powell indicated that the recent inflation overshoot is largely due to tariffs, which added up to half a percentage point to the cost of living. Without them, core PCE would already be just above 2%.

The message was clear: the bias is toward future rate cuts, although the bar for action remains high. Current conditions support holding rates steady for now, with markets no longer expecting a cut before June.

Fed succession: risk of a hawkish shift

On Friday, Kevin Warsh was named as Powell’s successor. A former Fed governor (2006–2011), Warsh is known for his critical stance on expansionary monetary policy. He has opposed QE programs beyond the initial post-subprime round, arguing that they distort markets, fuel inflation, and politicize the Fed.

His conservative approach and preference for orthodox monetary policy—emphasizing price discipline, a leaner balance sheet, and limited intervention—have raised concerns among investors. He has even questioned recent decisions such as the 50 basis point cut in September, which he views as politically motivated. His appointment could strain the current balance between growth and financial stability and may strengthen the dollar.

Inflation, productivity, and dollar dynamics

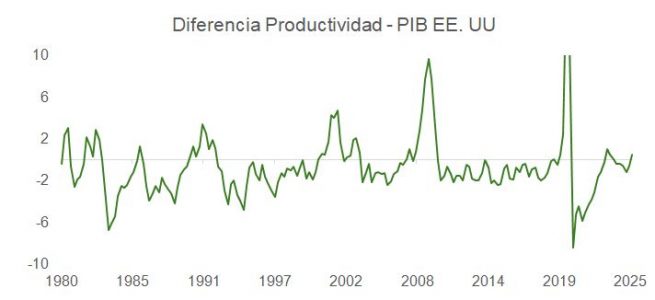

The disinflationary trend continues. Productivity growth is outpacing GDP, easing wage pressures. Oil prices are supportive, and rents are moderating, while the impact of tariffs on the CPI is expected to fade in the coming months.

Despite this favorable macroeconomic backdrop, the recent decline in the dollar, coinciding with a rally in real assets such as gold, silver, and copper, appears to reflect a narrative of eroding monetary credibility rather than underlying fundamentals.

Treasury Secretary Scott Bessent publicly defended a “strong dollar” policy, which helped stabilize the EUR/USD exchange rate after a technical oversold condition. However, the interest rate differential between the United States and the Eurozone suggests that a political risk premium is weighing on the pair, bringing it closer to April 2025 levels.

Earnings and Market Sentiment: Software in the Spotlight

The earnings season for the software sector reveals a technical capitulation. Companies like MSFT, NOW, and SAP have seen significant declines—not due to poor results, but rather their inability to justify previously high valuations. Adding to the pressure are concerns that AI solutions such as Anthropic Cowork could disintermediate major SaaS providers, threatening the traditional per-user licensing model.

The sector is clearly oversold. However, sentiment and technical damage will take time to recover. Key indicators to watch include upcoming data on Net Revenue Retention (NRR), cRPO, and company guidance. The market is looking for signs that renewals and workflow organization continue to hold up, and that AI has not yet had a structurally negative impact. Workday’s earnings on February 25 could be the catalyst to shift this narrative.

Circularity in the AI Ecosystem: Are Funding Rounds Inflated?

Another source of concern comes from the funding side. Reports of a potential $100 billion round for OpenAI, allegedly backed by its own partners (Nvidia, Amazon), have reignited fears over excessive circularity in the AI ecosystem. The perception that capital circulates within a closed loop of beneficiaries undermines the credibility of projected growth models.

AI Investment: Persistence and Barriers

Despite these concerns, AI investment shows no signs of slowing. The focus has shifted toward closed models with access to user data and reasoning capabilities—elements that could create durable barriers to entry.

While the market now demands tangible results, the disruptive potential and monetization opportunities continue to justify capital deployment. In 2026, AI-related CapEx will remain a key driver of corporate growth.

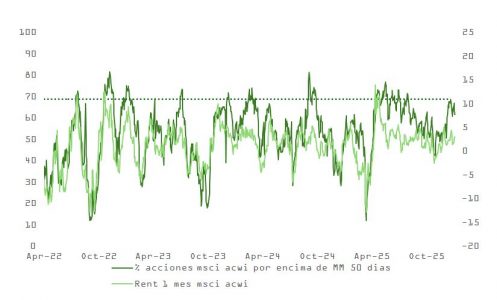

In conclusion, despite volatility and political risks, the macroeconomic backdrop remains constructive. The combination of robust growth, disinflation, and monetary prudence supports risk exposure. However, sector rotation, the evolving AI narrative, and the interpretation of post-Powell monetary policy will be critical to tactical portfolio construction in the first half of 2026. In the short term, there are also technical signals worth monitoring closely.