After pressure from the White House on the Fed Chair, the U.S. dollar weakened, starting the week at a low. According to experts, it’s not just this tension that is taking a toll on the greenback—protectionist policies from the Trump administration are also weighing on it. This is clearly being felt in its exchange with other currencies: the euro has reached $1.15, levels not seen in three years. As a result, some asset managers are looking further ahead and suggest that, after having reigned supreme in international trade, the dollar’s status as a safe-haven asset is now being called into question.

The interpretation so far, according to asset managers, is that the dollar weakened sharply during the first quarter of the year, as the “Trump Trade”—higher rates, stronger U.S. equity performance, and a rising dollar—collapsed after the inauguration on January 20.

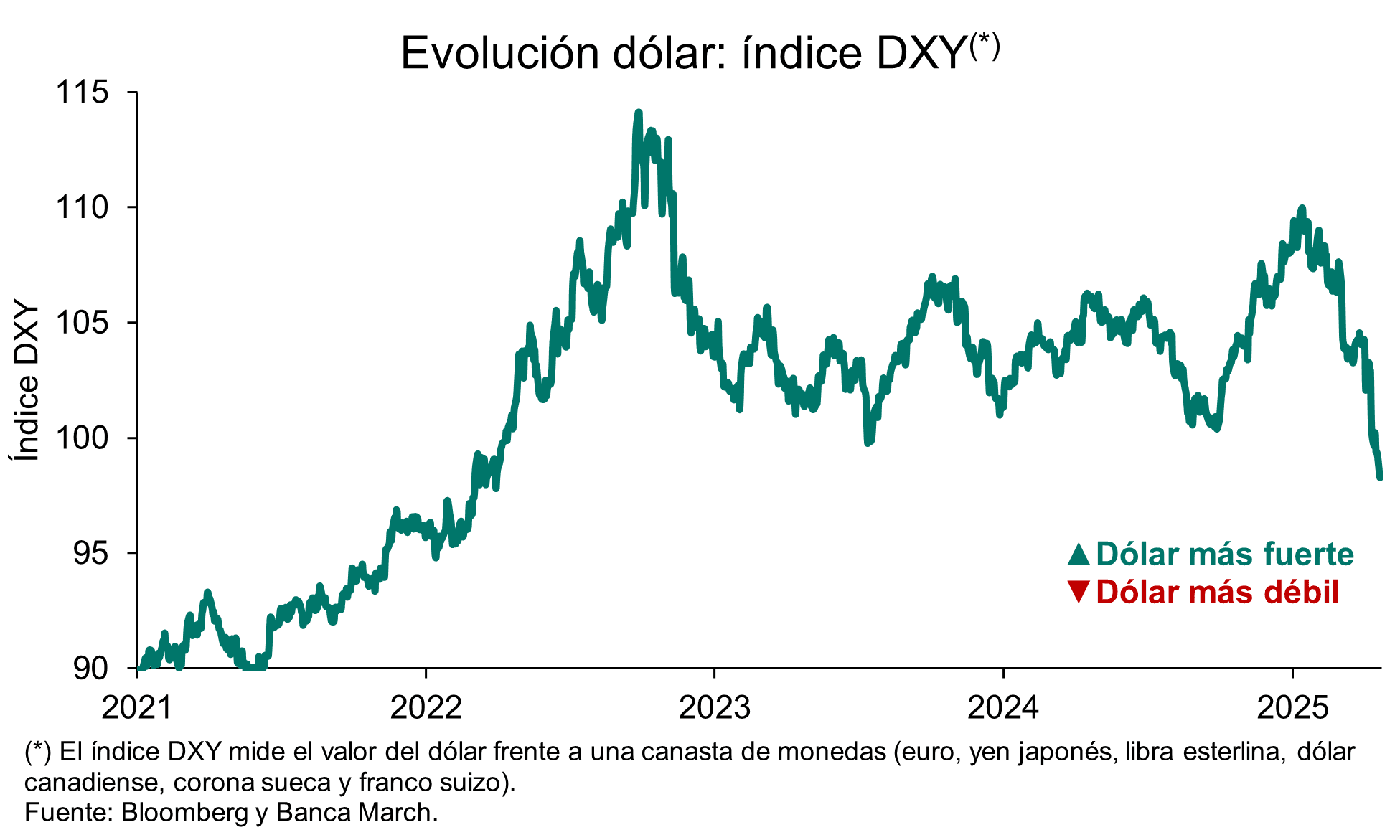

“With the first tariff announcements targeting Mexico and Canada as key trade partners, U.S. political uncertainty rose sharply. The collapse in consumer and business confidence increased expectations of rate cuts in the U.S., narrowing the yield gap between the U.S. and its major peers. The plunge in the USD DXY worsened after the tariff announcement on April 2, causing it to fall 5% year-to-date,” explains Thomas Hempell, Head of Macro Research at Generali AM (part of Generali Investments), regarding the dollar’s weakening.

Reasons for Its Weakness

The recent drop in the DXY index below the 99 level, reaching lows not seen since early 2022 around 98.2 points, underscores the growing uncertainty in financial markets. According to Claudio Wewel, currency strategist at J. Safra Sarasin Sustainable AM, the dollar has shown a downward trend in recent weeks, as U.S. activity indicators have pointed to weakness due to high political and macroeconomic uncertainty. In contrast, he notes that hard data remain strong, with a resilient U.S. labor market. “We have adopted a cautious stance on the dollar, especially following President Trump’s announcement of very high reciprocal tariffs on U.S. trading partners, which in our view represents a significant recession risk,” acknowledges Wewel.

For his part, Thomas Hempell states that, with U.S. exceptionalism eroding rapidly and the effective dollar still expensive, they expect the U.S. currency to continue retreating in the coming months. “Amid growing cyclical concerns, the Fed will be more willing to overlook the inflationary impact of tariffs and will maintain a dovish bias to the detriment of the dollar,” he adds.

Loss of Confidence

For Marco Giordano, Chief Investment Officer at Wellington Management, the erosion of U.S. institutional integrity could further weaken the dollar’s status as a reserve currency and disrupt global capital flows. “The dollar and U.S. Treasuries have more than completely reversed the move since the November 2024 elections. The euro, yen, and Swiss franc have continued to appreciate against the dollar, as investors seek safe-haven currencies amid rising geopolitical uncertainty,” says Giordano.

Beyond short-term movements, what worries analysts is the questioning of the dollar’s role as a global reserve asset. According to a report by Eduardo Levy Yeyati, Chief Economic Advisor at Adcap, since January, the DXY has fallen more than 8%, hitting a three-year low. “Unlike past episodes, the dollar is not acting as a safe haven. In fact, it has depreciated against the yen, the Swiss franc, and gold — a sign of structural loss of confidence,” he notes.

According to their in-house report, the narrative from the Trump administration — which sees the “exorbitant privilege” as a barrier to competitiveness — has sparked fears of even more uncoordinated fiscal and monetary policy. “Investors are already contemplating extreme scenarios: tariffs on foreign purchases of Treasuries, capital controls, withdrawal from the IMF, and even selective defaults as a political tool. All of which could bring irreparable damage to the international financial system — just as we suspect the tariffs already have to trade,” Yeyati adds in the report.

The main hypothesis is a growing distrust in the dollar, a situation with consequences that are difficult to gauge and that would benefit alternative currencies such as gold. After reigning supreme in international trade, the dollar’s status is being questioned. In fact, its share in central bank reserves has dropped from 65% in 2016 to 57% in 2024, according to the IMF. To replace it, central banks around the world have rushed to gold, explains Alexis Bienvenu, fund manager at La Financière de l’Échiquier.

In Bienvenu’s view, the gradual distancing from the dollar is now joined by the U.S.’s willingness to loosen the constraints surrounding a reference currency. “This status, which ensures unrelenting demand, automatically results in structural overvaluation and thus a loss of competitiveness for exports. The core of the Trump administration’s economic objective is to correct this situation. In principle, the depreciation of the dollar — including pressuring the Fed to prematurely cut interest rates — would help boost goods exports. This policy could even lead to a concerted devaluation of the dollar, as rumors surrounding the mysterious ‘Mar-a-Lago accords’ suggest. From this perspective, gold would play a safe-haven role, since no one can devalue it. Hence its appeal,” concludes the fund manager.

Associated Risks

Looking ahead, Quásar Elizundia, Market Research Strategist at Pepperstone, believes the dollar’s trajectory appears tied to a complex interplay of factors. “Trade policies and their impact on inflation and economic growth will continue to be key. However, the shadow of political interference in the Fed’s independence adds considerable risk. As long as uncertainty over the Fed’s independence persists, we are likely to see increased volatility and potential structural weakness for the U.S. dollar. The dollar’s status as the ultimate safe-haven asset can no longer be taken for granted; it is actively being put to the test,” Elizundia adds.

In Giordano’s view, one risk the Trump administration may face is that, due to the loss of trust, countries may be less willing to negotiate than in the past.

“This risk has been accelerated by the administration’s tariff announcement and is unlikely to dissipate even if some of these tariffs are paused for 90 days before implementation. There is a higher likelihood of rising economic nationalism and capital repatriation. We expect this announcement to be the trigger — or at least the accelerator — of net capital outflows from U.S. financial assets toward global fixed income, which should imply significantly higher risk premiums and higher long-term bond yields for the U.S. Elsewhere, this could become a major technical factor supporting non-U.S. financial assets, with European, Japanese, and Chinese fixed income potentially benefiting from U.S. outflows,” he adds.

The latest report published by Ebury acknowledges that, as a main trend, we are seeing a rise in G10 currencies, including the euro. “Since Liberation Day, the euro has been the world’s best-performing currency, except for the Swiss franc, which suggests the eurozone is receiving a significant share of capital fleeing the U.S. Evidence of this is the euro’s rise even after the ECB’s dovish meeting, which should have been bearish for the common currency,” the report notes.