Political Noise Rises in France After Prime Minister Sébastien Lecornu Submitted His Government’s Resignation on Monday to President Emmanuel Macron, less than a month after taking office and just one day after presenting the new composition of his cabinet. The question now is: what impact will this new political collapse have on European markets?

So far, the market’s reaction has been relatively moderate following the resignation of French Prime Minister Lecornu, less than a month after his appointment. “The euro is down 0.6%, French government bond spreads have risen 5 basis points in the intermediate and long maturities, and credit spreads of major French issuers have widened by just a couple of basis points. As for equities, the CAC 40 is down less than 1.5%, with banks and utilities the most affected, while most of the French large-cap index heavyweights have dropped less than 1%,” summarizes Kevin Thozet, member of the Investment Committee at Carmignac.

For now, investors are passively following the twists and turns of French politics, trying to separate noise from signal. “French Treasury issues have not been affected by this lack of visibility, and we still believe this interest rate level represents an entry point. However, we observe a slight appreciation of the dollar, reminiscent of its safe-haven status, as well as the upcoming rating agency calendars, which could add noise from time to time. Moody’s will announce its decision on October 24, and Standard & Poor’s on November 28,” comments Mabrouk Chetouane, Head of Global Market Strategy at Natixis IM Solutions (Natixis IM).

In the view of Peter Goves, Head of Developed Markets Sovereign Debt Research at MFS Investment Management, this situation adds a new layer of uncertainty to the markets. “The situation is obviously very fluid, and it is uncertain what exactly will happen next. This is one of the reasons why OAT-Bund spreads remain wide and could widen further,” he says. In the short term, he sees it as plausible that Macron may appoint a new prime minister, but “in any case, all the fundamental issues remain: how to pass a budget in a highly fragmented parliament.”

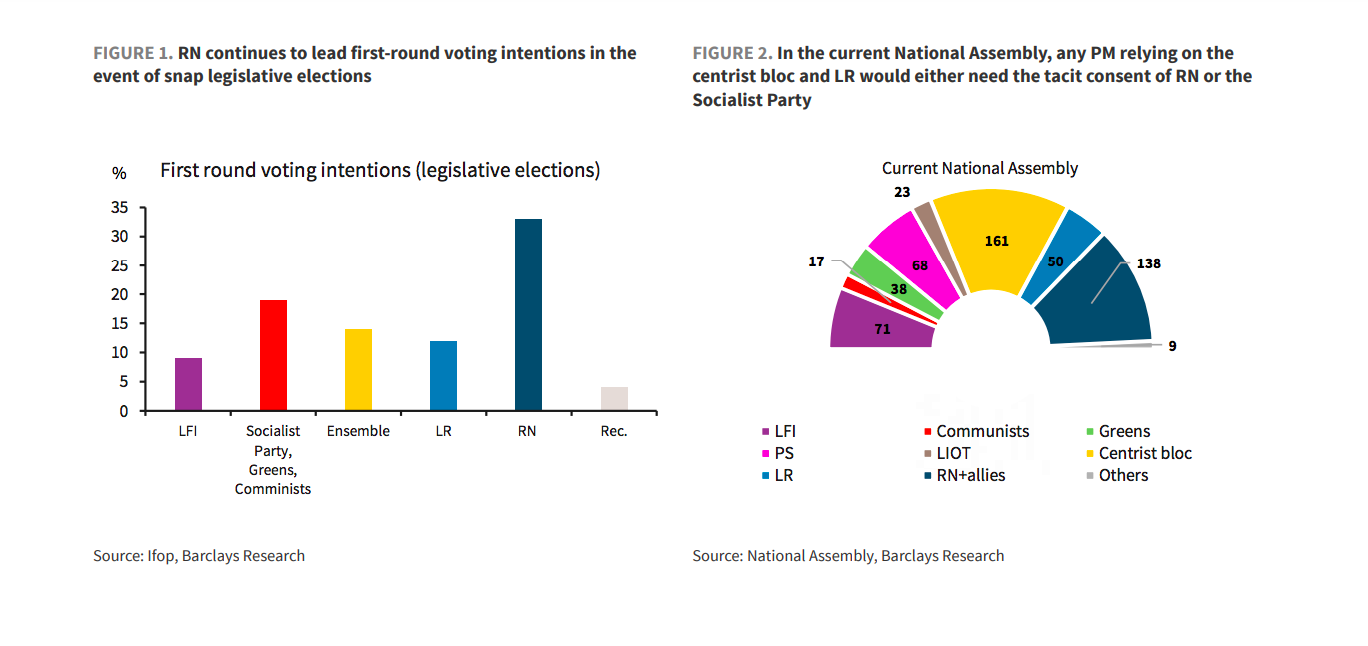

Goves shares this reflection while acknowledging the rising possibility of new parliamentary elections, the outcome of which is inherently unknowable, but represents an event risk that could result in RN gaining seats. “This remains a French matter, with limited contagion effects for the euro area as a whole. Our main takeaway is that it is difficult to argue for a significant narrowing of the OAT-Bund spread at this time,” he adds.

Experts from asset managers agree that increased uncertainty about how the political situation will be resolved does not support market sentiment. “This morning, the spreads between French treasury bonds — OATs (Obligations Assimilables du Trésor) — and German bonds have approached the historical highs of December 2024, which we view as fair, as it reflects rising electoral risk. France is trading notably above its European peers. For a further increase, one would expect new elections and a decisive swing in the polls to the right or left,” argues Alex Everett, Senior Investment Director at Aberdeen Investments. According to his analysis, overall OAT bond trading remains fairly orderly despite the political noise. “Markets are waiting for President Macron’s next move,” Everett notes.

For Michaël Nizard, Head of Multi-Asset & Overlay, and Nabil Milali, Portfolio Manager Multi-Asset & Overlay at Edmond de Rothschild AM, this political turmoil “could intensify upward pressure on French interest rates and deepen the undervaluation of the CAC 40, with significant risk that tensions spread to other assets such as French banks, the euro, and peripheral spreads.”

Possible Scenarios

It is clear that Lecornu’s resignation worsens France’s political and economic unrest. “The current political turmoil increases the risk of delays in approving the 2026 budget and significantly limits the chances of the upcoming budget including meaningful fiscal consolidation measures. This uncertainty further undermines confidence in the sustained execution of the government’s consolidation plan and raises the likelihood of fiscal outcomes being worse than expected,” comments Thomas Gillet, Director and Analyst of the Public and Sovereign Sector at Scope Ratings.

According to the expert from Aberdeen Investments, for opposition parties, this is further proof that Macron-aligned groups cannot lead Parliament, and so calls for new elections will intensify.

“New elections would further reduce President Macron’s control, so appointing another prime minister may be his preferred option. However, the discontent expressed by nearly all parties — including the Republicans and Socialists, who had so far shown more support — makes it clear that there is very little interest in reaching a consensus. At this moment, we see little reason for political optimism, as even the status quo of a new prime minister would likely only further incite opposition party anger,” he argues.

“Although the likelihood of the president resigning seems low, neither a new dissolution of the National Assembly nor the appointment of a more left-leaning prime minister can be ruled out. The latter scenario would reopen the possibility of additional fiscal measures on companies, a factor we continue to monitor closely in our portfolios,” says Flavien del Pino, Head of BDL Capital Management for Spain.

For his part, Gillet explains that President Macron now faces a limited number of options: appoint another prime minister to attempt new coalition negotiations or call early legislative elections. “However, growing political fragmentation and polarization, along with upcoming electoral milestones, are making France’s political outlook increasingly complex, raising the risk of greater short-term instability,” he notes.