Since last Friday, Malaysia’s capital (Kuala Lumpur) has been the setting for the fifth round of trade negotiations between China and the U.S., following a staged escalation in tensions last week. According to experts, these meetings have aimed to ease the atmosphere ahead of the face-to-face meeting between Xi Jinping and Donald Trump, which will take place in three days.

At DWS, they emphasize that the Asian giant is better prepared to face the trade and tariff challenges posed by the U.S. Firstly, as explained in the latest report by its CIO, the situation is not new. “China was already a key focus of U.S. foreign policy under President Biden. Moreover, although China remains one of the main targets of the United States’ tariff policy, its impact was diluted in April, when Washington imposed punitive tariffs on multiple countries worldwide. China also responded quickly to Trump’s return, adopting economic policy measures aimed at stability. And finally, the share of Chinese exports destined for the U.S. has halved over the past eight years, now standing at around 10%. Ultimately, China’s economy today is much less dependent on international trade than is commonly assumed: in 2024, exports accounted for less than 20% of GDP, compared to 36% in the case of the European Union,” they point out.

Just last week, China announced its new five-year plan, which largely signals a continuation of recent policy priorities—under the umbrella of “high-quality development”—placing increased emphasis on accelerating technological self-sufficiency and scientific capabilities. In the opinion of Robert Gilhooly, senior economist specializing in emerging markets at Aberdeen Investments, this will be seen as a continuation of the effort to improve and expand domestic manufacturing capabilities, as outlined in the ‘Made in China 2025’ plan, though it is unlikely the name will be renewed, as it has irritated key trade partners.

“Recently, policy has attempted to boost consumption, but geopolitical pressure is likely to keep priorities tilted toward the supply side of the economy, which will make it harder to eliminate deflationary pressures—even if authorities focus on sectors with well-known overcapacity issues, such as automobile manufacturing, solar energy, and batteries,” Gilhooly notes.

The Secret of Tariffs

In addition to China’s stronger position at the negotiating table, Philippe Waechter, chief economist at Ostrum AM (a firm affiliated with Natixis IM), argues that, at its core, the U.S. tech sector cannot fully decouple from the Asian country. “Trump’s response, with tariffs on China 100% higher than those already in place, is a reaction born of helplessness, as the United States cannot do without many Chinese products. Chinese advances are harming the U.S. tech and defense industries. What’s new is the shortage this could cause on the other side of the Atlantic. It is no longer a matter of prices, but of a break in the value chain. It’s not comparable, and the consequences for U.S. industry could be far greater than the mere application of customs duties,” Waechter states.

As the Ostrum AM expert recalls, “The U.S. economy is strong, but artificial intelligence plays a major role: it explains 92% of growth in the first half of the year. Without it, GDP would have grown just 0.1%. The U.S. economy is likely not as robust as it appears.”

For Sandy Pei, senior portfolio manager at Federated Hermes, despite the renewed escalation of the trade war, the risks facing China’s economy are well understood and already priced in. “We expect supportive policies to stimulate the economy, particularly for high-tech industries, especially in areas where China currently lags behind global leaders. However, financial support is likely to taper off quickly, as the government prefers a market-driven approach: only the most competitive companies will come out ahead,” she argues.

Chinese Equities

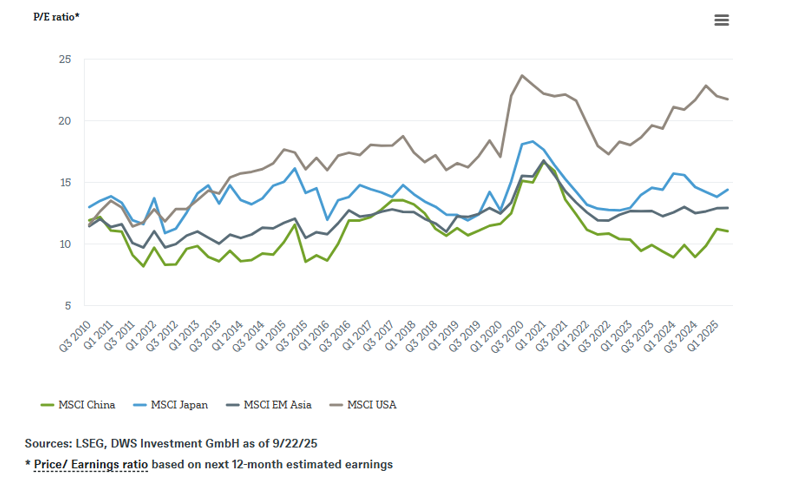

For now, no other country is subject to as intense a burden of tariffs and sanctions from the United States as China. However, the Asian giant also appears to be the best-prepared country for a second Trump term, and DWS believes Chinese equity markets may be benefiting from this. “Sometimes, equity markets can be ironic. Chinese stocks began to rebound roughly at the time Trump returned to the presidency in January 2025,” notes the latest report from its CIO.