Donald Trump has completed the first 100 days of his term as President of the United States, making it a timely moment to assess this highly significant period. Some of the words that best capture what has transpired since January 20, 2025, include: tariffs, uncertainty, volatility, and declines.

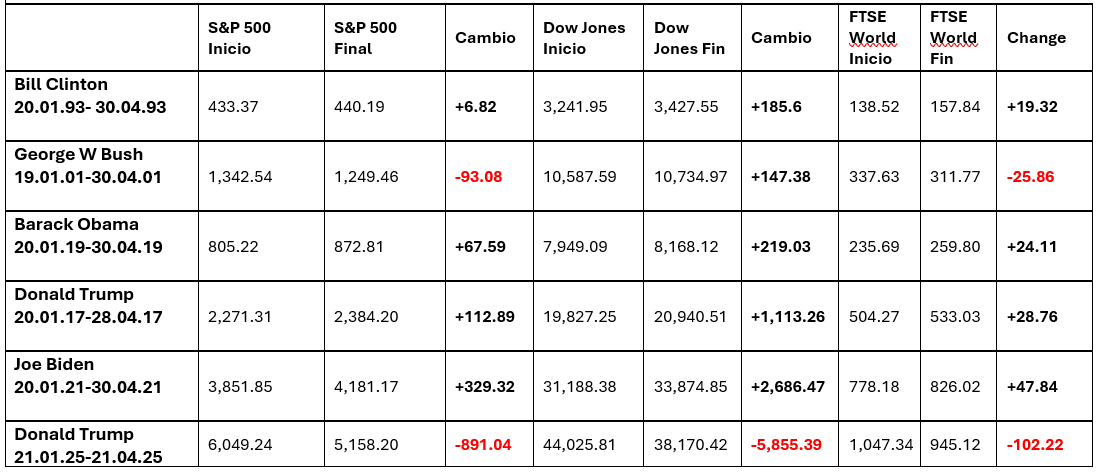

According to Aberdeen Investments, a striking statistic to illustrate these months is that this is the only presidential term in which the S&P 500, the Dow Jones, and the FTSE World have all declined during the first 100 days.

Furthermore, U.S. economic growth projections continue to deteriorate. A Bloomberg survey reveals that the average forecaster assigns a 45% probability to a recession in 2025, while Apollo Management has raised the alarm by predicting not only a recession but also a stagflation scenario beginning in June, with mass layoffs expected in the trucking and retail sectors.

“The current financial market landscape presents a dangerous combination of weakening economic conditions, geopolitical tensions, and uncertain monetary policy. In the U.S., the risks of recession and stagflation are increasing, while fiscal expansion, far from easing, is intensifying, fueling concerns about the sustainability of public debt. Technical support from corporate buybacks may provide temporary relief but doesn’t change the underlying slowdown,” notes Felipe Mendoza, Financial Markets Analyst at ATFX LATAM.

100 Days by the Numbers

For Ben Ritchie, Head of Developed Market Equities at Aberdeen, these 100 days of Trump 2.0 have starkly shown that when governments and markets collide, investors often lose out. “While market volatility may offer long-term buying opportunities for patient and contrarian investors, it can also wreak havoc on short-term investor expectations,” he reminds.

In this regard, global asset managers have a clear view: while markets initially expected Trump’s presidency to unleash American businesses’ animal spirits via tax cuts and deregulation, a more sober assessment has now taken hold. “Trump is doing what he said he would on tariffs—and more. While we assume tariffs may decline going forward, there’s considerable uncertainty. Both tariffs and uncertainty represent a stagflation shock to the U.S. economy (slower growth, higher inflation), and equities have had to adjust accordingly,” says Paul Diggle, Chief Economist at Aberdeen Investments.

Mario Aguilar, Senior Portfolio Strategist at Janus Henderson, summarizes the period: “Trump’s first 100 days have been marked by increased volatility across all markets and rising investor doubts regarding the U.S.’s role and the dollar’s status in the global economic system. The volatility has undoubtedly been driven by the executive orders issued by Trump—130 so far this year. By comparison, in his first year, Biden issued 77, and Trump issued 55 during his first term. Beyond the executive orders, we must also consider the impact of Trump’s statements and opinions posted on X about various social and economic topics.”

The Tariff Issue

Trade policy has taken center stage over the past 100 days—and its impact is clear. In the short term, Aguilar notes that these policies have caused significant declines in equity markets and a rise in 10-year Treasury yields. “This increase in rates seems to have prompted Trump to delay the implementation of tariffs by 90 days. Short-term volatility is likely to persist, but the longer term is more worrying. The attack on supposed U.S. allies with high tariffs will likely lead to the creation of new supply chains, new trade alliances, and perhaps a new dominant global trade currency other than the dollar,” he points out.

According to Maya Bhandari, Chief Investment Officer for Multi-Asset EMEA at Neuberger Berman, tariffs are the area where President Trump has most clearly “overdelivered,” though she notes that the latest move—a “pause” until July 9 on the temporary activation of the so-called “Trump option”—has brought some relief. “These are 90 days of surface calm, with intense behind-the-scenes negotiations,” Bhandari explains.

This expert at Neuberger Berman notes that this has already led to visible changes—for example, the effective U.S. tariff rate has risen from 2.5% at the start of the year to nearly 17.5%, reflecting 25% tariffs on steel, aluminum, and automobiles, plus a universal 10% tariff. “In this regard, we’ve gone back to the 1930s–1940s. This, in turn, introduces significant downside risks to growth (we expect a 0.5% to 1% impact on U.S. real growth) and upside risks to inflation (3.5% to 4%). For example, growth could be just one-sixth of what it was in 2024. The adjustment will take time, and not all asset markets have adapted—for instance, with valuations at 20 times projected 2025 earnings, U.S. equities still look expensive by historical standards,” she warns.

Dollar Weakness

For Kevin Thozet, member of the investment committee at Carmignac, one of the most striking features of Trump’s first 100 days is the dollar’s 10% decline over the year. “Despite Scott Bessent’s claims, market action in April looks less like a ‘normal deleveraging’ and more like a silent exodus of real capital, both domestic and foreign, from the U.S. due to cyclical factors (stagflation risk) and structural ones (questioning of the U.S.-centered monetary system),” he explains.

In his view, with Trump’s attacks on the independence of the judiciary and the Federal Reserve nearing a constitutional crisis, the likelihood of this silent capital exodus accelerating into a full-blown dollar flight increases. “The normalization of the dollar could go hand-in-hand with another downward correction in U.S. equity valuations. In fact, such a scenario could trigger the reappearance of the ‘dollar smile’—where the dollar appreciates when macroeconomic conditions deteriorate—although the activation point is now expected to be much lower than historically,” Thozet argues.

From Janus Henderson’s perspective, attacks on the Fed and Jerome Powell are dangerous because currency strength depends partly on the stability and independence of monetary policy and the central bank. “If a central bank loses market credibility and is seen as politically driven rather than data-driven, inflation expectations could become unanchored. That would lead to sharp equity declines and spikes in bond yields. It could also call into question the dollar’s reserve status, potentially dismantling the post-Bretton Woods order, with negative global impacts—especially for the U.S. economy if international investors start liquidating U.S. bond positions,” Aguilar states.

Ripple Effects

Finally, Rebekah McMillian, Associate Portfolio Manager on the Multi-Asset team at Neuberger Berman, notes that aggressive trade policy and new tariff announcements have unleashed greater market volatility and triggered key themes shaping markets in 2025 so far. She highlights two main effects: first, a downward revision in U.S. (and therefore global) growth prospects due to cooling economic activity, contrary to the “soft landing” narrative prevalent earlier in the year. Second, she notes significant shifts in fiscal and economic policy approaches worldwide—especially in Germany and China, which have launched support measures to counter the negative effects of tariffs and bolster their domestic economies.

“As a result, we’ve seen a clear risk-off reaction in markets, significant performance divergence between U.S. and non-U.S. assets, a weaker dollar, and U.S. Treasury bond sell-offs—all sharply contrasting with the post-election ‘American exceptionalism’ narrative,” says McMillian.

According to international asset managers, the Trump 2.0 shock is far from over. “The damage should not be underestimated. U.S. policy-making has been made a laughingstock, and the current uncertainty demands higher risk premiums—especially from foreign investors in U.S. assets. Above all, companies are voicing real concerns about the impact on demand and earnings prospects. The Trump shock isn’t over. The odds remain high that macro, valuation, sentiment, and technical indicators for U.S. assets will continue flashing red,” states Chris Iggo, CIO of AXA IM.

The Investor’s Dilemma

This entire context has left investors with a clear dilemma over the past 100 days: whether to react or stay the course. According to David Ross, CFA, International Equity Manager at La Financière de l’Échiquier (LFDE), Trump’s second term has made fund managers’ jobs significantly harder. “From a long-term perspective, we’re reassessing positions based on returns and the potential impact of tariffs in the coming years. In the short term, given how quickly policies can change, relevant analysis is almost impossible. All we can do is speculate—and speculation isn’t enough to make sound investment decisions,” Ross notes.

In his view, just a few months ago we were in a bull market where investors used dips as buying opportunities, but the rise in risk premiums for U.S. assets has shifted market sentiment. Now, he believes, we’re in a bear market mindset—one summed up as “sell the dip.”

“In recent weeks, the S&P 500 has repeatedly failed to break above the 5,400-point level. We now view this as the new ceiling. And since the biggest rallies often occur in bear markets, my advice to the team is simple: don’t panic and remain highly cautious,” Ross concludes.

Finally, Amadeo Alentorn, Systematic Equity Manager at Jupiter AM, notes that we’ve gone from a 2024 ending in uncertainty—but with optimism—to deeper uncertainty with more pessimism. “This shift is evident in investment styles. Investors have moved away from expensive, fast-growing companies—especially in tech—toward cheaper, undervalued, defensive stocks that didn’t benefit from the tech boom. This shift has been driven by erratic U.S. policy and the cooling of growth expectations and inflation trends,” he explains.

In this context, Alentorn recommends building more diversified portfolios, especially with strategies designed to decouple from overall market behavior. “2025 will be a year of volatility. Even if all tariffs were suddenly reversed, Trump’s impact on business, consumer, and investor confidence is lasting. We’re witnessing a historic regime change. After years of strong equity returns above historical averages, we’re entering a new cycle in which we must rethink how to navigate the next five years,” the Jupiter AM manager emphasizes.