Vanguard has announced the reduction of fees on seven of its fixed income exchange-traded funds (ETFs) available to European investors, effective July 1, 2025. According to the firm, this measure reinforces Vanguard’s commitment to making fixed income investing more accessible, especially in a context where bonds are playing an increasingly important role in investors’ portfolios.

“The bond market is currently twice the size of the equity market, but it remains opaque and costly. Investors deserve something better. At Vanguard, we believe that in investing, you get what you don’t pay for. Costs matter. By reducing fees, we are helping to make fixed income more accessible and transparent. We estimate that these changes will represent approximately 3.5 million dollars in annual savings for investors. We have already expanded, and will continue to expand, our fixed income offering throughout this year,” said Jon Cleborne, Head of Vanguard for Europe.

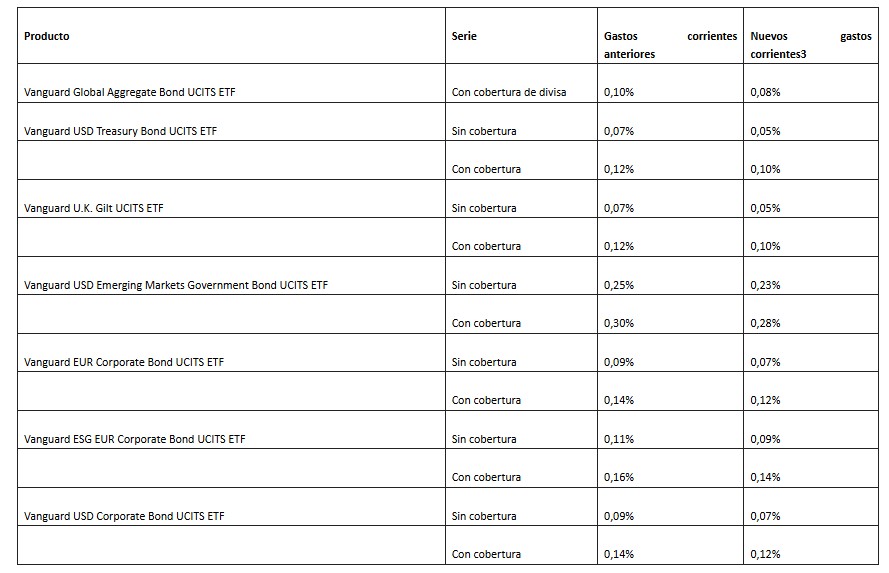

The following ETFs will have their fees reduced starting July 1.

Vanguard Positions Itself in Fixed Income

Vanguard is the second largest asset manager in the world, with 10.5 trillion dollars in assets under management globally as of May 31, 2025. Its fixed income group, led by Sara Devereux, manages more than 2.47 trillion dollars globally, combining deep expertise to deliver precise index tracking, prudent risk management, and competitive performance.

Earlier this year, Vanguard expanded its range of European fixed income products with the launch of the Vanguard EUR Eurozone Government 1–3 Year Bond UCITS ETF, Vanguard EUR Corporate 1–3 Year Bond UCITS ETF, Vanguard Global Government Bond UCITS ETF, and Vanguard U.K. Short-Term Gilt Index Fund.

Following these changes, the weighted average asset fee of Vanguard’s European range of index and actively managed fixed income funds will be 0.11%. Currently, Vanguard offers 355 fixed income index products in Europe, and on average, its range of fixed income ETFs is the most cost-effective in the European market. Across its entire product offering in Europe, the weighted average asset fee will now be 0.14%.