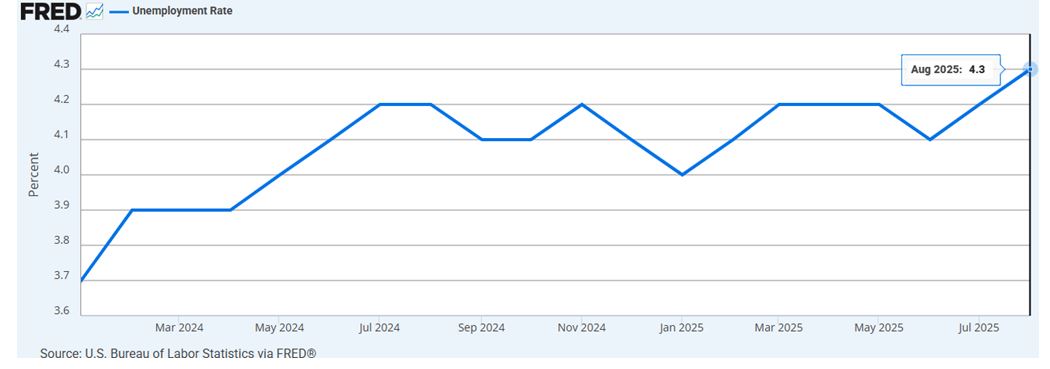

The U.S. labor market is showing clear signs of weakness. In August 2025, the economy generated only 22,000 nonfarm jobs, far below the expected 75,000, pushing the unemployment rate up to 4.3%, the highest level since 2021. This comes on top of the largest historical job revision in decades, with 911,000 positions erased from the statistics between 2024 and 2025.

This cooling of the labor market reinforces expectations that the Federal Reserve (Fed) will accelerate its interest rate cut cycle, with the possibility of further adjustments in the coming months.

For asset managers, this environment combines risks and opportunities, according to FlexFunds. On the one hand, traditional assets—equities and fixed income—may face limited returns and greater volatility. On the other hand, asset securitization is emerging as a key tool to diversify portfolios, improve liquidity, and enhance the distribution of investment strategies across international private banking platforms.

When unemployment rises and the Fed is forced to cut rates to contain recession risks, equity and bond returns tend to carry more systemic risks. In this context, accessing less correlated asset classes becomes a strategic priority.

Securitization allows liquid, illiquid, listed, and alternative assets to be repackaged into investment vehicles and distributed across multiple international private banking platforms. This gives managers access to cash flows different from traditional ones, reducing dependence on immediate macroeconomic performance.

A recurring challenge in times of heightened uncertainty is the need for liquidity without sacrificing diversification. Through structures such as Special Purpose Vehicles (SPVs), developed by FlexFunds, managers can transform illiquid assets into easily transferable and Euroclearable instruments, optimizing both operational and tax efficiency.

This benefit is significant: in an environment where investors demand agile and transparent solutions, securitization provides investment strategies with scalability, strengthens distribution, and facilitates capital raising in international markets.

Historically, rate cuts have increased the price of outstanding bonds, benefiting those who already had duration exposure. However, for new investment flows, a low-rate environment implies limited yields and narrower spreads.

In this scenario, the securitization of alternative assets becomes an effective way to capture attractive spreads without disproportionately increasing exposure to market volatility. Managers can offer vehicles backed by stable cash-generating assets that complement and reinforce the return structure of a multi-asset portfolio.

Competitive advantage of securitization for asset managers

Rising unemployment and the expectation of rate cuts in the U.S. mark a turning point in asset allocation strategies. In this new environment, securitization consolidates itself as a mechanism that provides competitive advantages:

- Transforms investment strategies into a vehicle with easy access and international reach.

- Expands the client base quickly and efficiently.

- Enables portfolio diversification beyond equities and fixed income.

- The creation and issuance process is fast and cost-efficient.

- Provides liquidity to traditionally illiquid assets (such as real estate).

- Enhances capital-raising capabilities.

- Adds scalability to investment strategies.

- Diversifies funding sources.

- Involves low operational costs.

- Can be issued on relatively small asset portfolios.

For asset managers, the key will be integrating these vehicles into portfolio architecture not as substitutes but as strategic complements that strengthen the value proposition to increasingly demanding clients in a macroeconomic environment filled with uncertainty.

With FlexFunds, it is possible to design and issue efficient, flexible investment vehicles tailored to each client’s needs. Our solutions are designed for managers seeking to scale their strategies in international capital markets and broaden their investor base.

For more information, please contact our specialists at info@flexfunds.com.