In recent years, international trade has been marked by a shift toward protectionism and fragmentation. Geopolitical tensions, coupled with unilateral tariff decisions, have triggered a wave of measures impacting countries, sectors, and supply chains in uneven ways. In this new environment, where trade policy increasingly influences financial flows, markets have responded with volatility and uncertainty, according to FlexFunds.

The imposition of selective tariffs, the redesign of trade agreements, and the growing regionalization of production are reshaping the global economic map. Sectors such as technology, manufacturing, and consumer goods—highly exposed to international flows—have been the most affected, while inflation expectations and monetary policy decisions add further pressure on portfolio returns.

The trade dispute between the United States and China marked a turning point in the international trade system. Protectionist measures imposed by both countries—such as increased tariffs on key products and the enforcement of technological restrictions—set off a chain reaction in other economies that also opted for protectionist approaches in their trade policies. The European Union, India, and even some Latin American nations have tightened foreign trade regulations to protect their domestic industries.

For institutional managers, these changes demand far more than tactical adjustments: they require a deep reassessment of diversification and asset allocation strategies. In this context, asset securitization emerges as a key tool to mitigate risks, preserve value, and capture new opportunities in an increasingly uncertain and fragmented environment.

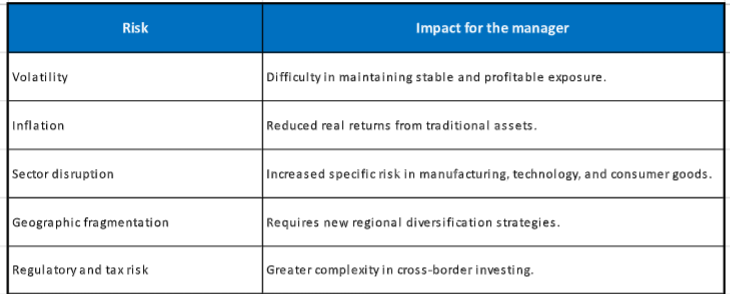

Widespread tariffs and growing trade uncertainty impose new challenges for asset managers:

Faced with this scenario, many managers are rethinking traditional exposures and adopting more flexible and resilient solutions. Among these, one strategic tool is gaining prominence: asset securitization.

Asset securitization enables the transformation of illiquid assets—such as real estate cash flows, invoices, corporate revenues, or loan portfolios—into structured, efficient, and tradable vehicles. This practice offers institutional managers significant advantages in the new environment:

1. Structural flexibility and improved liquidity

Converting private assets into listed or transferable instruments—such as structured notes or asset-backed funds—allows for quick adjustments to exposure without sacrificing diversification or efficiency.

2.- Ease of portfolio rebalancing

In an environment of geopolitical fragmentation and frequent regulatory changes, having structured vehicles allows for rapid portfolio adjustments, dynamically adapting to new trade restrictions, regional opportunities, or shifts in sector outlooks.

3. Targeted geographic diversification

Through securitization, managers can gain exposure to assets in regions less affected by tariff policies. For example, economies such as Mexico or India could benefit from supply chain shifts driven by nearshoring.

4. Inflation protection

Structures indexed to real cash flows—such as rents or adjustable fees—help preserve portfolio purchasing power, offering alternatives to traditional bonds currently under pressure from high interest rates.

5. Efficient access to defensive sectors

Securitization facilitates the inclusion in investment strategies of sectors less sensitive to international trade, such as infrastructure, energy, healthcare, or logistics, through structures tailored to institutional appetite.

6. Tax optimization and regulatory compliance

Structuring these vehicles from efficient jurisdictions, such as Ireland, maximizes tax and regulatory benefits, particularly in contexts where domestic rules may tighten.

Portfolio managers who integrate securitization as a strategic tool can:

- Reduce exposure to regions under tariff pressure or sanctions

- Access assets in areas with more stable or industry-friendly policies

- Capitalize on structural trends such as reshoring and nearshoring, which are reshaping global investment flows

And beyond mitigating geopolitical risks, they can:

- Align their portfolios with the new global value chains

- Position capital in regions and sectors with growth potential

- Design investment vehicles that respond to global macrostrategy, beyond mere asset selection

In an environment defined by volatility, trade polarization, and constant rule changes, asset securitization moves from being an operational technique to a strategic positioning tool. For institutional managers, it represents a way to preserve value, gain agility, and build portfolios aligned with the new global economic order.

Moreover, the ability to facilitate dynamic portfolio rebalancing—amid shifts in trade policies, regulatory risks, or macroeconomic adjustments—makes securitization a key mechanism for keeping investment strategies relevant and resilient in real time.

In this context, FlexFunds offers asset securitization solutions—a process that converts different types of financial assets into tradable securities. FlexFunds’ solutions can repackage multiple asset types into an investment vehicle, enabling managers or financial advisors to distribute their strategies more easily and cost-efficiently to a broader client base.

For more information, you may contact our specialists at info@flexfunds.com.