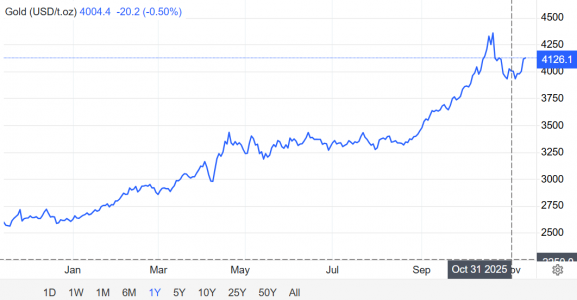

In an environment of rising prices for precious metals, many asset managers are seeking more efficient mechanisms to channel, finance, and distribute exposure to this segment. As of the end of October 2025, gold and silver posted double-digit gains, fueled by growing economic uncertainty in the United States and rising expectations of a short-term rate cut by the Federal Reserve. According to TradingEconomics data, gold has surpassed the US$4,100 per-ounce threshold, while silver stands at US$51—levels not seen in more than a decade.

At the same time, ETFs backed by physical gold have recorded unprecedented demand. According to the World Gold Council, in October 2025 alone these products attracted US$8.2 billion in net inflows, marking five consecutive months of positive flows. This scenario reinforces the market’s interest in instruments that offer diversified, liquid, and regulated exposure to the metals’ bullish cycle.

Source: World Gold Council. Gold ETF Flows: October 2025

Investment advisors view gold ETFs as a hedge against a wide range of risks, such as the depreciation of the US dollar, rising public debt, persistent inflation, geopolitical tensions, and more recently, concerns regarding the Federal Reserve’s independence.

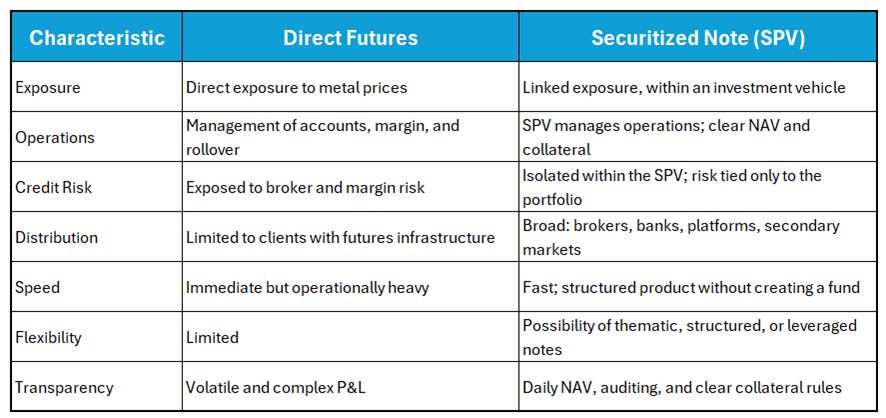

Meanwhile, precious metals futures remain intrinsically volatile instruments: they expire periodically, require margin, and must be continuously rolled over. For asset managers, trading these contracts directly can be complex and costly, especially when integrating them into broader portfolios or distributing exposure among different types of investors.

In this context, asset securitization emerges as a strategic alternative for managers holding positions in precious metals futures. Through a Special Purpose Vehicle (SPV), the economic flows generated by a derivatives portfolio can be transformed into structured financial instruments—such as notes or tranches (senior, mezzanine, and equity)—simplifying exposure and expanding distribution possibilities.

Strategic advantages for the asset manager

- Operational simplification:

Securitization allows managers to offer exposure to precious metals without requiring each investor to open futures accounts or manage margin and rollovers. The SPV handles the day-to-day operations internally, while the portfolio is presented clearly and in a regulated manner through daily NAV and defined collateral rules.

- Broader distribution base during price rallies:

In bullish periods like the current one, many institutional clients cannot—or do not wish to—trade derivatives directly. Securitization converts the strategy into an accessible, standardized product (with an ISIN), facilitating distribution through brokers, private banks, platforms, and secondary markets, and enabling its inclusion in portfolios that require securities rather than derivatives.

- Risk segmentation and credit isolation:

The futures portfolio is housed within the SPV, ring-fenced from other manager assets. This protects client exposure from manager balance-sheet risks and ensures clear collateral rules, fiduciary oversight, and auditing. Managers can therefore offer a robust, transparent, and predictable solution instead of a complex, operational futures portfolio.

- Flexibility for thematic or structured products:

The structure allows the creation of notes with controlled leverage, coupons, metal combinations, or multi-asset strategies. This makes it possible to launch products without creating a new fund, capturing specific demand during price rallies.

- Speed of implementation:

Unlike ETFs or funds, securitization vehicles allow swift action to capture flows during periods of high demand. For managers, this means being able to offer immediate exposure to metals while market interest is at its peak.

- Lower minimums and democratization:

Trading futures directly requires significant capital and complex operational management. A securitized note can reduce minimum investment tickets, enabling a manager to distribute the strategy among various segments of professional and institutional clients.

Comparison: Direct futures vs. securitized note

Securitizing precious metals futures offers managers a way to monetize, redistribute, and scale their commodities exposure at a time of strong demand—optimizing capital, diversifying funding sources, and attracting new investors without giving up participation in markets with solid fundamentals.

In a cycle in which gold and silver are solidifying their role as safe-haven and yield-generating assets, securitization stands out as an advanced management tool that combines financial innovation, operational efficiency, and strategic vision—exactly what distinguishes the modern asset manager.

At FlexFunds, we designed an asset securitization program through Irish Special Purpose Vehicles (SPVs), supported by top-tier service providers such as BNY, Interactive Brokers, Morningstar, and Bloomberg, enabling efficient distribution of investment strategies across multiple international private banking platforms.

If you would like to learn more, please feel free to contact one of our experts at info@flexfunds.com