The global economy is undergoing a structural transformation, driven by geopolitical tensions, shifts in trade policy, and the resurgence of tariffs as a strategic tool. This environment – marked by growing uncertainty and volatility – is also generating new opportunities for asset managers, who must adapt quickly to evolving market dynamics, according to FlexFunds.

Volatility is no longer an outlier; it’s become a defining feature of today’s investment landscape. In this context, agility and operational efficiency are key competitive advantages. For asset managers, managing risk is no longer just about responding to uncertainty – it’s about designing adaptive strategies that keep portfolios aligned with investment objectives.

Among the most valuable tools in this environment are exchange-traded products (ETPs), a category that includes exchange-traded funds (ETFs) and exchange-traded notes (ETNs). Since their debut in 1993, ETPs have evolved into versatile, efficient, and adaptive vehicles—suitable for both passive and active strategies.

Why have ETPs become essential for asset managers?

While the terms ETF and ETP are often used interchangeably, it’s worth clarifying: all ETFs are ETPs, but not all ETPs are ETFs. This article uses “ETP” as a broad term to refer to exchange-traded products that track the performance of an index, asset, or strategy.

ETPs are financial engineering products designed to repackage specific asset classes – such as stocks, bonds, commodities, or real estate. When structured around a large basket of stocks, bonds, or specific commodities, they are typically considered ETFs.

When the “basket” is smaller and includes special features like leverage or short exposure, they fall under the broader ETP category.

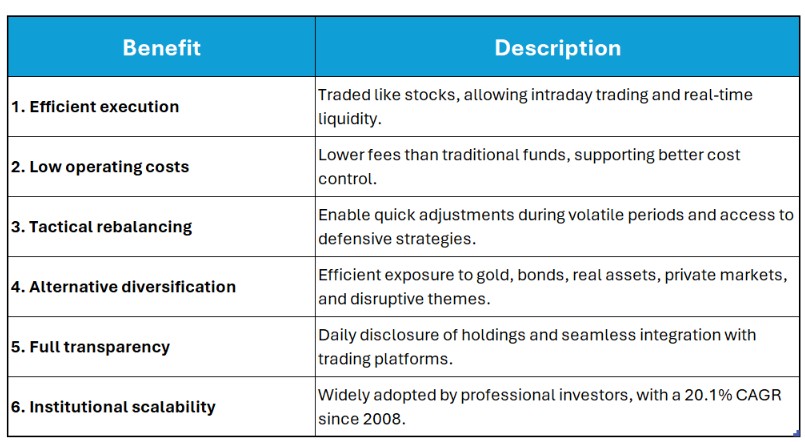

Strategic advantages of ETPs for asset managers

Operational simplicity and efficient execution

ETPs trade like stocks, meaning they can be bought and sold throughout regular market hours, allowing for intraday transactions and high liquidity. In periods of sudden market volatility, this flexibility enables portfolio managers to respond to market movements in real time – something traditional funds typically cannot offer.

Additionally, ETPs have operating costs that are, on average, less than half the cost of most other investment vehicles. This helps optimize assets under management (AUM) and supports more sustainable margins.

Agile rebalancing, access to alternatives, and diversification

In volatile markets, the ability to rebalance quickly is a competitive edge. However, according to a report by State Street Global Advisors Group Research Center, only 29% of investors regularly rebalance their portfolios – highlighting an opportunity for proactive managers.

ETPs make it easier to execute targeted hedging strategies, such as gaining exposure to Treasuries or gold – assets that have gained importance recently. As of March 2025, AUM in gold ETFs exceeded $345 billion, reflecting strong demand for inflation protection and geopolitical risk hedging.

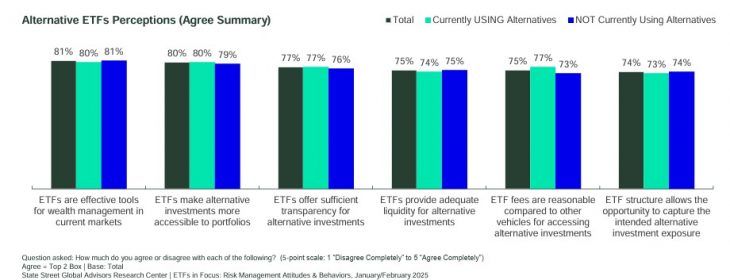

Beyond traditional assets, ETPs are expanding access to alternative investments. According to State Street Global Advisors’ report “ETFs in Focus: Risk Management Attitudes & Behaviors”, advisors generally view ETFs favorably as vehicles for alternative exposure.

This allows asset managers to build more robust portfolios without resorting to illiquid or overly complex structures.

Transparency for investors

Transparency is a hallmark of ETPs. Holdings are typically disclosed daily, and operations are integrated into widely used platforms for institutional investors and financial advisors, streamlining onboarding and reducing operational friction.

According to a State Street report, 62% of investors believe ETPs offer an efficient, cost-effective, and accessible way to invest in alternatives such as real assets, private markets, or active strategies. This makes ETPs a compelling alternative to more traditional or less liquid structures.

Resilience and sustained growth

Since 2008, ETPs have achieved a compound annual growth rate (CAGR) of 20.1%, reaching $13.8 trillion in AUM by the end of 2024. In the first two months of 2025 alone, global ETF inflows surpassed $293 billion. This signals strong and growing adoption by institutional and professional investors seeking fast, diversified solutions.

Today, there’s an ETF for nearly everything – from traditional asset classes to cutting-edge themes like artificial intelligence and future security. Asset managers continue to turn to ETFs for their transparency, liquidity, and efficiency across core market segments – but they’re also increasingly seeking specialized solutions tailored to achieving specific outcomes for each investor.

Ultimately, ETPs do more than complement asset managers’ strategies – they enhance them. They enable managers to deliver solutions aligned with client goals, risk tolerance, and the operational efficiency today’s markets demand.

FlexFunds specializes in the design and launch of efficient, flexible investment vehicles (ETPs), tailored to each client’s unique needs. Our solutions are designed for asset managers looking to scale their strategies in international capital markets and broaden their investor base.

For more information, feel free to contact our specialists at info@flexfunds.com.