Mexico is preparing to make history. In 2026, it will become the first country to host three editions of the world’s most-watched tournament: the FIFA World Cup. But this time, it’s not just the ball that will be rolling—so will billions of dollars in investment, consumption, tourism, and opportunities for those who know where to look.

An analysis by GBM outlines how this World Cup will be played not only on Mexico’s fields but also on its stock exchanges.

A Historic World Cup—On and Off the Pitch

The countdown continues for the FIFA World Cup hosted by Mexico, which will welcome the tournament for a third time. In 1970, the country saw Pelé win his third title, and in 1986, “the hand of God” and the “goal of the century” helped Maradona secure Argentina’s second World Cup. This time, alongside the United States and Canada, the Latin American nation will host millions of fans in three cities: Mexico City, Monterrey, and Guadalajara.

Following its triumph at Euro 2024, Spain could arrive at the 2026 World Cup as the top favorite, thanks to a young and talented generation led by Lamine Yamal, Nico Williams, and Pedri. France, runner-up in the last World Cup and champion in 2018, is also a strong contender with stars like Kylian Mbappé and a deep roster. Brazil, under new leadership with coach Carlo Ancelotti, remains a historical powerhouse seeking its sixth title. England, with players like Jude Bellingham, Bukayo Saka, and Harry Kane, aims to end its World Cup drought, while Argentina, the current champion, relies on the experience of Dibu Martínez, Enzo Fernández, and Julián Álvarez to defend the crown—possibly in Lionel Messi’s final World Cup. Portugal, recent winner of the 2025 Nations League, and Morocco, semifinalist in Qatar 2022, are also teams to watch, while Mexico dreams of making a surprise run, backed by talents like Santi Giménez, Edson Álvarez, and a solid base of Liga MX players.

The 2026 World Cup will debut a new format with 48 teams divided into 12 groups of four. The top two from each group, along with the eight best third-placed teams, will advance to the round of 32.

This format allows the champion to play up to eight matches—one more than in previous editions—and raises the total number of games to 104. The opening match is scheduled at Estadio Azteca on June 11, and the final will be held on July 19, 2026, at MetLife Stadium in New Jersey, home of the NFL’s Jets and Giants, making this the longest and most game-filled World Cup in history.

The World Cup Brings Goals and Economic Growth

Hosting a World Cup isn’t just a matter of prestige, as GBM highlights—it’s a high-impact economic play. To meet the standards of the world’s most-watched event, host nations must invest heavily. In Mexico’s case, the firm’s analysts estimate an infrastructure investment of $805 million, primarily focused on Mexico City, including key improvements at the international airport.

This amount is significantly lower than the investment planned by the United States, estimated at US$10.42 billion. The difference is due to Mexico and Canada hosting only 13 matches each, while the United States will stage 78 games, including all knockout rounds.

GBM notes that such investment is not made in vain. Global events in Mexico have historically generated strong returns. Since its return in 2015, Formula 1 has brought in around US$7 billion, while NBA, NFL, and MLB games have also drawn millions of fans, especially from Latin America.

But the World Cup is in a league of its own. It’s the one global sporting event capable of delivering the largest economic impact for a host country. According to figures cited in the analysis, Brazil 2014 contributed a 1.2% GDP increase and 158,000 temporary jobs, with its legacy being mainly tourism-driven. Russia 2018 modernized infrastructure and added over $14 billion to the economy, creating more than 300,000 jobs. Qatar 2022, with a record US$200 billion investment, cemented its global positioning.

According to GBM estimates, the 13 matches held in Mexico could generate an economic impact close to US$1 billion, driven by the arrival of approximately 5.5 million visitors during the tournament. This would represent a significant boost for domestic tourism. Additionally, the creation of 24,000 direct jobs related to World Cup activities is expected—from stadium volunteers to additional pilots for the increase in international flights.

Some analysts estimate that, indirectly, the total economic impact could reach up to US$7 billion, factoring in cultural, culinary, and sporting events organized across the country. And that doesn’t include the value the World Cup holds for global companies, sponsors, and sports brands.

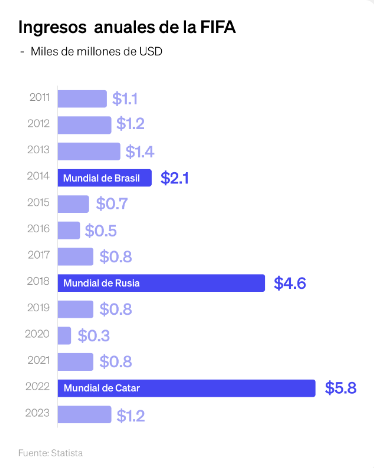

The analysis details how, for FIFA, the World Cup is its primary revenue source. As demonstrated by Qatar 2022, the sale of rights related to the tournament generated US$6.3 billion between 2019 and 2022, accounting for 83% of the organization’s total revenue during that cycle. This financial impact makes each World Cup a crucial event for the sustainability and global expansion of FIFA’s operations.