Nomura Has Successfully Completed the Acquisition of Macquarie’s Exchange-Traded Asset Management Business in the U.S. and Europe. According to the company, the purchase price was 1.8 billion U.S. dollars, and the closing of the transaction incorporates approximately 166 billion U.S. dollars (as of October 31, 2025) in assets from retail and institutional clients across equity, fixed income, and multi-asset strategies, under Nomura’s global brand, Nomura Asset Management.

As announced in April 2025, Nomura will integrate its private markets business, Nomura Capital Management (NCM), and its high-yield business, Nomura Corporate Research and Asset Management (NCRAM), together with the acquired assets to form Nomura Asset Management International, which will be part of Nomura Asset Management.

“The successful closing of this transaction marks an important step toward our 2030 Management Vision by boosting our assets under management and diversifying and strengthening our platform,” said Kentaro Okuda, President and CEO of Nomura Group.

New CEO and Strategic Alliance

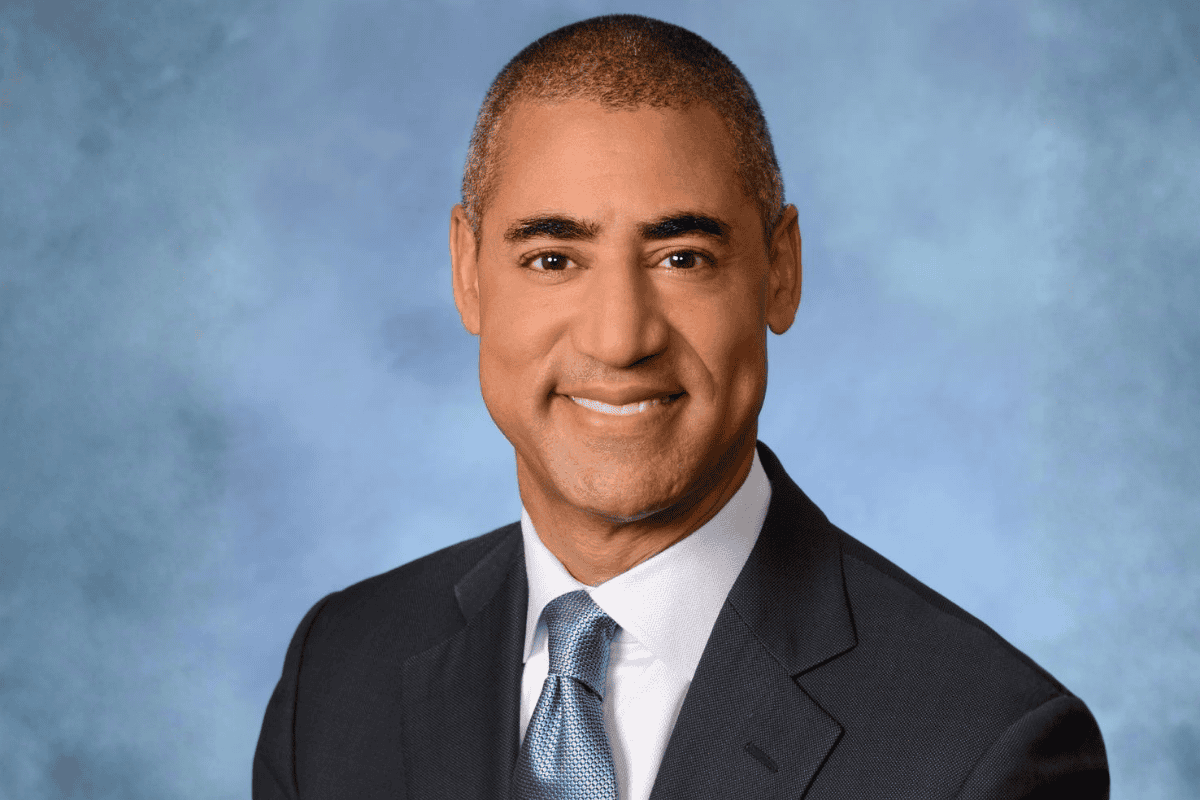

Headquartered in New York and Philadelphia, Shawn Lytle will be CEO of Nomura Asset Management International, and Robert Stark, President and Deputy CEO of Nomura Asset Management International. Lytle was formerly Head of the Americas for Macquarie Group, while Mr. Stark will continue in his current role as CEO of Nomura Capital Management and will report functionally to Yoshihiro Namura, Head of Nomura’s Investment Management Division, and Satoshi Kawamura, CEO and President of Nomura Holding America Inc., from a corporate perspective.

“The new combined business has a strong foundation, with a well-diversified platform across all major asset classes and client segments. We now have an exciting opportunity to strengthen the combined capabilities of the new business and grow the franchise globally,” said Shawn Lytle, CEO of Nomura Asset Management International.

In addition to completing the transaction, Macquarie and Nomura have formalized a strategic alliance for product distribution and joint development of investment strategies, as initially announced in April 2025. Under the agreement, Nomura will distribute certain private funds from Macquarie to high-net-worth clients and family offices in the U.S.

The alliance also establishes collaboration in developing innovative investment solutions for clients in the U.S. and Japan. “We have created a joint task force between Nomura and Macquarie, as part of this alliance, to explore additional opportunities aimed at generating value for clients through increased collaboration between the two organizations,” the company stated.

Key Statements

Following the announcement, Chris Willcox, Head of Nomura’s Investment Management Division and Head of Wholesale, stated: “We are delighted to have completed this acquisition ahead of schedule and to welcome our new colleagues from Macquarie Asset Management.”

Meanwhile, Yoshihiro Namura, Head of the Investment Management Division, added: “Our goal with this transaction is simple: to build a global platform with excellent capabilities and investment outcomes that help clients achieve what matters most to them. I believe the new leadership team, led by Shawn and Robert, is in an ideal position to realize our ambitions.”