The global bull market could continue in 2026, supported by growth in corporate earnings and resilient economic activity, although equity gains are unlikely to match the strong advance seen in 2025, according to Goldman Sachs Research. The firm expects continued global economic expansion across all regions and further moderate rate cuts by the U.S. Federal Reserve.

“Given this macroeconomic backdrop, it would be unusual to see a significant equity pullback or a bear market without a recession, even starting from elevated valuations,” writes Peter Oppenheimer, Chief Global Equity Strategist at Goldman Sachs Research, in the report Global Equity Strategy 2026 Outlook: Tech Tonic—A Broadening Bull Market.

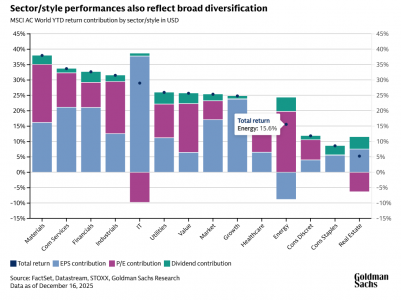

Looking back, diversification was a central theme for Goldman Sachs Research last year. “Investors who diversified across regions in 2025 were rewarded for the first time in many years, and analysts expect diversification to continue in 2026, extending to investment factors such as growth and value, as well as across different sectors,” they explain.

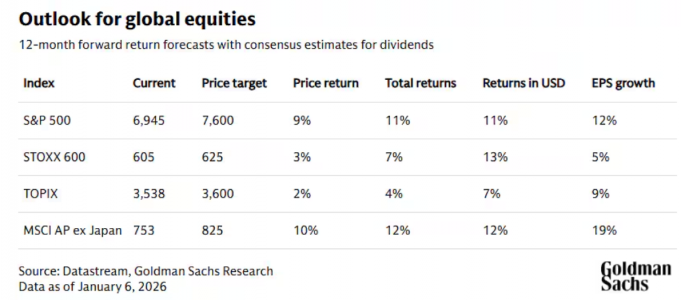

Outlook for Global Equities in 2026

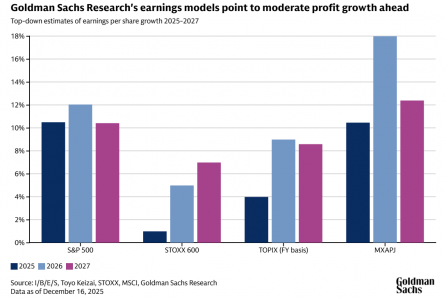

“We believe that returns in 2026 will be driven more by earnings growth than by rising valuations,” says Oppenheimer. The 12-month global forecast suggests that stock prices, weighted by regional market capitalization, could rise by 9% and deliver a total return of 11% including dividends, in U.S. dollars. “Most of these returns are driven by earnings,” he adds. Commodity indexes could also advance this year, with gains in precious metals once again offsetting declines in energy, as was the case in 2025, according to Goldman Sachs.