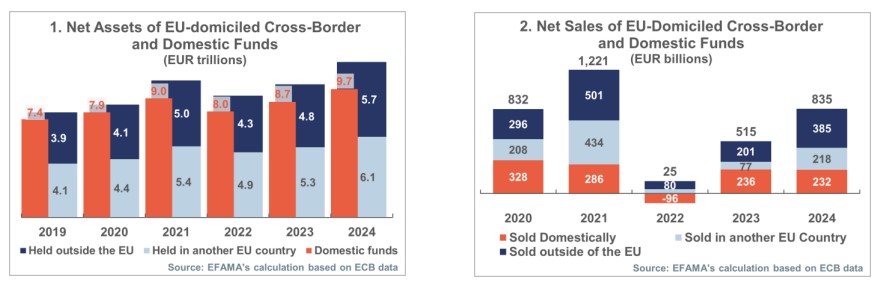

Within the European fund industry, the acronym UCITS enjoys great popularity and trust—but what about beyond Europe’s borders? The reality is that, according to aggregated data from the ECB, it is estimated that out of the €21.5 trillion held in UCITS and AIFs domiciled in the EU, €9.7 trillion corresponded to domestic funds. This means that €11.8 trillion are in the hands of investors outside the EU member states.

According to the latest report published by the European Fund and Asset Management Association (Efama) and prepared with exclusive data from Broadridge’s Global Market Intelligence (GMI) to analyze international UCITS distribution trends, thanks to the European passport regime, those €11.8 trillion are divided into two segments. On one hand, there are funds domiciled in EU countries and held by investors located in another member state, which reached €6.1 trillion at the end of 2024. On the other hand, there are those funds domiciled in the EU and held by investors located outside the EU, which reached €5.7 trillion.

“Over the past decade, the net assets of cross-border funds have grown considerably faster than those of domestic funds. While the assets of domestic funds increased by 83%, the assets of cross-border funds held in another EU country grew by 145%, and cross-border funds held outside the EU grew by 133%. Interestingly, in the past two years, the growth rate of cross-border funds outside the EU has outpaced that of intra-European cross-border funds, underscoring their increasing relevance on a global scale,” the report reveals.

According to the report, one of the main drivers behind this growth has been the increase in net sales. As the figures show, cross-border funds—especially those marketed outside the EU—have consistently attracted greater investment flows compared to domestic funds and cross-border funds within the EU.

Asia-Pacific: Largest Holder

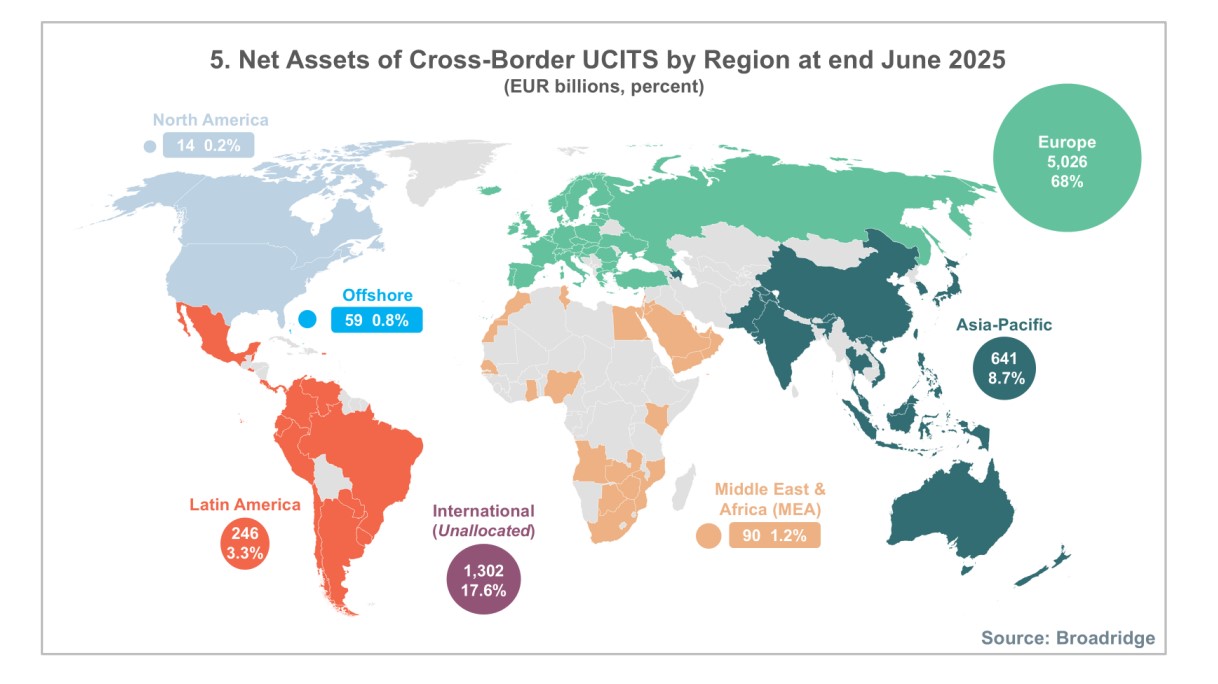

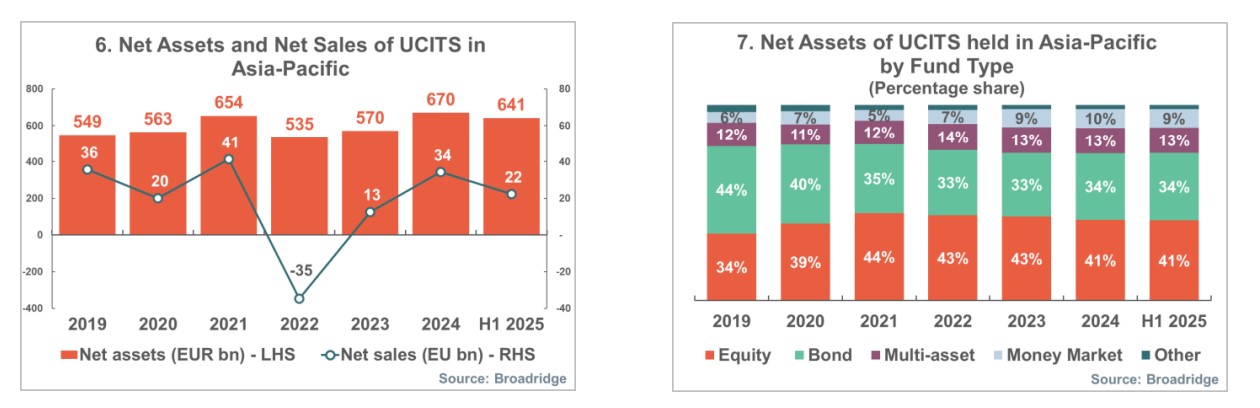

One of the conclusions presented in the report is that, as of the end of June 2025, the Asia-Pacific region accounted for 8.7% of cross-border UCITS holdings. Specifically, net UCITS assets in the region grew by 18% during 2024, although they declined slightly in the first half of 2025 (-4%).

“Over the past five years, cumulative asset growth has been 22%. This relatively moderate long-term growth reflects the impact of the sharp decline recorded in 2022, after which net assets took two years to fully recover. Net sales have generally been positive in recent years, with 2022 as the only exception,” the report explains.

Specifically, Hong Kong, Singapore, Japan, and Taiwan are the main Asian markets for cross-border UCITS. According to the report, following widespread redemptions in 2022, Singapore and Taiwan drove the regional recovery in 2023, recording net inflows of €9 billion and €4 billion, respectively.

In 2024, total net inflows into Asia-Pacific rose significantly to €34 billion, supported by continued strong demand in Singapore (€12 billion) and Taiwan (€6 billion), as well as a notable recovery in Hong Kong, where investors contributed €11 billion in new net investments. During the first six months of 2025, this positive momentum continued, with significant net inflows into Singapore and Hong Kong totaling €7 billion.

Geographic Overview

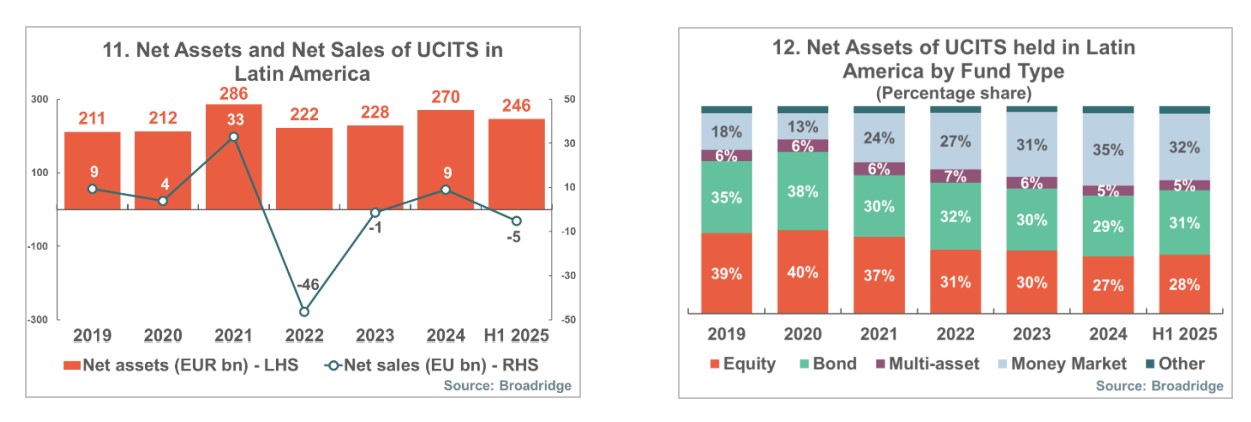

Looking at other regions, it is notable that the countries of South America and Central America accounted for approximately 3.3% of cross-border UCITS holdings at the end of the first half of 2025. According to the report’s data, as of the end of June 2025, Latin American investors held €246 billion in cross-border UCITS, excluding ETFs, and net assets fell by approximately 8.5% in the first half of 2025, after growing by 15% the previous year and 24% over the past five years.

“Total holdings remain below their 2021 peak. Net sales have been relatively weak in recent years, with two consecutive years of net outflows in 2022 and 2023. The market returned to positive territory in 2024, with net inflows of €4 billion, but so far in 2025, it has once again recorded net redemptions of €5 billion,” the document states.

Regarding the Middle East and Africa (MEA), the countries in this region accounted for approximately 1.2% of cross-border UCITS holdings at the end of June 2025. In the case of North America, the United States and Canada account for only 0.2% of cross-border UCITS holdings. “All of these are concentrated in Canada, since, although the United States is the largest fund market in the world—with total net assets exceeding €40 trillion in 2024—regulatory barriers effectively prevent the distribution of non-U.S. funds in that country,” the report explains.

It also highlights that U.S. fund managers widely use UCITS to market funds to investors outside the U.S., given that funds domiciled in that country cannot easily be marketed to international investors for tax and regulatory reasons. According to the report, it is also important to note that U.S. investors residing outside the U.S. do invest in UCITS, mainly through wealth managers in Latin America, offshore jurisdictions, or international regions.

Lastly, the offshore region represents 0.8% of European cross-border UCITS and includes several Caribbean countries and the Channel Islands, commonly defined as offshore financial centers, such as Bermuda, Curaçao, Guernsey, and Jersey. There is also an “unassigned international” region, as referred to in the report, which represents approximately 17.6% of cross-border UCITS assets that cannot be linked to a specific end-investor location.