A new report by Vanguard, titled “Financial Advice Economics: What SEC Filings Reveal About Costs and Services”, sheds light on how the financial advisory market in the United States is structured and how much fees can vary for similar services.

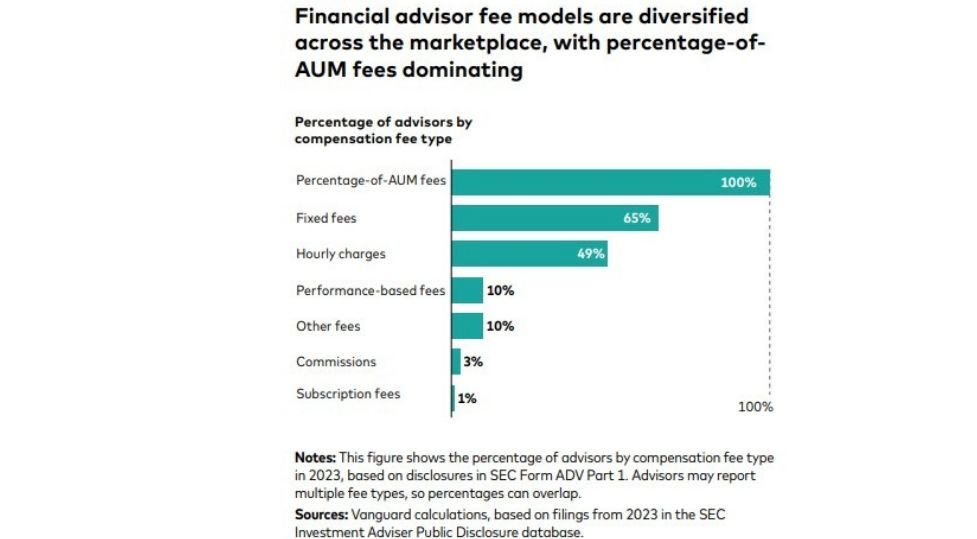

The study analyzed more than 21,400 filings from 15,396 advisory firms registered with the SEC, which together manage about $128 trillion in assets, to identify patterns in costs, services offered, and operating models.

According to the analysis, robo-advisors — automated digital platforms — charge an average of 30 basis points (0.30%) on assets under management, while hybrid models (a combination of human advisor and technology) reach fees close to 85 basis points. Vanguard notes that 80% of hybrid advisory offerings charge between $225 and $1,500 per year to an investor with $100,000, which represents a cost difference of more than six times.

Although higher fees are expected to imply a more comprehensive service offering, the study did not find a direct and consistent relationship between price and breadth of services. Vanguard warns that many high-cost advisors do not necessarily include tax planning or behavioral advice, two of the areas with the highest added value for the investor.

Another key finding is that advice offered through the workplace (for example, in corporate retirement plans) tends to be more affordable and, in many cases, includes more services than traditional retail channels. This suggests that individual investors could benefit from taking advantage of employer-sponsored advisory programs, which typically have more competitive cost structures.

A Difference That Erodes Gains

The report, authored by Nicky Zhang, Fiona Greig, Andy Reed, Paulo Costa, and Malena de la Fuente, puts into perspective the effect of cost on long-term returns: a one-percentage-point (100 bps) difference in annual fees for a $100,000 portfolio can reduce the final value by approximately 25% after 30 years, assuming a gross annual return of 6%.

“Understanding what is being paid — and what is received in return — is essential. Transparency in fees and services is key for investors to make informed decisions,” the report emphasizes.

Vanguard recommends that investors carefully review the fees and services of their financial advisors and not assume that a higher cost guarantees superior service. It also suggests evaluating the advisory programs available through employment and confirming that the services offered are aligned with personal needs.

In an environment of economic uncertainty and increased digital offerings, the report concludes that efficiency and clarity in financial advice will be key to improving long-term investment outcomes.