The European Fund and Asset Management Association (Efama) highlights in its document “The EU Must Adopt a New Deal to Mobilize EU Savings” that, according to the European Commission, more than €600 billion must be invested annually to achieve a successful green transition, as well as additional billions to support the digital transition. In light of this reality, Efama calls for the creation of the necessary investment conditions to address these challenges.

What exactly do these measures to create the “necessary investment conditions” entail? According to Bernard Delbecque, Senior Director at Efama, “a decisive shift in EU policies is needed, particularly in competition and industrial policies, to improve investment opportunities, boost the valuation of Europe-based companies in global stock indices, and increase investments from asset owners into EU companies. Once asset owners see more promising prospects in the EU, they will increase their investments in the region, thereby supporting the financing of the green and digital transitions.”

The report prepared by Efama states that to unlock private investment and finance the EU’s capital needs, it is crucial to leverage the potential of the Single Market and develop an effective Capital Markets Union (CMU) that offers more opportunities and better outcomes for European companies and savers. Additionally, it is imperative to redirect the European Commission’s Retail Investment Strategy to encourage EU citizens to invest more in capital market instruments and promote retirement savings, thereby increasing the pool of available savings to support the EU’s ambitions.

Impact on UCITS Funds

Efama sees addressing these challenges as urgent, as its report demonstrates that this situation is impacting the growing allocation of UCITS assets to U.S. equities, attributing this trend to the superior performance of U.S. stock markets. “By the end of 2023, 44.6% of UCITS equity portfolios were invested in U.S. assets, compared to 19.2% in 2012. The high exposure of European UCITS equity funds to foreign assets is specific to Europe, according to the study. In 2023, equity funds domiciled in the EU and the UK had 27% and 29% of their portfolios invested in local stocks, respectively, compared to 78% and 84% for equity funds in the U.S. and the Asia-Pacific region,” the report argues.

The document outlines several factors that may explain the lower domestic bias among European investors, such as the benefits of cross-border investments, the role of financial advisors, the development of fund platforms facilitating investments in funds tracking global indices, the relatively small size of EU stock markets, and the enthusiasm for leading U.S. tech companies.

“The strong performance of U.S. markets, which led to an increased allocation of equity assets to U.S. stocks, reflects a combination of factors and policies, including robust population growth, higher spending on research and development, substantial fiscal stimulus, and lower energy prices,” the report explains.

A Matter of Competitiveness

Efama’s main conclusion is that, to compete effectively on the global stage and foster the emergence of industrial leaders based in Europe, the EU must embark on a transformative path to boost economic growth, improve investment opportunities, generate higher investment returns, and increase the market capitalization of European companies. In their view, these are necessary conditions to attract more investment capital to the EU and ensure that European companies have access to financing throughout their development.

“This, in turn, could initiate a virtuous circle where higher economic growth strengthens asset owners’ confidence in the EU economy, thereby bolstering the ability of asset managers to provide a critical source of stable, long-term financing for European governments, companies, and infrastructure projects,” Efama concludes.

The Brazilian investment fund industry closed August with positive net inflows of 11.7 billion reais (more than 2 billion dollars), according to data from the Brazilian Association of Financial and Capital Market Entities. Cumulatively in 2024, financing has already reached 286.2 billion reais (more than 50 billion dollars), with a strong focus on fixed income funds, which continue to lead resource inflows.

In August, the fixed income class saw a 64.2% increase compared to the same period last year. Pedro Rudge, director of Anbima, attributed this performance to the prospects of maintaining the Selic rate at high levels, which benefits funds in this category. “With the current trajectory of the Selic, fixed income funds should maintain their appeal in the coming months, which is likely to bolster resource flows into this class and sustain the positive performance of the industry,” he stated.

Among fixed income funds, those classified as Low Duration Fixed Income with Investment Grade stood out the most. These funds focus on assets with low credit risk and an average duration of less than 21 business days, primarily investing in federal government bonds.

In addition to fixed income, Credit Rights Investment Funds (FIDC) also performed well, followed by pension funds and Private Equity Investment Funds (FIP).

On the other hand, the multi-market and equity classes showed a negative balance in August. ETFs (Exchange Traded Funds) also recorded a negative balance.

In terms of net assets, the fund industry reached 9.3 trillion reais in August, a 15% increase compared to the same month in 2023.

The judicial reform in Mexico seems imminent, and investors have taken precautions in anticipation of what is considered a profound change, the consequences of which—positive or negative—remain uncertain. This week will be decisive, as the reform has already passed without issue through the first of the two legislative chambers, the House of Deputies, where the majority of the ruling party pushed it through.

Markets are unsettled, with the exchange rate holding near 20 pesos per dollar, representing a 21% depreciation compared to the closing rate before the June 2 election. Meanwhile, the country’s main stock exchange continues its erratic trajectory, closing August with a 0.42% drop and accumulating a year-to-date decline of 10.85%.

Julius Baer highlights some expected effects on Mexican markets. One major consequence, should the judicial reform be approved, would be that credit rating agencies could downgrade Mexico next year. Currently, Mexico holds “investment grade” status from the three most important global rating agencies.

Moody’s rates Mexico at Baa2; S&P at BBB; and Fitch Ratings at BBB-. All three agencies have a stable outlook for Mexico’s sovereign debt. Just last Thursday, SURA Investments stated that it did not foresee adjustments to Mexico’s credit rating in the short term, which is understood to mean within the next 12 months.

However, other immediate indicators reflect the risks perceived by the markets regarding the judicial reform. According to Julius Baer, the Mexican peso will remain under pressure, prompting a revision of their year-end forecast for the currency to 20 pesos per dollar. It’s important to note that the peso was trading at 16.53 pesos before the June 2 election.

“The Mexican peso has depreciated 0.24% since Wednesday, surpassing the 20 USD/MXN level. It has weakened by 15% year-to-date against the USD due to fears of a U.S. slowdown, the unwinding of JPY-financed trades, and the constitutional reforms,” their analysis notes.

What Does the Judicial Reform Propose?

The controversial judicial reform proposes that all judges in the country, including those on the Supreme Court, be elected by popular vote in 2025 and 2027. This raises concerns that judicial decisions could eventually be biased toward those who supported the candidates.

Julius Baer warns that although the economic impact is not yet fully clear, markets are concerned about the potential weakening of the rule of law and the concentration of judicial and executive power, which could reduce oversight and accountability.

Just this past weekend, the U.S. newspaper *The Wall Street Journal* reported that U.S. companies had delayed plans to invest around 35 billion dollars in Mexico due to concerns about how the approval of the judicial reform could affect their businesses.

This amount is significant as it is nearly equivalent to Mexico’s average annual foreign direct investment.

UBS International has added Omar Castro and Javier Villanueva to its Coral Gables office, according to a LinkedIn post on Tuesday by Catherine Lapadula, Market Executive of UBS Florida International.

“I’m thrilled to announce that Omar Castro has joined our international division of UBS in Florida and will be based in our Coral Gables office!” Lapadula posted.

The bankers are joining from Merrill Lynch to cover the international market in South Florida.

Castro brings over a decade of experience from firms such as J.P. Morgan Private Bank, where he worked from 2012 to 2018, and Merrill Private Wealth Management, where he served from 2018 until joining the Swiss bank, according to his profile on the corporate social network.

Villanueva, joining alongside Castro, has more than 25 years of experience, having worked at firms including Santander, Banamex, JV Global Capital, and Merrill Lynch.

With the aim of further strengthening its capital base, the Chilean bank Bci returned to the local perpetual bond market. The firm issued its second AT1 bond in the international market.

According to a statement, the issuance raised 500 million dollars in fresh capital and achieved an issuance rate of 7.5%.

The bond is part of Bci’s strategy to optimize its capital structure and allows the bank to meet Basel III requirements a year ahead of the deadline set by the Financial Market Commission (CMF), they highlighted.

Earlier this year, the financial firm entered the perpetual bond market. In early February, it made its first issuance, also for 500 million dollars.

For Javier Moraga, manager of Bci’s Investments and Finance division, the outcome of this transaction “reflects international investors’ confidence and understanding of the bank’s development strategy.”

He also noted that the issuance strengthens the bank’s diversification of funding sources across the United States, Europe, and Asia.

In this regard, the executive highlighted the role of the team in charge of the launch, stating that they “positioned Bci in a very strong way for the implementation of new capital regulations in the Chilean market,” as noted in the press release.

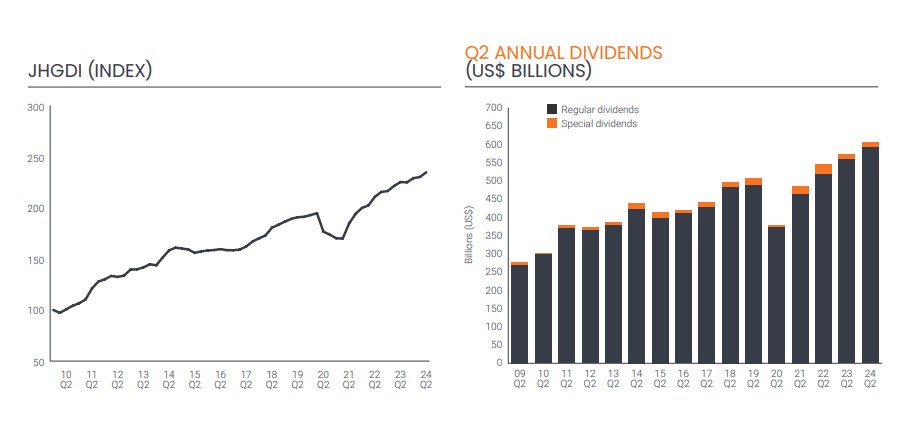

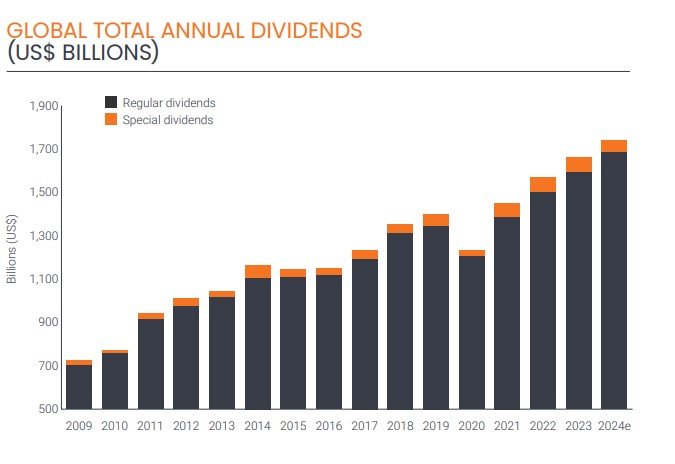

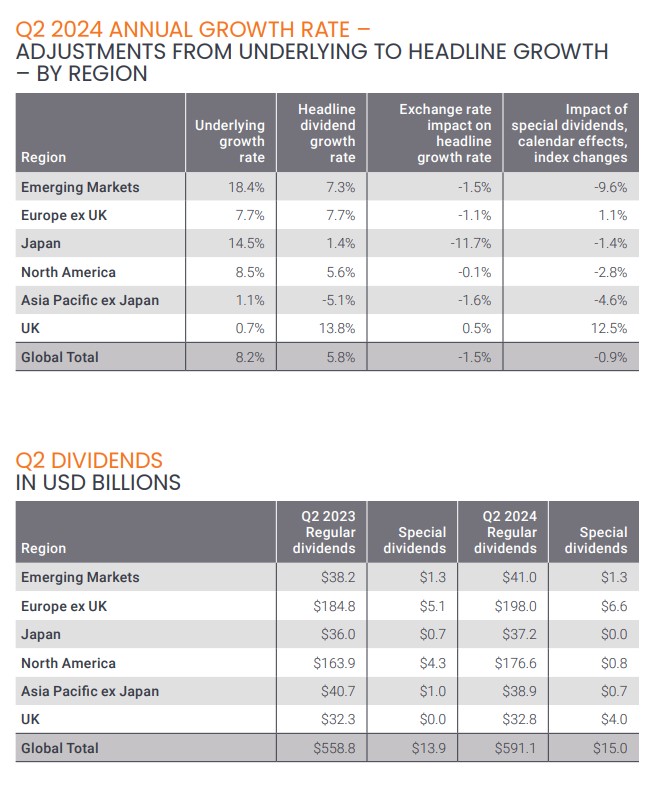

Global investors focused on income generation enjoyed a strong second quarter in 2024, according to the latest edition of the Janus Henderson Global Dividend Index. Dividends increased by 5.8% on a headline basis, reaching a record high of $606.1 billion. The underlying growth rate was even higher at 8.2%, after adjusting for currency effects, particularly the weakening of the Japanese yen.

According to the asset manager, the initiation of dividend payments by major U.S. companies such as Meta and Alphabet boosted global growth in the second quarter by 1.1%. However, overall growth was widespread, with 92% of companies worldwide either raising or maintaining their dividends. Additionally, one-third of sectors posted double-digit underlying growth, while dividends declined in only three sectors.

Geographic Analysis

The second quarter is the peak season for dividend payments in Europe. Payouts rose 7.7% year-on-year, reaching a record $204.6 billion for the region. France, Italy, Switzerland, and Spain all saw record dividend payouts. More than half of Europe’s dividend growth came from banks, which have benefited from higher interest rates. In contrast, Germany saw a 1.2% decline in payouts, mainly due to Bayer’s significant dividend cut. In the U.S., dividends increased by 8.6%, with 40% of that growth attributed to Meta and Alphabet paying dividends for the first time.

The second quarter is also seasonally significant in Japan, where dividends increased by around 14% on an underlying basis, setting a new record in yen. However, the weak exchange rate prevented record payouts in dollar terms. Toyota Motor, the largest dividend payer in Japan, made one of the largest increases after reporting record profits in its last fiscal year. Elsewhere in the Asia-Pacific region, dividends remained stable in Hong Kong but fell sharply in Australia due to a cut by Woodside Energy. Singapore, Taiwan, and South Korea all posted double-digit growth.

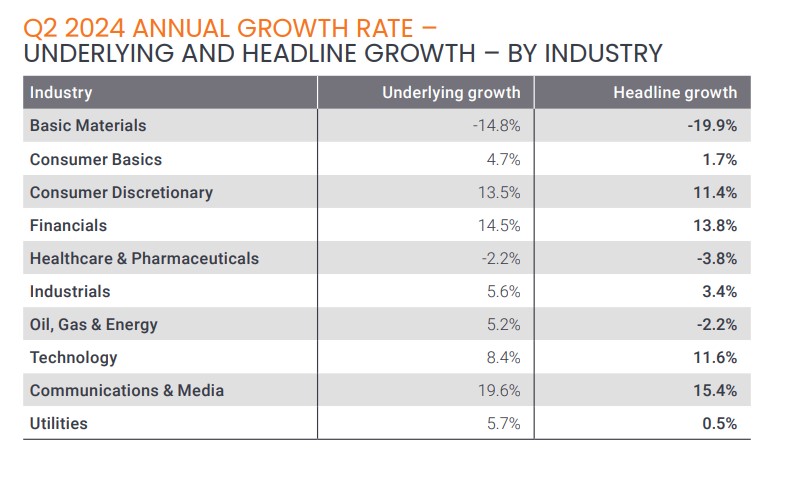

Sector Analysis

Once again, banks were the primary drivers of dividend growth, accounting for one-third of the underlying year-on-year increase. European banks contributed the most, although this trend was evident globally. Insurers, automakers (especially in Japan), and telecommunications companies also played a significant role in the second quarter’s growth.

Outlook and Trends

Following a strong second quarter, and given the substantial contribution that new dividend payers could make this year, Janus Henderson has raised its 2024 dividend forecast. The asset manager expects companies worldwide to distribute a record $1.74 trillion, marking a 6.4% underlying increase compared to 2023 (up from the 5.0% estimated in the first-quarter report) and a 4.7% headline increase (compared to the previous 3.9% estimate).

“We had optimistic expectations for the second quarter, and the outlook was even brighter than anticipated thanks to the strength in Europe, the U.S., Canada, and Japan. Economies around the world have generally weathered the impact of higher interest rates well. Inflation has slowed, and economic growth has been better than expected. Moreover, companies have proven resilient, with most sectors continuing to invest for future growth. This favorable environment has been especially positive for the banking sector, which enjoys solid margins and limited credit deterioration, boosting profits and generating ample cash for dividends,” said Jane Shoemake, Client Portfolio Manager in the Global Equity Income team at Janus Henderson.

In her view, the initiation of dividend payments by major U.S. media and technology companies such as Meta, Alphabet, and China’s Alibaba, among others, is a highly positive sign that will drive global dividend growth by 1.1 percentage points this year. “These companies are following a well-established path seen in growth sectors over the past two centuries, reaching a stage of maturity where dividends are a natural way to return excess cash to shareholders. By doing so, they have surprised skeptics who believed this group of companies was different. The stock market evolves over time as sectors rise and fall to meet society’s changing needs. Paying dividends will also increase their appeal to investors for whom dividends are a vital part of their investment strategy and could encourage more companies to follow their lead,” Shoemake added.

BNY Mellon announced that it has reached a definitive agreement to acquire Archer, a leading technology service provider of managed account solutions for the wealth and asset management industry.

“Archer provides asset and wealth managers with comprehensive middle-office and back-office solutions to meet the managed account needs of institutional, private, and retail investors,” the firm’s statement says.

Through its fully integrated, cloud-based platform, Archer helps its clients expand distribution, streamline operations, launch new investment products, and deliver personalized outcomes to a broader market, the text adds.

With the integration of Archer’s managed account solutions, capabilities, and professional services team, BNY will enhance its enterprise platform to support retail managed accounts, a market expected to grow at a double-digit compound annual growth rate to over eight trillion dollars in assets in the next three years in the U.S., according to data from Cerulli.

“Managed accounts are one of the fastest-growing investment vehicles in the asset management industry, enabling investment advisors and asset managers to deliver personalized portfolios to retail investors at scale,” said Emily Portney, Global Head of Asset Servicing at BNY.

In addition to enhancing BNY’s current capabilities in asset servicing for managed accounts, Archer will provide BNY Investments and BNY Pershing’s Wove wealth platform for advisors with expanded model portfolio distribution and access to Archer’s multi-custodial network, the company notes.

“Today’s asset and wealth managers have a strong desire to create multi-asset solutions through a variety of products, along with direct indexing and tax-optimized portfolios, to meet the needs of their distribution partners and investors,” added Bryan Dori, President and CEO of Archer.

The transaction is expected to close in the fourth quarter of 2024, subject to regulatory approvals and other customary closing conditions.

Schroders has announced the appointment of Richard Oldfield as Group CEO, succeeding Peter Harrison, effective November 8, 2024, subject to regulatory approval. According to the firm, this announcement follows an orderly and thorough succession process that began in April and included a global search, with both internal and external candidates. The process was led by the Chair of the Board, supported by a Board Subcommittee, our Senior Independent Director, and a leading search firm. Peter Harrison will remain Group CEO until November 8, 2024, after which he will step down from the Board and continue working with Richard until the end of the year.

Until now, Oldfield served as Chief Financial Officer at Schroders, bringing with him extensive experience. He spent 30 years at PwC, where he held senior roles, including Vice Chairman of the firm and Global Markets Leader. Reporting to the Global Chairman, he was responsible for increasing profitability across PwC’s business lines while advising global clients on their most complex matters. “Since joining Schroders, Richard’s contribution has been significant, bringing a fresh perspective on capital management, driving new initiatives such as the inaugural bond issuance earlier this year, and integrating commercial discipline across the Group,” the company noted.

Dame Elizabeth Corley, Chair of Schroders’ Board, stated: “Richard has demonstrated his natural ability to lead client- and people-focused businesses. He has a global outlook, a strategic growth mindset, and a proven track record of leadership. The Board unanimously determined that Richard was the most suitable candidate.”

Corley explained, “It was clear that his strong business vision would drive decisive transformation at an accelerated pace, and we are confident that he will advance our strategic priorities, enabling Schroders to continue growing and serving clients. His personal values are closely aligned with Schroders’ culture; he is authentic, sincere in his approach, passionate about clients, and committed to nurturing talent.”

Meanwhile, Peter has shown strong leadership and unwavering commitment, leading the business through a remarkable transformation over the past eight years. He has successfully expanded our capabilities in both private and public markets, overseeing sustained growth in our Wealth business and more than doubling assets under management to a record £773.7 billion. It has been a true pleasure working with Peter, and I would like to thank him, both personally and on behalf of the Board, for his exceptional service.”

For his part, Richard Oldfield said, “It is an honor to have been chosen as the next Group CEO of Schroders. Since joining, I have seen what a great company Schroders is. We are known for our long-term approach, meeting client needs, and delivering excellent investment returns. Despite the challenges facing the industry, I know we have the capabilities and the people to seize the right opportunities to grow our business and be one of the world’s leading wealth creators. I am eager to get started.”

“Schroders will always hold a central place in my life as I began my career here straight out of university. I am very proud of what we have achieved, and I feel a great affinity with the wonderful people working at the firm. When we hired Richard, I was impressed by his vast experience in managing and growing businesses, as well as his client-centric approach. He has brought fresh ideas during his first year, and I am confident he will continue to drive the business forward,” concluded Peter Harrison, the current CEO.

Consolidation remains a highly active trend across the financial industry. According to the latest report from Cerulli Associates on this sector, titled “Wealth Management Consolidation: Analyzing the Drivers Behind a M&A Deal Environment”, the pursuit of scale and the goal of capturing a larger share of the advisory value chain are fueling merger and acquisition (M&A) activity throughout the industry. The consulting firm believes this trend will create a more competitive environment for wealth managers.

The imperative to grow larger and more profitable has driven much of the intensified M&A activity that has been underway in the asset and wealth management industry for over a decade, resulting in an environment dominated by key players. According to Cerulli, the top five wealth management firms control 57% of the assets under management (AUM) of broker-dealers (B/D) and 32% of B/D advisors, while the top 25 B/D firms and their various affiliates control 92% of the AUM and 79% of the advisors.

Wealth managers are increasingly focused on providing truly comprehensive wealth management services, pursuing M&A to strengthen capabilities and capture more of the value chain. Although increasing share of the client’s portfolio has been an elusive goal in the industry for decades, Cerulli sees significant consolidation opportunities among wealthy investors. According to the research, 57% of advised households would prefer to consolidate their financial assets with a single institution; however, only 32% currently use the same provider for both cash management and investment services.

“Following a merger or acquisition, companies rarely emerge as well-oiled machines offering top-tier capabilities and services. The vertical integration of technology systems, client account migration, and changes in workplace culture are all potential pain points when an organization restructures. As wealth management firms enter new segments through acquisition, they must have a plan to transition clients to service models that meet their needs,” says Bing Waldert, Managing Director of Cerulli.

According to the firm, now more than ever, due diligence is a step that must be fully developed. “Deals that make sense on paper can turn into cautionary tales when acquirers miscalculate the impact of merging operations,” says Waldert. “In a wealth management environment where advisors and assets are more mobile than ever, there is an increased potential for a deal to have negative ramifications for advisor retention,” Waldert concludes.

Venerable Investment Advisers, an investment advisor and subsidiary of Venerable Holdings, announced the launch of its initial line of investment funds, comprising approximately $9.9 billion in assets under management.

The investment funds from this launch, and future ones, serve as investment options for the separate accounts of insurance companies and incorporate the internal management of the underlying investment funds into the variable annuity business of Venerable Insurance and Annuity Company.

Venerable Advisers enlisted the investment advisory affiliates of Russell Investments and Franklin Templeton to provide sub-advisory services for the Venerable Variable Insurance Trust.

“This is an important milestone in the rollout of our investment advisory business, and we appreciate the collaboration of Russell Investments and Franklin Templeton along the way. We look forward to continuing to focus on optimizing our business and growing our AUM with future fund launches,” said Tim Brown, president of Venerable Advisers.

Zach Buchwald, president and CEO of Russell Investments, added that the multi-manager options are designed to address current investment challenges. “Russell is honored to partner with Venerable Advisers to offer a more efficient model that will help drive better outcomes for policyholders,” he added.

“The partnership with Venerable Advisers in launching their inaugural line of investment funds has required exceptional collaboration, focused on delivering results to clients,” said Jeff Masom, head of U.S. Distribution at Franklin Templeton.