Reinhard Koester Joins Aquiline Capital Partners

| By Alicia Miguel | 0 Comentarios

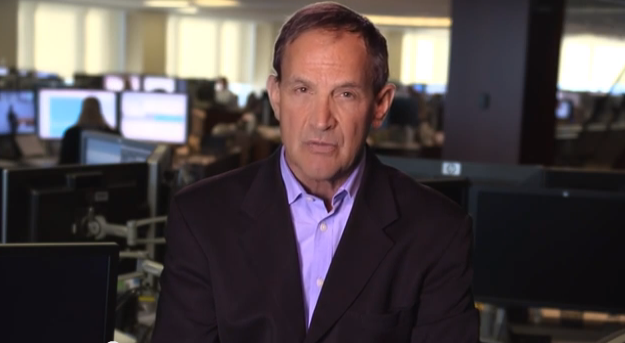

Aquiline Capital Partners, a New York-based private equity firm investing in financial services, has announced that banking industry veteran Reinhard Koester has joined the firm as an investment professional. Mr. Koester joins Aquiline from J.P. Morgan and will focus on banking and credit investments.

“We have known Reinhard for many years and have been impressed by the quality of his work and industry expertise,” said Jeff Greenberg, Chief Executive of Aquiline. “Reinhard will share his expertise across the firm and play a major role on our banking and credit team, which has become one of our most active areas with a range of attractive investment opportunities.”

With over 20 years of financial services experience, Mr. Koester joins Aquiline from J.P. Morgan where he was a Managing Director and Co-head of Specialty Finance and Alternative Asset Managers in New York. Previously, he was with Goldman Sachs as a Managing Director and Co-head of Specialty Finance in New York and a Managing Director in London. He also served as Executive Vice President and Chief Risk Officer for The PMI Group in San Francisco and practiced law as an Associate with Davis, Polk & Wardwell in New York and London. He began his career as a consultant with McKinsey.

Mr. Koester has a J.D. from Yale Law School, an M.B.A. from the University of Michigan and a B.S. from Arizona State University.

“Aquiline has an excellent record of building companies and making successful investments across a range of financial services. I look forward to contributing to the success of the firm and its portfolio companies,” commented Mr. Koester.

Aquiline is a private equity firm based in New York investing globally in financial services enterprises in industries such as banking and credit, insurance, investment management and markets, and financial technology. Aquiline seeks to add value to its portfolio companies through strategic, operational and financial guidance.