This Tuesday, October 1st, a new term begins in Mexico, and for the first time, a woman, Claudia Sheinbaum, will assume the presidency of Mexico, making her the first female president in the North American region.

Fiscal stability, economic growth, and the creation of necessary infrastructure to face the challenge of nearshoring are the main challenges the economic team will face immediately as they take the reins of the Mexican economy starting on October 1st, according to analysts.

Who are the officials who, as of October 1st, will be responsible for steering the second-largest economy in Latin America and the 13th largest in the world?

Rogelio Ramírez de la O: Fiscal Consolidation as a Priority

This year, Mexico reached a fiscal deficit of 5.8% of GDP, the highest level in 36 years. This will be a decisive factor in determining the country’s credit rating, as noted by rating agencies like Moody’s.

The highest fiscal deficit in decades is the challenge for Rogelio Ramírez de la O, the current Secretary of Finance, who will continue in his position under Claudia Sheinbaum’s administration starting this Tuesday, October 1st.

In addition to fiscal consolidation, analysts consider that other challenges include a fiscal reform and fostering economic growth beyond the 2.1% average Mexico has experienced for the past four decades.

Marcelo Ebrard Casaubón: Renegotiating the USMCA, the Upcoming Battle

As of this Tuesday, October 1st, the new Secretary of Economy is Marcelo Ebrard, who served as Foreign Minister under Andrés Manuel López Obrador’s administration and ran for the presidential nomination from the ruling party.

As Secretary of Economy, Ebrard will be tasked with designing and promoting public policies to boost the country’s economic growth, as well as reviewing or renegotiating the US-Mexico-Canada Agreement (USMCA) in 2026 with the country’s regional partners, the United States and Canada.

According to analysts, this will be one of the most important challenges of the upcoming term. The trade agreement, which began 30 years ago in 1994, has been a significant economic driver for Mexico.

Before the agreement, initially known as NAFTA and now as USMCA, Mexico’s exports to the U.S. were around $43 billion. Last year, Mexico’s exports to the world’s largest economy totaled $593 billion.

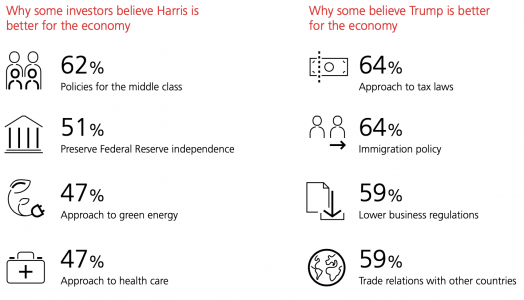

The USMCA review brings many challenges for Mexico, compounded by the U.S. electoral process. While it is technically just a review of the treaty, some analysts believe it could lead to a new negotiation, depending on the U.S. economic situation in the coming months.

Victoria Rodríguez Ceja: Keeping Inflation Under Control

Though the Governor of the Bank of Mexico is not officially part of the presidential economic cabinet and cannot be removed until her term ends on December 1, 2027, she plays a crucial role in economic policy by preserving the purchasing power of the currency.

The new term looks promising for Banxico, as it has managed to steer inflation toward the target of 3% ± 1%, although estimates suggest that the goal will not be reached before 2026.

In September, Banxico resumed interest rate cuts, which analysts believe will help stimulate the Mexican economy and avoid a potential recession, though it may not be enough to prevent the current slowdown.

Jesús Antonio Esteva Medina: Infrastructure and Nearshoring as Priorities

The next Secretary of Infrastructure, Communications, and Transport (SICT) will face a significant challenge: promoting infrastructure development to make the country competitive in the context of nearshoring.

This task is complicated by a contraction in available resources due to the fiscal deficit and the funds committed to social programs, leaving little room for additional spending.

The outgoing administration scaled back physical investment spending. Data from the Ministry of Finance and Public Credit (SHCP) showed that from January to November 2023, infrastructure spending was 778.3 billion pesos, a 2.9% drop compared to the same period in 2022.

It is estimated that during the current administration, infrastructure investment fell by 30% compared to the previous government, despite emblematic projects like the Dos Bocas refinery, the Felipe Ángeles International Airport (AIFA), and the Maya Train.

Julio Berdegué Sacristán: Modernizing Mexican Agriculture

The Secretary of Agriculture and Rural Development (SADER) in Claudia Sheinbaum’s cabinet is Dr. Julio Berdegué Sacristán.

Among his many roles, he was appointed Regional Representative for the United Nations’ FAO in Latin America and the Caribbean in 2017. During his time at the FAO, he emphasized that hunger in the region is closely linked to economic inequality and the historically rigid income distribution in Latin America and the Caribbean.

Mexico ranks 12th in global food production and excels in agriculture, livestock, and fishing. Since NAFTA’s implementation, Mexican agri-food exports have grown by over 600%.

The sector’s productivity, combined with greater trade openness, has enabled Mexico to increase agri-food exports, reaching nearly $10 billion in sales in the first four months of this year and a projected total of $30 billion by year-end.

However, the sector urgently needs continuous resource injections for modernization, as many parts of rural Mexico lack the technological capacity required today.

Three Major Challenges for the Mexican Economy

Analysts agree that three major challenges could shape the next six-year term:

1. Tackling fiscal deterioration: The country must quickly return to a manageable fiscal deficit. A 5.8% deficit is unsustainable in the short term for an economy like Mexico’s.

2. Boosting economic growth: The 2.1% average growth rate over the past 40 years is no longer sufficient. Mexico needs sustained and substantial growth for decades to overcome its economic lag.

3. Infrastructure development: Mexico has a historic opportunity with nearshoring, but it must be prepared with adequate infrastructure; otherwise, the opportunity could slip away.