Managers Are Exploring More Liquidity Solutions, Investment Vehicles, and Value Creation to Strengthen the Momentum of Alternatives

| For Amaya Uriarte | 0 Comentarios

According to the latest survey from Goldman Sachs Asset Management titled *2024 Private Markets Diagnostic Survey, Charting New Routes,* conducted with 235 institutions and fund managers worldwide, demand for private market assets is expected to continue rising. Investor optimism and expectations of uncovering new opportunities across strategy classes are driving this growth. The survey also indicates a reduction in concerns around potential economic recession or inflation resurgence, with investor attention now focused more on geopolitical risks from global conflicts.

One key finding from the report is that sentiment is generally positive across all asset classes, with fund managers displaying more optimism than wealth managers. Even in the real estate sector, often considered the most challenging asset class, 38% of asset managers see improved investment opportunities, compared to 31% who perceive worsening prospects.

Investors remain confident in venture capital funds and optimistic about infrastructure, believing these assets can continue delivering stable returns through market cycles. Meanwhile, private credit has seen a slight decline in favorability among nearly a quarter of Limited Partners, though net sentiment remains positive.

“Investor sentiment is improving overall, even in asset classes like real estate that faced headwinds over the last two years. Limited Partner focus on macroeconomic risks has diminished as inflation moderates and interest rates drop. However, concerns persist over inflated valuations and their impact on trading volumes,” explained Jeff Fine, co-head of Goldman Sachs Alternatives’ Capital Formation.

According to Dan Murphy, Head of Alternative Portfolio Solutions at Goldman Sachs Asset Management, “Investors are creating asset allocations in new areas of private markets, including private credit and infrastructure, through various entry points such as secondaries and co-investments.”

Key Trends and Concerns

The survey highlights liquidity as a top priority for investors. Fund managers are increasingly exploring liquidity solutions to return capital to investors, as exits are still hindered by ongoing macroeconomic uncertainty and valuation disconnects between buyers and sellers. “While some Limited Partners face over-allocation issues, private markets generally remain underweighted, with strong demand for new entry points like co-investments, secondary investments, and semi-liquid vehicles,” noted Stephanie Rader, global co-head of Alternative Capital Formation at Goldman Sachs Alternatives.

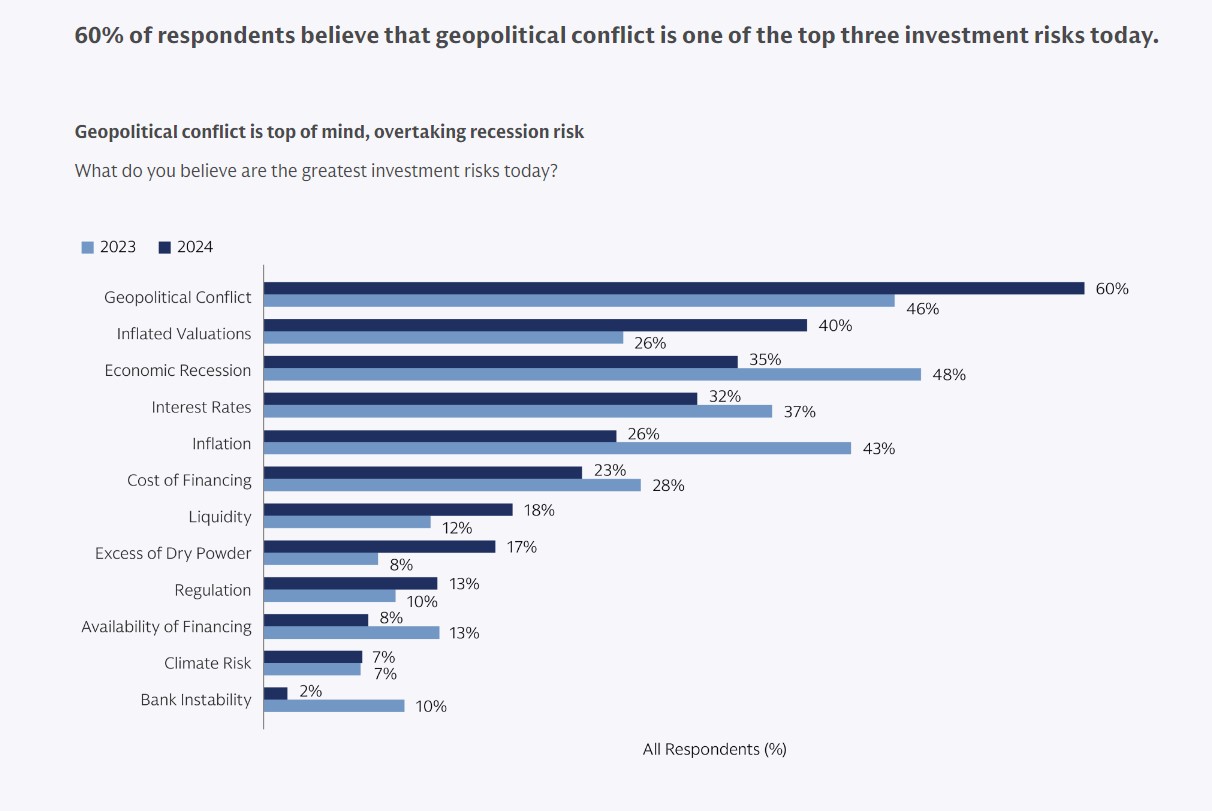

Geopolitical conflict now tops investor concerns at 61%, followed by inflated valuations at 40%, and recession risk at 35%. Limited Partners are relatively more focused on valuation-related risks, recession, and inflation, while General Partners place greater emphasis on interest rates and regulatory challenges.

Due to widespread underweighting, 39% of Limited Partners are increasing their capital deployment, while only 21% are reducing it, a significant change from last year’s 39% reduction. Capital deployment is now concentrated on credit strategies (34%)—where underweighting is most pronounced—followed by private equity (18%), real estate, and infrastructure (10% each).

Challenges in the Industry

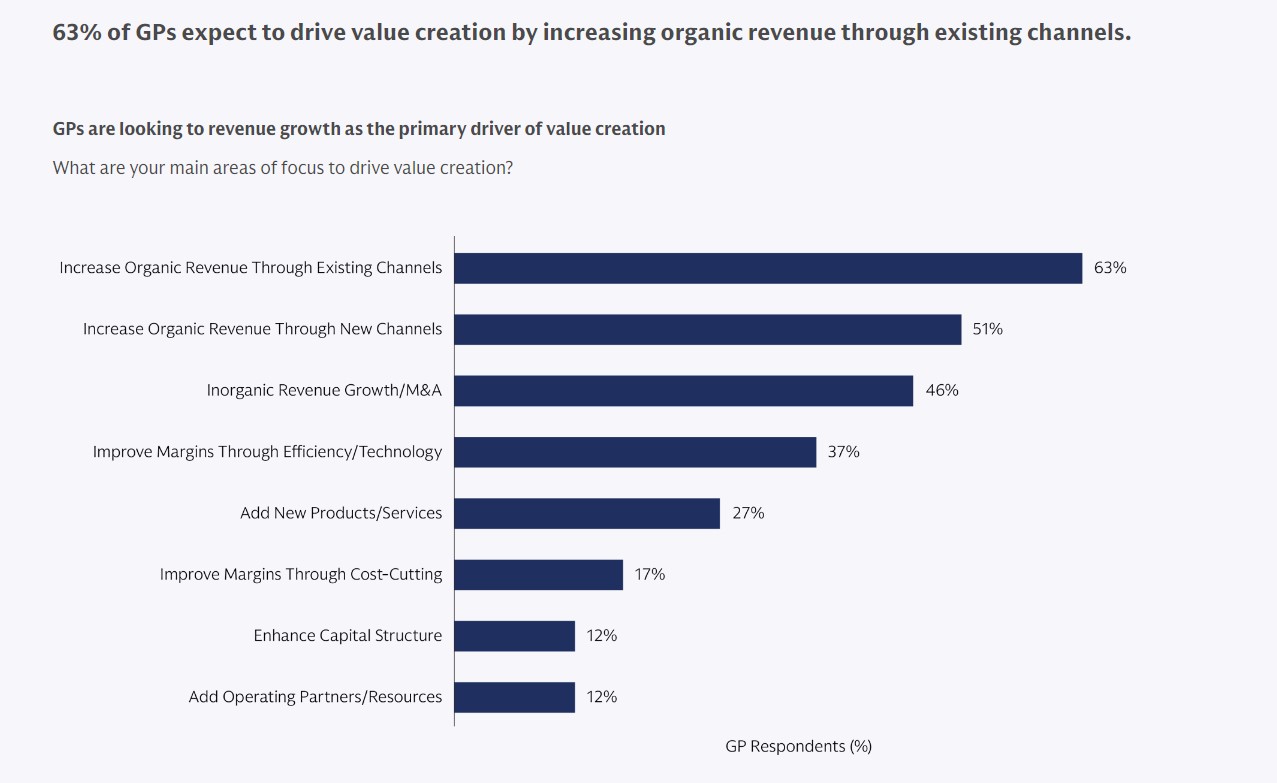

To address valuation gaps, General Partners focus on value creation through revenue growth: 63% aim to boost organic revenue via existing channels, and 52% through new channels. Other significant value creation avenues include mergers and acquisitions (45%), margin improvement via technology and efficiency (35%), and introducing new products or services (27%).

As exits remain sluggish and valuations appear inflated, private equity managers are prioritizing profit growth as the primary source of value creation. Strategic sales are expected to remain the primary exit route (81%), followed by sponsor sales (70%), though optimism toward IPO markets has declined. Demand for interim liquidity solutions, such as dividend recapitalizations (54%), continuation vehicles (52%), and preferred shares (44%), is on the rise. In recent years, most General Partners have expanded their capabilities, either organically (46%), through spin-offs (24%), or via acquisitions (5%).

“General Partners are broadening their product offerings in both strategies and structures, often seeking external capital to support these expansion plans,” stated Ali Raissi, global co-head of Goldman Sachs’ Petershill Group.

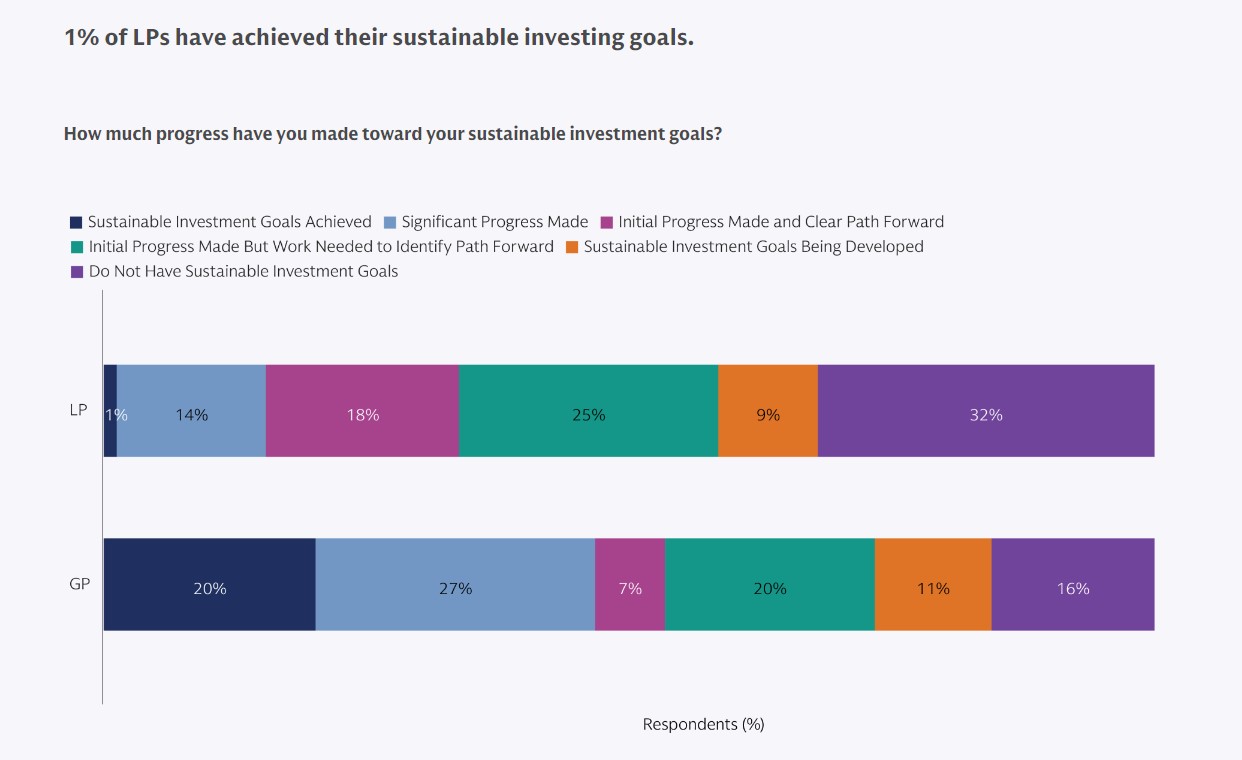

Sustainability is also a central consideration in private markets, especially for large Limited Partners outside the Americas. Adoption varies based on the asset base, with larger cohorts more likely to integrate sustainable factors and wider stakeholder concerns (84%). “We continue to observe significant attention to sustainable investing from major investors, particularly in EMEA and APAC, although LPs generally have more progress to make toward their goals,” said John Goldstein, global head of Sustainability and Impact Solutions, Asset & Wealth Management at Goldman Sachs.

With the macroeconomic environment relatively stable, Limited Partners and General Partners express growing optimism across all asset classes. They see the post-COVID-19 normalization process ongoing and the long-term growth trajectory of private markets as strong. “New frontiers in AI, investment vehicles, and value creation are increasingly explored, driven by both opportunity and necessity. Looking ahead, we expect both LPs and GPs to continue adapting to an evolving private markets landscape that plays an increasingly vital role across sectors and regions,” Murphy concluded.