North America Dominates the Global Fund Industry: The Region Accounts for 61% of Assets Under Management

| For Amaya Uriarte | 0 Comentarios

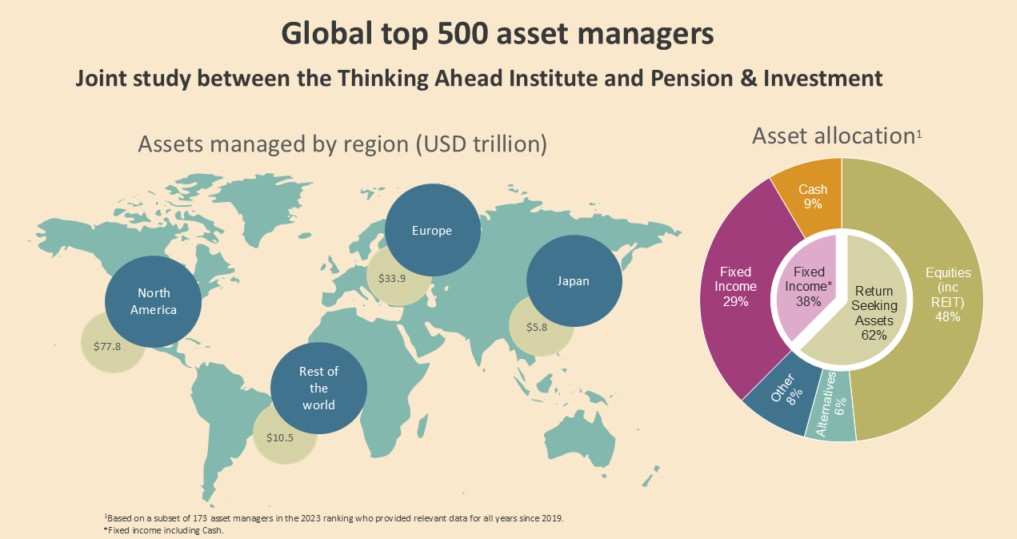

According to the latest study by the Thinking Ahead Institute (TAI), associated with WTW, assets under management (AUM) by the world’s 500 largest asset managers reached $128 trillion at the end of 2023. Although levels from 2021 were not reached, the annual growth of 12.5% already marks a significant recovery following the previous year’s correction, when AUM dropped by $18 trillion in 2022.

The study highlights the evolution in active and passive management, showing that, for the first time, passive management strategies account for more than a third (33.7%) of assets under management among the top 500 asset managers, though nearly two-thirds continue to be actively managed.

In terms of asset class allocation, there is notable growth in private markets. Equity and fixed income, however, remain the predominant asset classes, totaling 77.3% of assets under management—48.3% in equities and 29% in fixed income. This represents a slight 0.2% decrease from the previous year as investors continue seeking alternatives such as private equity and other illiquid assets to achieve higher returns.

“Due in part to the performance of American equities as a driver of returns, North America experienced the highest growth in assets under management, with a 15% increase, followed closely by Europe (including the UK), which recorded a 12.4% rise. Japan, however, saw a slight decrease, with a 0.7% drop in AUM. As a result, North America now accounts for 60.8% of the total AUM among the top 500 managers, reaching $77.8 trillion at the end of 2023,” the report explains.

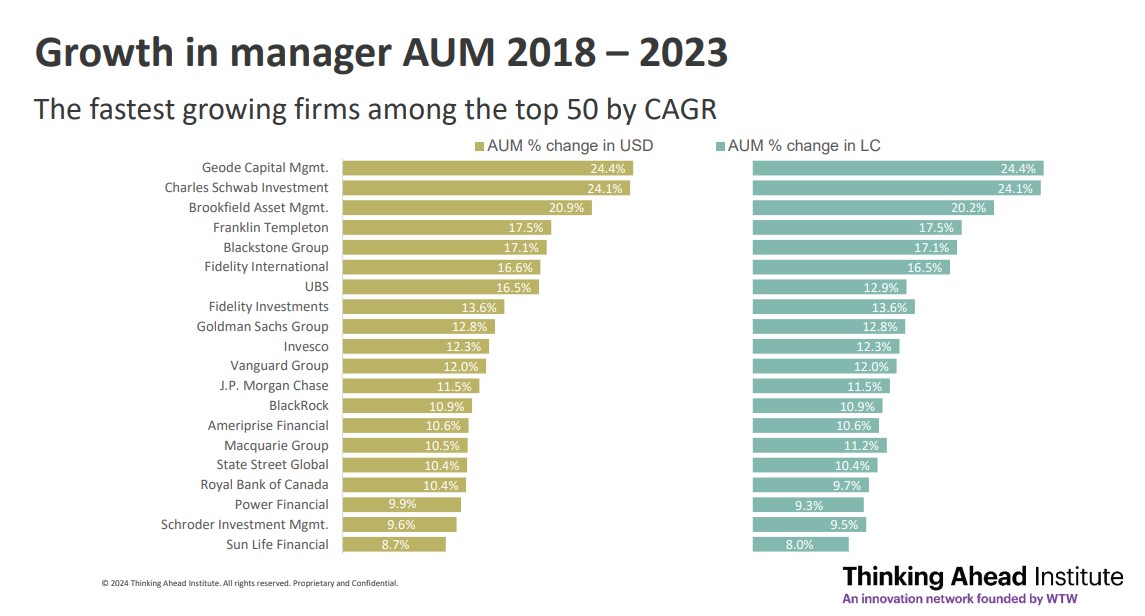

Consequently, U.S. asset managers dominate the top of the ranking, holding 14 of the top 20 positions and representing 80.3% of assets in this group. Among individual asset managers, BlackRock remains the world’s largest, with total assets exceeding $10 trillion. Vanguard Group holds the second spot with nearly $8.6 trillion, both far ahead of Fidelity Investments and State Street Global, ranked third and fourth, respectively. Among the managers with the most notable rises in the past five years are Charles Schwab Investment, which climbed 34 spots to reach 25th place, and Geode Capital Management, which rose 31 spots to 23rd. Canada’s Brookfield Asset Management also advanced 29 positions, reaching 31st place.

“Asset managers have experienced a year of consolidation and change. While we’ve seen a return to positive market performance, there have also been significant transformative factors,” says Jessica Gao, director of the Thinking Ahead Institute.

The report’s findings indicate that macroeconomic factors have played a key role, with high interest rates in 2023 exerting various pressures across asset classes, geographies, and investment styles. The study explains that as rates begin shifting toward a reduction phase, equity markets are again delivering positive returns, driven by growth expectations. Future uncertainties are centered on geopolitical events and several major national elections.

Raúl Mateos, APG Leader for Continental Europe, notes that asset managers face significant pressure to evolve their investment models: “Technology is essential, not only for maintaining a competitive edge but also for meeting client needs and expectations, as well as responding to the growing demand for more customized investment solutions. These demands are challenging traditional industry structures. In this context, we have seen notable successes among independent asset managers compared to many of those tied to insurers and banks.”

Regarding specific geographies, Mateos points out that in the past decade, we’ve seen a rise in AUM globally; however, Spain’s market share has declined over this period, from managing 1.5% in 2013 to 0.6% in 2023. “We need to go down to 99th place to find a Spanish representative, Banco Santander, with a total of $239.49 billion, leading the list of ten Spanish managers that include entities like CaixaBank, BBVA, and Mapfre. Moreover, assets managed under ESG criteria grew by 15.5% in 2023, reaching 29.6% of ESG investments within portfolios, marking the highest level in the past three years. This trend shows that ESG criteria are increasingly being integrated into asset selection, demonstrating a growing focus on the impact of our investments on the world,” he concludes.