Direct Lending Market: Are We Witnessing a Widespread and Permanent Erosion of Credit?

| For Amaya Uriarte | 0 Comentarios

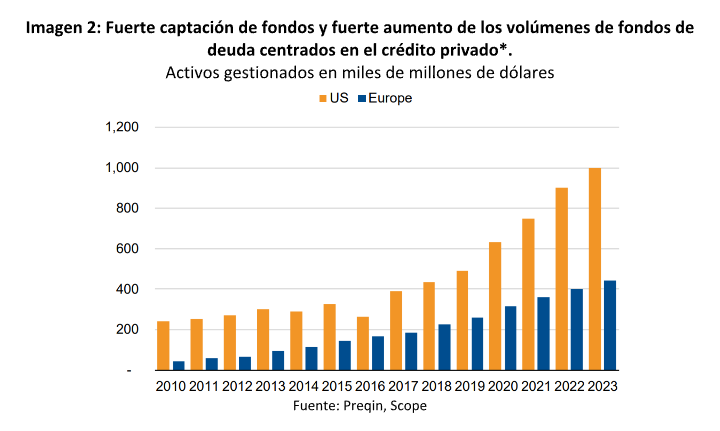

Direct lending has transitioned from a niche market to becoming a significant financing channel for SMEs, where traditional bank financing has been steadily replaced by debt funds. As a result, according to Sebastian Zank, Head of Corporate Credit Production at Scope Ratings, direct lending is increasingly used for SMEs with strong growth prospects, either bolstered by mergers and acquisitions or through exposure to high-growth segments.

In his latest analysis, Zank concludes that the growth of assets managed by direct lenders focused on European companies is expected to slow amid constraints on growth and investment. He also acknowledges that while the credit profiles of borrowers have deteriorated over the past two years, the outlook is improving.

“The weakening of credit profiles has been primarily due to the impact of variable and unhedged interest rates, weaker-than-expected operating results, low returns on reduced investments, and delays in deleveraging. However, we believe the erosion of credit quality has bottomed out given the decline in interest rates, easing concerns about economic growth, and the adaptation to a more challenging environment. Meanwhile, the heightened risk of default can be mitigated through a series of measures provided by private equity firms and direct lenders,” Zank explains.

In his view, these measures include greater flexibility between direct lenders and borrowers regarding payment terms compared to more traditional financing; commitments from private equity firms for capital injections or shareholder loans that can be converted into equity or PIK (payment in kind) facilities, where interest is paid by issuing new debt to the benefit of borrowers; as well as substantial dry powder (liquid financial resources available for investment) that can be used to provide bridge financing to companies likely to face difficulties.

In this context, Scope has already assigned 70 private ratings and 24 point-in-time credit estimates to various borrowers accessing direct lending, with a total rated credit exposure of over €5.6 billion. According to Sebastian Zank, issuer ratings are largely concentrated in the B category.

“The most surprising aspect is the migration of ratings. While around half of the ratings in our coverage could be maintained or reflect an upgrade, the other half shows a deterioration in ratings, either through actual downgrades/point-in-time downgrades or weaker outlooks. However, this does not indicate a widespread and permanent erosion of credit. When observing the outlook distributions, a significant portion of the negative credit migration has already been reflected, and it is likely that the erosion of credit will slow down,” Scope explains.

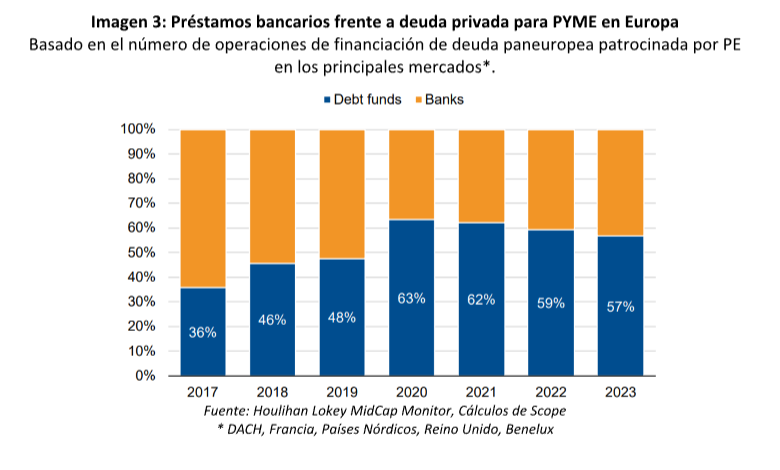

Assets under management by debt fund managers focused on direct lending to European companies have reached $400 billion. However, Scope expects growth to continue at a slower pace than the 17% CAGR (compound annual growth rate) of the past 10 years, at least until current constraints on economic growth and investment (such as higher long-term interest rates) are offset by supportive factors.

“Although the strong growth of direct lending over the past decade has been supported by a wide range of factors, we do not believe that the recent headwinds are strong enough to halt the growth in fundraising and deal allocation. We expect direct lending activities in Europe to continue growing, albeit at a slower pace than the average annual fundraising of approximately $40 billion in the past five years,” adds Zank.

Scope notes that while this suggests a pronounced growth trajectory (10-year CAGR: 17%), assets under management in Europe remain significantly lower than volumes in the U.S., where direct lending took off well before the global financial crisis and has become a widely utilized, if not commoditized, financing strategy.

The slower development of direct lending in Europe is primarily associated with several reasons, explains Zank: “The still significant regional and local banking sectors in most European markets, where bank financing remains the most common channel for mid-market companies, and the non-harmonized environment across European markets, where local knowledge of insolvency laws and lending conditions is crucial for debt fund managers.”

He adds: “Nonetheless, direct lending has transitioned from a niche market to becoming a significant financing channel for SMEs, where traditional bank financing has been steadily replaced by debt funds. In particular, we observe the use of direct lending for SMEs with strong growth prospects, either supported by mergers and acquisitions or through exposure to high-growth segments. Moreover, this financing channel is frequently used in cases of business successions and recapitalizations,” he concludes.