Erste AM: “Cocoa – When the Chocolate Dream Turns Into a Nightmare“

| By Gabriela Huerta | 0 Comentarios

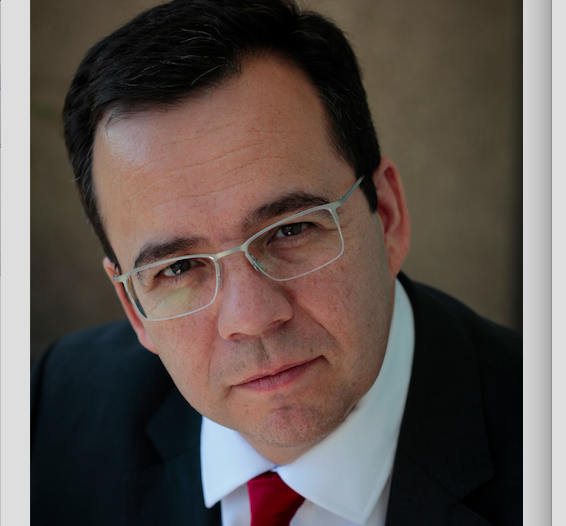

The times when chocolate was a luxury good are long gone. Consumption has increased continuously and amounts to about 5.2kg per person and year in Europe. While demand has been on the rise, climate change and social problems in production constitute challenges that cause an imbalance of supply and demand. For the cocoa farmers, the chocolate dream can easily turn into a nightmare. We talked to Stefan Rößler, quantitative analyst in the ESG team of Erste Asset Management, about how this situation could be changed.

Mr Rößler, many of us have a sweet tooth for chocolate. However, most people are not aware that the cultivation of cocoa and its processing can cause problems.

Rößler: That’s right. Our analysis clearly shows two main problemat- ic areas, i.e. the environment and the social impact. With regard to the latter, we are specifically talking about child labour and low work- ing and social standards. Initial steps have been taken to remedy the situation, but the implementation leaves a lot to be desired. The vast number of cocoa farmers in West Africa makes organisation difficult.

As far as the purchase of cocoa goes, the producers are also faced with structural challenges. There are eight global companies that buy almost the entire crop. The nontransparent and convoluted supply chain adds to the difficulties of implementing adequate measures in terms of social and environmental standards.

You just mentioned the environmental aspect – what are the challenges in this area?

Rößler: It is important to bear in mind that cocoa is not the only in- gredient used in the production of chocolate. Other raw materials such as sugar, hazelnuts, and palm oil are also required; and they cause problems similar to those of cocoa. The high demand for chocolate and thus cocoa has led to a status quo where investments are largely funnelled into higher productivity. However, this strategy is extremely one-sided. What would be necessary and preferable is a double-edged strategy: investment in know-how that facilitates a rise in productivity, but also investment in sustainable cultiva- tion skills. According to forecasts climate change will make it impossible to cultivate cocoa in West Africa by 2050. This will also affect the chocolate producers down the road, as their security of supply will be taken away from them.

Investments are always also a question of what price can ultimately be charged. What are we looking at from this angle?

Rößler: That is correct, more funding is necessary for investments in know-how and the modernisation of pro- duction in order to facilitate sustainable cultivation. From our point of view, the cocoa price would have to dou- ble in order to compensate the cocoa farmers fairly, make education possible, and modernise cultivation.

Your prediction: will we still be able to indulge our longing for chocolate in the future, or will we at some point run into a supply shortage?

Rößler: We have spoken with various research agencies, NGOs, and market participants. The good news is: there will be cocoa in the future – and therefore chocolate as well. Numerous initiatives and certificates such as FairTrade, UTZ, and Rainforest Alliance are going in the right direction. Everybody should support this on an individual basis by buying chocolate with such labels. And we as investors, Erste Asset Management, can do the same thing: we only invest in the shares of companies that maintain certain minimum standards and that do not violate labour laws or human rights in the supply chain. Environmental controversies are also criteria that we take into account. Thus, everyone can contribute to the best of their abilities to ensure that cocoa farmers make a decent living and that they therefore have a future.

If the transformation to sustainable cocoa cultivation fails, the perspectives for the cocoa farmers will be gloomy. Because then production will be moved to regions where cocoa cultivation is still possible in spite of the climate change.

For more on cacao and chocolate, you can read Erste AM’s ESG Letter on Environmental, Social and Governance issues, which focuses on this commodity, following this link.