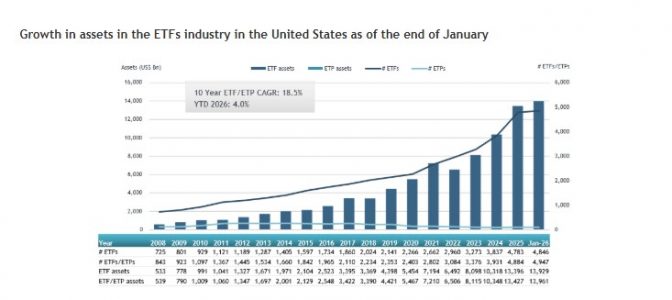

2026 begins strongly for the US ETF market. According to data published by ETFGI, assets in this class of vehicles listed in the US reached $13.96 trillion, after achieving the largest monthly inflows in history: $166.65 billion, compared to $9.025 billion in January 2025.

This means that in the first month of the year, industry assets increased by 4%, and the strong level of inflows could mark a clear trend for the rest of the year. Regarding flows, equity ETFs stood out with strong demand, gathering $78.14 billion, more than triple the $24.55 billion recorded in January 2025. Meanwhile, fixed income ETFs contributed $29.02 billion in net inflows, compared to $20.28 billion a year earlier. Commodity ETFs recorded $3.68 billion in net inflows, “a sharp turnaround from net outflows of $1.06 billion in January 2025,” explain ETFGI. Lastly, active ETFs also experienced significant growth, attracting $64.71 billion in net inflows, compared to $44.03 billion in January 2025.

According to ETFGI, iShares is the largest provider by assets, with $4.13 trillion, representing a 29.6% market share; Vanguard is second with $3.99 trillion and a 28.6% share, followed by State Street SPDR ETFs with $1.90 trillion and a 13.6% share. “The top three providers, out of a total of 462, account for 71.8% of the assets under management invested in the US ETF industry, while the remaining 459 providers each have less than a 6% market share,” they conclude.