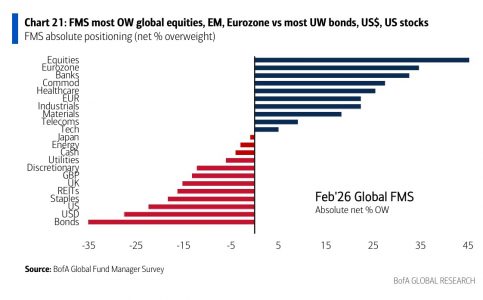

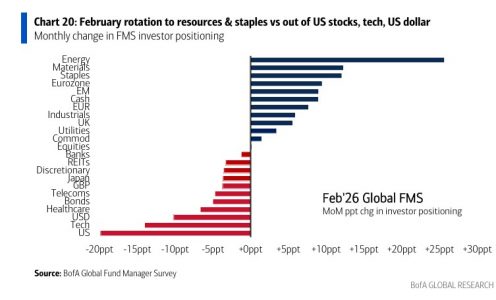

Bank of America’s February global fund manager survey confirms the rotation in asset allocation from the U.S. toward Europe and emerging markets. Looking at the absolute positioning of FMS investors (% net overweight), it is observed that, this month, investors are more overweight in equities, emerging markets, and the eurozone, and more underweight in bonds, the U.S. dollar, and the U.S.

Compared with history, that is, the past 20 years, investors are overweight the euro, commodities, and bank stocks, and underweight the U.S. dollar, cash, and REITs. In fact, investors’ overweight position in emerging market equities has risen to a net 49%, the highest level since February 2021. In addition, for the first time in 10 months, a majority of managers believe that small caps will outperform large caps (net 18%).

Another significant data point, which also shows a certain sector rotation, is that investors increased allocations to energy, materials, and consumer staples, while allocations to technology in U.S. equities and to the U.S. dollar were reduced. We may also be facing a change in perception regarding which investment style could perform better in the current context. “A net 43% expect value stocks to outperform growth over the next 12 months, the highest reading since April 2025,” the survey indicates.

Looking for further developments in asset allocation, the February survey also shows that the combined allocation to equities and commodities stands at a net 76%, the highest level since January 2022. “Historically, FMS allocation to equities and commodities (risk assets) has been correlated with the ISM manufacturing PMI. However, recently the two have diverged significantly, as manufacturing PMIs have lagged,” BofA explains. Finally, the survey highlights another shift, this time in currencies: “A net 23% is overweight the euro, a historic high since October 2004. In fact, FMS investors have been consistently overweight the euro since July 2024.”

A Look at Sectors and Market Capitalization

Investment firms had already detected this rotation, which we first clearly saw in the second half of 2025. In the opinion of Nenad Dinic, Equity Strategy Analyst at Julius Baer, the recent style and sector rotations show that the market is broadening beyond the concentration in mega-cap technology. “We view these ongoing rotations as a healthy development and expect them to continue in the short term,” notes Dinic.

For this expert, after three years in which U.S. mega-cap technology stocks drove most of the gains in the global market, equity markets are now experiencing a notable and healthy rotation. “We see these rotation developments as constructive and timely. Concentration risk is declining as crowded positions in the large U.S. technology complex are unwound, creating room for greater diversification. European equities stand out with expected earnings growth of around 8% and greater fiscal support, especially in cyclical and value-oriented segments. At the same time, maintaining an allocation to high-quality defensive exposures can provide stability. Asian markets, including Japan, India, and China, are also benefiting from a renewed capital rotation, while global emerging market equities are strongly supported by solid upward earnings revisions and the tailwind of an expected Fed easing,” he argues.

From Edmond de Rothschild AM, they believe that the main victim of this sector rotation is technology, and particularly software. “Concerns about the enormous investment needs in AI increased during the week and triggered sharp declines in U.S. technology giants, even among those that reported good results. In addition, improvements in the new Anthropic model, with its impressive capabilities in computer code generation, fueled fears about software companies’ ability to compete. As a result, the sector continued to lose ground and has already accumulated a drop of nearly 30% from the peak reached last October. The correction was especially severe in market segments exposed to retail investors, who are suffering significant losses—including those stemming from the massive sell-off in crypto assets—and are now forced to unwind positions across all risk asset classes,” they explain.

Anthony Willis, Senior Economist at Columbia Threadneedle Investments, believes it is too early to say how far this rotation will go, but acknowledges that we are witnessing changes in sentiment regarding how AI will evolve. “We are in an early phase of adoption and at the beginning of a long-term trend. Over time, greater clarity will emerge, but for now investors are being somewhat more cautious with respect to large technology companies. One positive aspect of the recent difficulties in the technology sector is that other sectors that had gone unnoticed are receiving greater attention. We have seen small caps, value stocks, and other regions demonstrate better performance, including Japan, Asia, and Latin America,” notes Willis.

Direction: Cyclical and Old Economy Stocks

For his part, Steve Chiavarone, Deputy CIO of Global Equities at Federated Hermes, agrees with this style rotation reflected in the latest Bank of America survey. According to his analysis, the market is moving in a more cyclical direction: “Cyclical value companies and old economy names are starting to respond and participate more. And given the volatility we have seen so far this year, defensive dividend-paying names are also starting to respond and, in many cases, lead.”

For Chiavarone, this broadening is something market participants have been waiting for over the past two years, and it is now clearly visible in large dividend-paying companies, which are also participating and, in many cases, leading. “This broadening is something market participants have been waiting for over the past two years, and we are now clearly seeing it in large-cap value, on both the cyclical and defensive sides. At the same time, small caps are beginning to outperform for the first time in several years,” he argues.