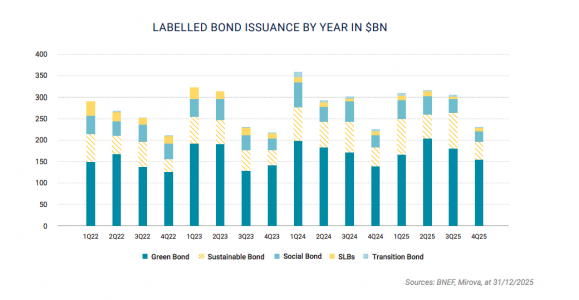

In the opinion of Johann Plé, of BNP Paribas AM, one of the most notable milestones of this asset class is its shift toward a more mature market, in which issuance levels are settling into a more predictable range. “This universe has moved from being a niche to becoming a consolidated offering. Ultimately, green bonds are firmly positioned as the backbone of the sustainable bond investment universe. In 2025 they continued to be the main driver of GSS growth (approximately 61% of total GSS issuance) and the primary source of new issuers, underscoring their central role in market expansion,” he notes.

In fact, he highlights that last year corporates once again were a major driver of issuance, accounting for 55% of total volume (compared to 51% in 2024). “This greater contribution from corporates not only reflects significant investments in renewable energy and energy efficiency, but also the credibility of the instrument, since most issuers are repeat issuers—that is, they issue more than one green bond,” adds Plé.

Main Trends

Mirova’s report highlights that Europe is showing signs of maturity, with significant penetration of sustainable bonds in certain sectors, while Asia-Pacific is consolidating its position as the fastest-growing region. At the same time, a reduction in the relative weight of the American continent is being observed. One of the most striking data points is the “greenium,” that is, the yield difference between a sustainable bond and a comparable conventional one. In this case, the document notes that it remains limited, “which may reduce the incentive for some issuers, especially in a context of potential scarcity of eligible assets,” it acknowledges in its conclusions.

In the opinion of Agathe Foussard and Lucie Vannoye, fund managers at Mirova (Natixis IM), its growth is likely to be in line with that of the conventional bond market, at around 10%, reflecting a broadly stable penetration rate. “The market should receive a boost from outstanding labeled bonds that are set to mature and require refinancing, as well as from a recovery effect in the utilities sector. On the other hand, the use of sustainable formats could be slowed by strong greenium compression and the risk of a shortage of eligible assets,” they explain.

By contrast, the report detected an unexpected slowdown in the issuance of sustainable sovereign bonds in 2025. Despite this, Europe continues to lead this segment, with several countries accounting for a significant portion of the market, in contrast to the weight of the United States in the traditional sovereign market and its limited presence in the labeled sovereign bond market. According to the report, there is no doubt that these sustainable bonds remain a public financing tool.

Catalysts for 2026

Looking ahead to this year, the BNP Paribas AM expert believes there are factors that should continue to support optimism around this asset class. “One is technical, due to the maturities expected in the coming years: the proportion of green bonds maturing is expected to increase by 30% in 2026 compared to 2025, reaching approximately 170,000 million dollars. These maturities will mainly come from banks and quasi-sovereign issuances and should support the market going forward, although there is no guarantee that all of these maturities will be refinanced through green bonds,” he notes as the main factor.

In addition, he adds that strong investments in renewable energy, grids, and green buildings should continue. Although themes such as climate adaptation and water (blue bonds) are emerging trends that are likely to attract greater interest, allocation will grow slowly in the short term partly due to structural factors. “In this context, 2026 could see a refocusing of the green bond market toward ‘historical’ issuers, more naturally aligned, with a higher proportion of readily accessible eligible assets, reflecting where investments and refinancing needs are actually occurring. Other issuers may choose to exit. A rebound in the APAC region could also be expected, as taxonomy updates over the past year may boost issuance,” states Plé.

Ultimately, Plé believes that, with a size roughly similar to that of the euro investment-grade credit market, investors should expect issuance to stabilize and to be more influenced by technical factors and investment schemes. “Overall, we would expect green bonds to remain the main driver of issuance growth, still dominated by European issuers and, more broadly, by euro-denominated issuances,” he concludes.

The U.S. Challenge

Beyond dramatic headlines predicting the slow death of this asset class, Mitch Reznick, global head of sustainable fixed income at Federated Hermes, believes there are factors that show it as an evolving and indelible part of the capital markets. “Starting with the labeled bond market, figures suggest that primary issuance in sustainable bond markets in 2025 may have reached 1.2 trillion dollars, representing a slight increase compared to 2024. What makes this figure particularly striking is that the number of labeled corporate bonds issued outside the U.S. has fallen by nearly 40%. However, in recent years there has been a notable boom in the U.S. in labeled social securitized bonds, which has remained strong well into 2025,” notes Reznick.

According to the expert, the state of Texas turns out to be one of the U.S. states—if not the leading one—that invests the most in and adopts renewable energy. For example, in 2024, renewable sources in Texas generated more than 166 GWh of energy, even ahead of California. In his view, this trend could continue after several legislative initiatives against renewables failed to pass this year. “California, along with Texas and a handful of southern states, continues to top the rankings in renewable energy investment,” he adds.

Finally, from a regulatory standpoint, the U.S. is reducing sustainability disclosure requirements, while Europe appears to be losing momentum in this area. “Meanwhile, the rest of the world is moving forward. In Asia, India, the United Kingdom, and Australia, the focus is on including ‘transition’ activities in disclosures and taxonomies. This inclusion makes a great deal of sense. If the global economy is to pivot in a way that generates economic value sustainably, a successful transition is essential,” concludes Reznick.