Global assets in actively managed ETFs reached a new all-time high of $1.92 trillion at the end of December, surpassing the previous record of $1.86 trillion set in November 2025. This means that, in 2025, assets grew by 64.5%, rising from $1.17 trillion at the end of 2024 to $1.92 trillion.

According to ETFGI’s analysis of the data, “during December, the global actively managed ETF industry recorded net inflows of $56.23 billion, bringing total net inflows for 2025 to a record $637.47 billion.” This flow activity was driven by globally listed, actively managed equity ETFs, which saw net inflows of $33.31 billion. “This brought total inflows for the year to $361.33 billion, significantly higher than the $211.34 billion accumulated in 2024,” they noted.

Actively managed fixed income ETFs also saw strong demand, with $18.56 billion in inflows in December and $237.93 billion year-to-date, well above the $139.69 billion recorded in 2024.

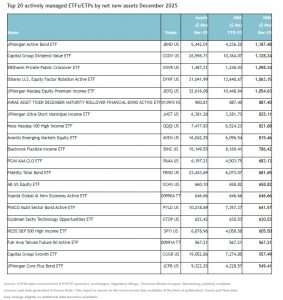

They note that “the substantial inflows can be attributed to the 20 top active ETFs by new net assets, which collectively gathered $15.89 billion during December.” Specifically, the JPMorgan Active Bond ETF (JBND US) attracted $1.19 billion, marking the largest individual net inflow.