Unlike in previous years, currency markets in 2025 were largely driven by geopolitics, and following a wave of new political developments in the early days of 2026, that trend appears likely to continue. According to experts, this is particularly true for the U.S. dollar.

In fact, the greenback has weakened notably over the past week: the DXY index has fallen by approximately 2%, and the euro/dollar exchange rate is now trading below the firm’s three-month forecast of 1.18. Analysts explain that this has happened despite a solid growth outlook in the U.S. and expectations that the next Fed rate cut won’t arrive until June.

“The recent weakness of the dollar seems to be largely driven by inconsistencies in U.S. foreign and domestic policy, which have undermined investor confidence. As a result, narratives around currency devaluation have resurfaced, pushing the dollar lower even in the absence of macroeconomic catalysts. Although it has weakened, it remains significantly overvalued. That’s why we continue to expect further declines as its interest rate advantage narrows,” says David A. Meier, economist at Julius Baer.

That said, not all analyses place the full weight of the dollar’s decline on geopolitics. In the view of Jack Janasiewicz, portfolio manager at Natixis IM Solutions, the recent drop in the U.S. dollar stems from moves in the Japanese yen, following weekend speculation about potential Fed intervention in the USD/JPY exchange rate. However, beyond these technical factors, he acknowledges that “the tensions over Greenland have weakened confidence in the U.S. dollar, which is why we’re seeing it hit recent lows again.”

A Trend Since 2025

Last year, the dollar’s decline was concentrated mainly in the first half of 2025, following President Trump’s announcement of reciprocal tariffs in April, marking a significant escalation in his global trade war.

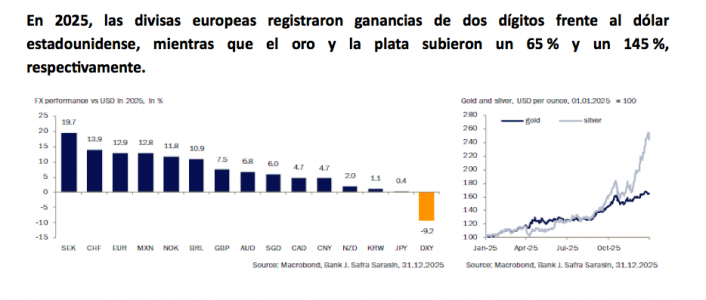

“The dollar’s depreciation largely reflected a sharp rise in currency hedging on expectations of a weaker dollar. European currencies posted double-digit gains as the ‘sell America’ market narrative took hold in the second quarter of 2025, prompting a rotation into European assets. Precious metals were the main beneficiaries of the uncertain political backdrop in 2025, with gold rising 65% and silver surging by a spectacular 145%,” recalls Claudio Wewel, FX strategist at J. Safra Sarasin Sustainable AM.

Looking ahead to this year, Wewel believes that the weight of geopolitics and decisions by the Trump administration will continue to influence the dollar’s performance, and he anticipates a bearish trend for 2026. “The currency remains overvalued by historical standards. We see this argument as particularly relevant in the current political environment. Structural demand for the dollar should decline if the U.S. continues to pursue predatory policies, which would also justify lower fair-value exchange rates compared to the past,” he emphasizes.

He adds another nuance to his outlook: “In 2026, we also expect support for the dollar to weaken from a relative cyclical perspective. Economic growth should converge more between the U.S. and the eurozone, as the European economy benefits from the disbursement of the German fiscal package.”

Threats to Its Status

So far this month, the dollar index (DXY) has dropped approximately 1.5%, reaching its lowest level since September 18. Based on its performance yesterday, in line with this trend, some analysts conclude that the market is rotating positions, rather than turning to the dollar as a safe haven, investors are now seeking other assets. Despite this, experts do not believe the dollar will lose its status as a reserve currency or safe-haven asset.

“The book Smart Money, by Brunello Rosa, argues that the main threat to the dollar comes from China’s global expansion. Through policies such as the Belt and Road Initiative and the development of Beijing’s central bank digital currency (CBDC), China is slowly increasing the use of the renminbi in global trade payments. Control over global supply chains and raw materials goes hand in hand with global monetary hegemony. There is still a long way to go before the dollar’s reserve currency status faces a terminal threat,” says Chris Iggo, chief investment officer (CIO) at AXA IM Core, BNP Paribas Asset Management.

However, Iggo does acknowledge that the growing use of CBDCs, along with a more bipolar global balance of power, poses a threat. “Having influence over a larger share of the world’s oil supply is a counterbalance to these risks, as is maintaining strategic relationships with major oil producers, particularly Saudi Arabia. But there are also risks to the dollar beyond geopolitics: the deterioration of the U.S. fiscal position, potential political interference in monetary policy, and the possibility that global investors will respond to political and economic uncertainty by reducing their dollar allocations in global portfolios. The rise in gold, silver, and platinum prices in dollar terms likely reflects both geopolitical risks and concerns related to U.S. economic policy. For the United States, the biggest threat is that declining confidence in the dollar could increase the cost of financing its twin deficits. Higher Treasury yields would be bad news for an equity market already trading at very high valuations,” he concludes.