The debate is no longer whether securitization is a valid tool, but which asset managers are prepared to use it in a world that has changed its rules. The current environment, marked by structurally higher interest rates, persistent geopolitical tensions, and a much more demanding investor, is penalizing asset managers who continue trying to scale strategies with outdated structures.

Today, the biggest mistake an asset manager can make isn’t being wrong about an investment thesis but insisting on formats that no longer match the market’s reality. The message from the latest Morningstar 2026 Global Outlook is clear: uncertainty is not a one-time event; it’s the new starting point.

In this context, generating a good investment idea is not enough. If that strategy cannot be distributed efficiently, provide liquidity, meet institutional standards, and adapt to various regulatory frameworks, it simply becomes uncompetitive. This is where securitization stops being a technical solution and becomes a strategic advantage.

For asset managers, securitizing means separating alpha from operational friction. It allows converting both liquid and illiquid strategies into listed, tradable, and transparent vehicles. In an environment of recurring volatility, access to intraday liquidity and secondary markets is no longer a “value-added”: it’s a basic requirement.

The reality is uncomfortable for many traditional managers. Institutional investors and private banks are no longer willing to take on illiquid structures, manual processes, or vehicles that are difficult to explain to regulators. They seek products with ISINs, clear valuations, broker access, and a robust governance framework. Securitization precisely meets this demand.

Morningstar also warns that many supposedly “diversified” portfolios are actually exposed to the same risks: extreme concentration, demanding valuations, and liquidity dependent on sentiment. Meanwhile, private assets continue to grow, but their access is still limited by operational friction, high costs, and opaque structures. As the report points out, the problem is not the asset: it’s the format.

This is where securitization stops being a technical tool and becomes a strategic decision. Transforming liquid or alternative assets into listed, liquid vehicles with institutional standards allows asset managers to meet three key demands of today’s market: flexibility, risk control, and global access.

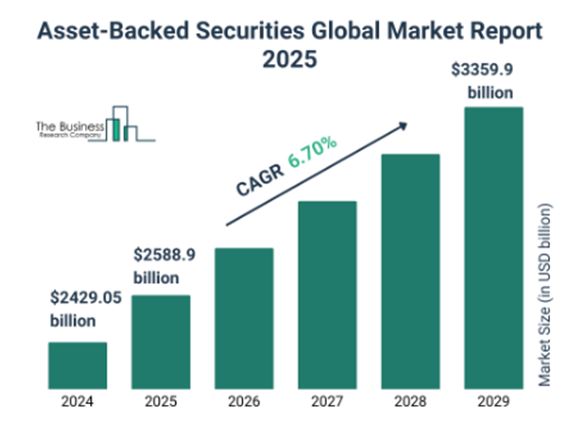

According to The Business Research Company, the global market for asset-backed securities surpassed USD 2.4 trillion in 2024 and is projected to continue growing at an annual rate of 6% in the coming years. Beyond the size, this data reflects a structural shift in institutional capital toward securitized instruments in response to the need for more stable income, real diversification, and more efficient structures in an interest rate volatility environment.

This growth is not a search for yield, but a shift in priorities. For many asset managers, securitized strategies provide access to cash flows tied to the real economy, with less reliance on individual issuers and a better ability to manage duration, credit risk, and liquidity compared to traditional fixed-income alternatives. In this regard, Janus Henderson has pointed out that securitized assets are gaining weight in institutional portfolios for their ability to offer recurring income and greater resilience in scenarios of high-interest rate volatility, relying on diversified portfolios of thousands of underlying assets.

Ignoring this reality comes at a cost. Investors, increasingly informed and sensitive to liquidity and governance, are no longer willing to accept difficult-to-explain structures. They seek products with clear valuations, secondary market trading, and robust regulatory frameworks.

In this scenario, FlexFunds positions itself as a strategic partner for asset managers who want to stay relevant. Its model allows asset managers to repackage assets into listed vehicles (ETPs), ready for global distribution, without the manager needing to become a legal, operational, or regulatory expert. The focus returns to where it should be: portfolio management.

This approach is complemented by integration with solutions like Leverage Shares, a leader in leveraged ETPs in Europe, and Themes ETFs, a specialist in thematic ETFs in the United States, reflecting where the market is heading: liquid, listed vehicles designed to capture opportunities in an agile manner.

The conclusion is clear. From 2026 onward, the question won’t be who has the best investment idea, but who structured it to survive in an environment where uncertainty is no longer the exception, but the norm. Securitization is not a trend: it’s the new standard, and asset managers who don’t integrate it into their business model won’t be defending their identity: they’ll be giving up their future.

If you want to explore how to scale investment strategies in today’s environment, contact the FlexFunds expert team at info@flexfunds.com and discover how to repackage multiple asset classes into listed, liquid, and globally distributable vehicles.