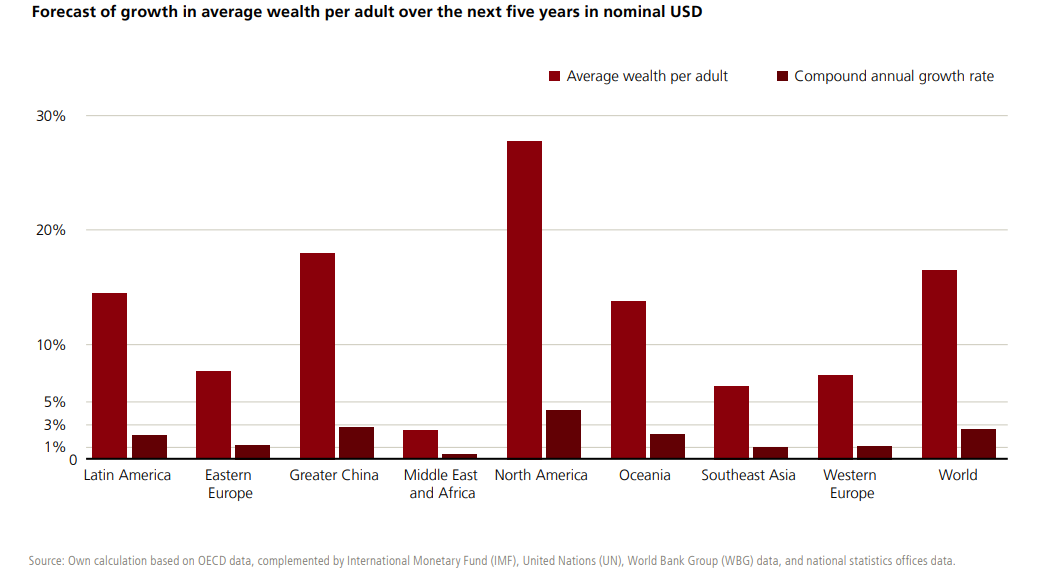

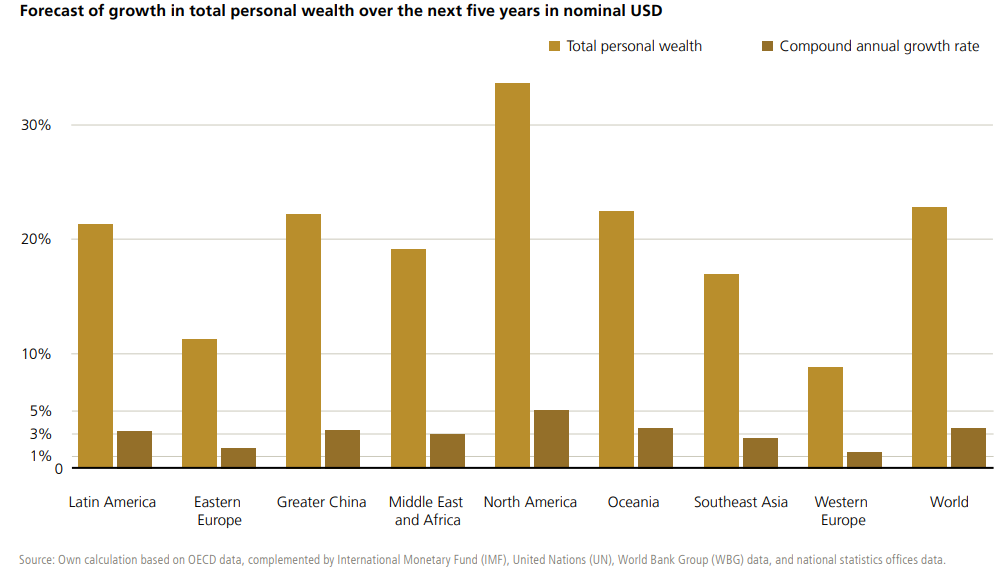

Average Wealth per Adult Will Continue to Grow Over the Next Five Years, with the United States as the main driver of this expansion, followed by the China region, Latin America, and Oceania, according to the UBS Global Wealth Report 2025. Europe and Southeast Asia are expected to experience solid but more moderate growth, while the Middle East and Africa will remain stable or see slight increases.

According to the latest report from the institution, total personal wealth is expected to show particularly dynamic behavior, with annual growth close to 5% in North America and approximately half that pace in the Middle East and Africa. The momentum will come mainly from rising asset prices and value creation associated with technological innovation in a context of structural transformation.

In this scenario, it is estimated that by 2029 there will be more than five million new millionaires worldwide. This trend will be reflected in the majority of the 56 markets analyzed, with no distinction between developed or emerging economies, large or small, dynamic or stagnant.

One of the Most Striking Findings of the Study Is That the Evolution of Wealth Does Not Always Move in Parallel With Economic Growth. At Times, It Far Outpaces It; at Others, It Lags Behind. Even Within Regions Showing Strong Macroeconomic Performance, There Can Be Areas Where Wealth Accumulation Is Weak or Stagnant.

Added to this is the fact that asset prices do not necessarily follow the same trajectory as GDP, and that the private sector—where individual wealth is concentrated—does not move at the same pace as the public sector, which is particularly relevant in economies where the latter holds considerable weight.

Another Key Factor Going Forward Will Be the Individual Mobility of Wealth, Driven by Intergenerational Transfers. In This Regard, the Size of the Population or Economy Is Not the Only Thing That Matters: Some Smaller Countries Could Surpass Much Larger Nations in Transfer Volume, Even When Demographic Projections Would Suggest Otherwise.

UBS Concludes That, While These Scenarios Are Subject to Multiple Factors and Could Evolve in Various Ways, the Initial Signs of Growth Already Observed Provide a Solid Foundation for Reflecting on the Path That Global Wealth Will Take in the Coming Years.