The introduction of digital assets into investment portfolios crossed a new threshold with the approval of Bank of America. The firm recommends a 1% to 4% allocation to crypto assets for clients of its Merrill, Bank of America Private Bank, and Merrill Edge platforms.

The investment strategists of the American bank will begin covering four bitcoin ETFs in January 2026, according to press sources.

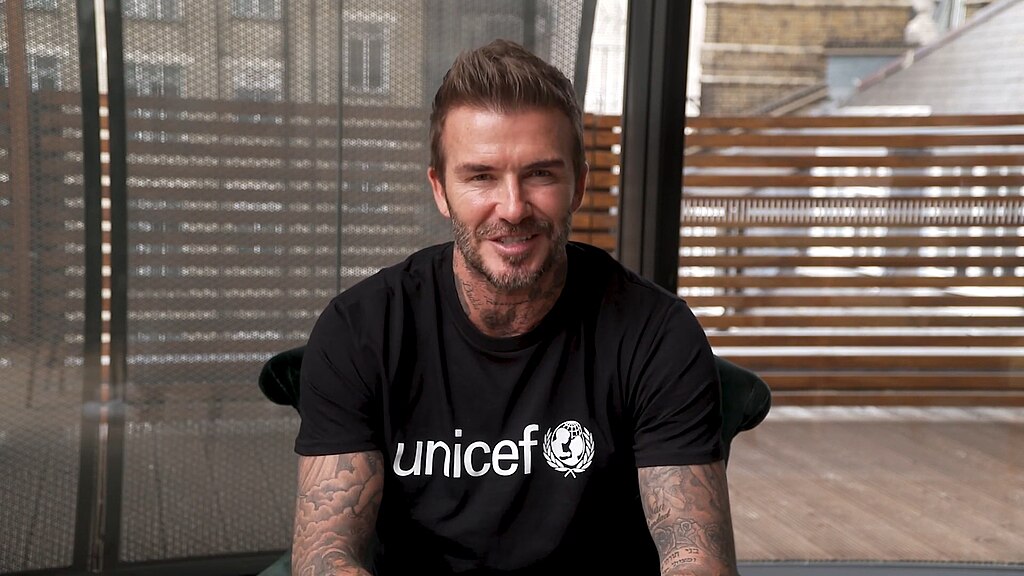

“For investors with a strong interest in thematic innovation and who are comfortable with high volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,” said Chris Hyzy, Chief Investment Officer of Bank of America Private Bank, in a statement.

“Our guidelines focus on regulated vehicles, a thoughtful allocation, and a clear understanding of both the opportunities and the risks,” he added.

Starting January 5, 2026, the bitcoin ETFs covered by the firm’s Chief Investment Officer will include the Bitwise Bitcoin ETF (BITB), Fidelity’s Wise Origin Bitcoin Fund (FBTC), Grayscale’s Bitcoin Mini Trust (BTC), and BlackRock’s iShares Bitcoin Trust (IBIT).

“The lower end of this range may be more appropriate for those with a conservative risk profile, while the upper end may be suitable for investors with greater tolerance for overall portfolio risk,” noted Hyzy.

Previously, wealthy Bank of America clients only had access to the products upon request, which meant that the bank’s network of more than 15,000 wealth advisors could not recommend exposure to cryptocurrencies, and many retail investors were forced to seek access through other sources.

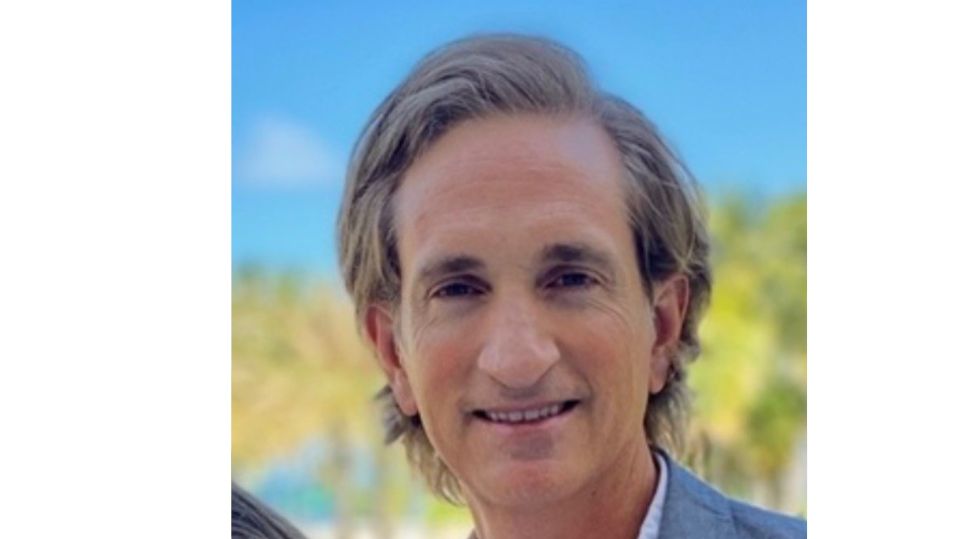

“This update reflects the growing demand for access to digital assets from clients,” added Nancy Fahmy, Head of the Investment Solutions Group at Bank of America.