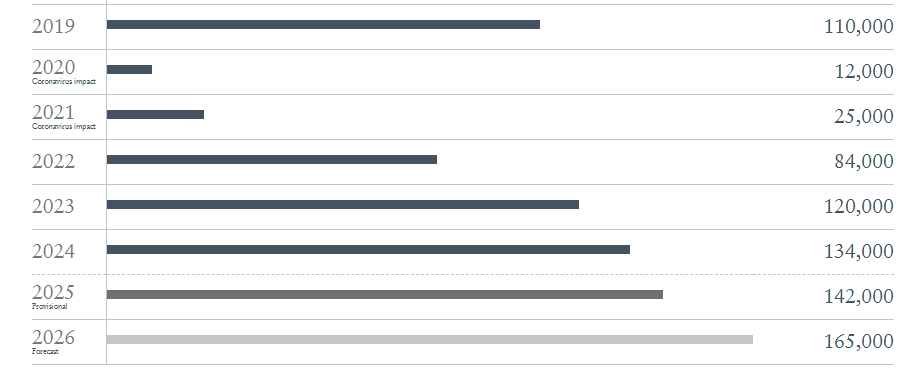

Throughout 2025, 142,000 millionaires will change countries. This figure represents the largest global movement of high-net-worth individuals recorded in recent history. According to the Henley Private Wealth Migration Report 2025, the United Kingdom tops the list of countries with the highest net loss of millionaires, with a projected 16,500 departures—far surpassing China, which, for the first time in ten years, falls to second place with 7,800.

This phenomenon, which reflects a profound shift in global elite mobility trends, is driven by tax changes, perceptions of political stability, and new investment opportunities in other destinations. “2025 marks a turning point. For the first time in a decade, a European country leads the millionaire exodus. This is not just about taxes, but about a deeper perception that opportunities, freedom, and stability lie elsewhere in the world,” says Dr. Juerg Steffen, CEO of Henley & Partners.

Key Trends

In addition to the United Kingdom, France, Spain, and Germany will also experience net losses of high-net-worth individuals in 2025, with projected outflows of 800, 500, and 400 millionaires, respectively. Other countries such as Ireland, Norway, and Sweden are beginning to show similar signs. By contrast, Switzerland is solidifying its position as one of the main wealth havens in Europe, with a net inflow of 3,000 millionaires, while Italy, Portugal, and Greece are set to experience record arrivals—driven by favorable tax regimes, high quality of life, and active investment migration programs. Meanwhile, Monaco, with more than 200 new millionaires, continues to attract the ultra-wealthy, particularly from the UK, Africa, and the Middle East.

On the global stage, the United Arab Emirates once again ranks as the most popular destination, with an estimated net inflow of 9,800 millionaires. It is followed by the United States (+7,500) and Saudi Arabia (+2,400), the latter on the rise thanks to the arrival of international investors and the return of nationals.

In Asia, Thailand is beginning to challenge Singapore’s dominance, with Bangkok emerging as a new regional financial hub. Hong Kong and Japan are also showing rebounds, while Taiwan and South Korea are facing significant outflows due to geopolitical tensions and economic factors.

In the Americas, flows to Costa Rica, Panama, and the Cayman Islands stand out, while Brazil leads the wealth exodus in Latin America with a net outflow of 1,200 millionaires, followed by Colombia (–150). The U.S., Portugal, and Costa Rica are among the top destinations for wealthy Latin Americans.

The British Case: From Wealth Magnet to “WEXIT”

Since the Brexit referendum in 2016, the United Kingdom has shifted from being a destination for millionaires to a net exporter of wealth. The projected outflow of 16,500 millionaires in 2025 is largely attributed to tax reforms introduced in the October 2024 budget, which significantly increased taxes on capital gains and inheritances and altered tax benefits for non-domiciled residents.

This mass departure has been dubbed “WEXIT” (wealth exit) and is prompting many affluent individuals to relocate to more favorable jurisdictions such as Dubai, Monaco, Malta, Switzerland, Italy, Greece, and Portugal.

“The UK has been the only country among the world’s top 10 economies to record a decline in millionaires since 2014, with a 9% drop, compared to an average growth of 40% across the rest of the group,” explains Prof. Trevor Williams, former chief economist at Lloyds Bank.

The Future of Wealth: Asia at the Center of the Board

Despite the challenges, Asia remains the world’s economic engine. While China and India continue to show net outflows, they are also showing signs of stabilization, driven by their tech and entertainment sectors. At the same time, Singapore and Japan are solidifying their roles as new wealth hubs, while South Korea and Taiwan illustrate how geopolitical tensions can influence the residency decisions of the ultra-wealthy.

“The wealth landscape in Asia is a mix of ambition and caution. Asia will remain at the heart of global wealth trends in 2025,” concludes Dr. Parag Khanna, author and founder of AlphaGeo.