Looking ahead and considering how private markets will evolve over the second half of the decade, it is important to assess some of the cyclical obstacles currently weighing on the market. According to the Preqin study “Private Markets in 2030,” private equity fund distributions have been relatively low in recent years, which has limited cash flows to Limited Partners (LPs) and, in turn, reduced investors’ willingness to commit capital to new funds. This stands in sharp contrast to the strong growth and accelerating activity in private markets when pandemic-era stimulus measures were in place in 2021.

Since the peak of the cycle in 2021, private markets have remained in a quiet phase, with only tentative signs of recovery in exit volumes. Looking five years ahead, Preqin expects that the recovery in exit volumes will help drive a new cycle within private equity—and private markets more broadly.

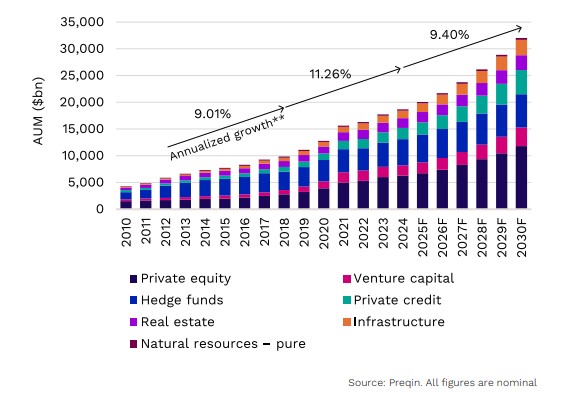

To such an extent that alternative assets under management are on track to reach $32.01 trillion globally by 2030, according to the report. The firm forecasts that the sector will recover from the current stagnation in exit volumes, which could mark the beginning of a new cycle in private markets, as detailed by Cameron Joyce, Director and Global Head of Research Insights.

Alternatives AUM expected to exceed $30tn in 2030F

Alternatives assets under management by asset class

Preqin experts identify five key trends in alternative markets for the next five years:

A New Cycle Should Emerge

We expect that the recovery in exit volumes will help drive a new cycle in the field of private equity and private markets more broadly. Scenarios that could trigger this new cycle include a reduction in official interest rates, continued convergence in asset valuations between buyers and sellers, and an ongoing structural shift in allocations from public to private markets.

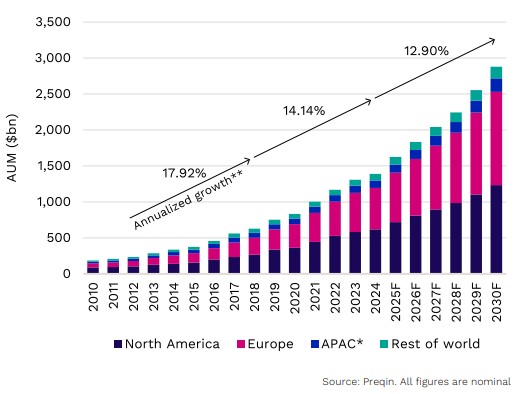

Infrastructure Moves to the Forefront

Infrastructure as an asset class is expected to accelerate in growth, with assets under management approaching $3 trillion by the end of 2030. Growth in Europe is expected to outpace that of North America in this area.

European infrastructure to grow fastest up to 2030F

Infrastructure AUM by region focus

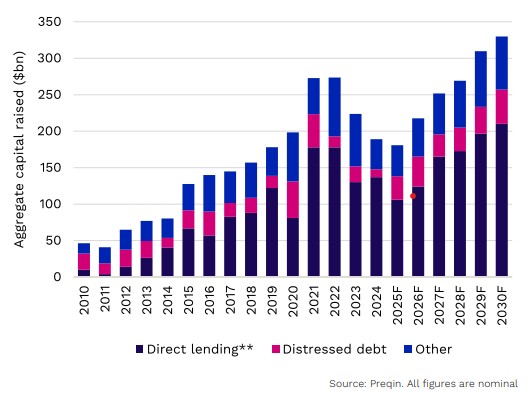

Private Credit Reaches Maturity

The firm also expects that the introduction of new, more liquid fund structures in private credit will support growth in assets under management within this asset class. At the same time, it anticipates that the continued expansion of private credit will enhance the sector’s ability to compete with the banking industry. Forecasts indicate that private credit will double its assets under management by 2030, with further growth potential driven by greater investor access and banking disintermediation.

Fundraising for distressed debt forecast to grow at faster rate than direct lending

Aggregate fundraising by sub-strategy