The AmAfore 2025 meeting will take place on November 12 and 13, and its program confirms the growing prominence of retirement savings in the global conversation on investments, private credit, and infrastructure.

With the participation of international leaders such as Scott Kleinman (Apollo), Michael Rees (Blue Owl), Michael Smith (Ares Credit Group), and Kirk Smith (GTCR), the event highlights Mexico’s role as a bridge between local institutional capital and major global asset managers. The presence of the AFOREs, along with Banxico, Hacienda, and CONSAR, reflects the interest in strengthening the sophistication of pension fund portfolios and incorporating advanced strategies in credit, private equity, and technology.

Retirement savings in Mexico continue to consolidate as one of the country’s main sources of institutional capital, currently representing 22% of GDP. According to figures from CONSAR as of September 2025, the AFOREs currently manage 438.412 billion dollars, of which 34.541 billion are invested in structured instruments—mainly CKDs and CERPIs—which allow them to participate in national and international private equity funds. This exposure represents 7.9% of the average portfolio; the AFORE with the highest participation reaches 11.4%, while the lowest stands at 4.8%.

Between December 2020 and September 2025, assets under management grew by 85% in dollar terms, rising from 237.196 billion to 438.412 billion. Of this increase, 76 percentage points are attributable to growth in pesos—driven by contributions and returns—and 9 points to the appreciation of the peso against the dollar.

The compound annual growth rate (CAGR) during this period is 13.8% in dollars. If this pace is sustained, the assets managed by the AFOREs could exceed 825 billion dollars by 2030—more than triple their size in 2020 and nearly double compared to 2025—consolidating the Mexican pension system as the main source of institutional capital in Latin America and strengthening its capacity to finance infrastructure, private credit, and long-term global funds.

Currently, Afore Profuturo is the largest in the system, managing 83.899 billion dollars, slightly ahead of Afore XXI-Banorte, which closed September with 83.678 billion dollars.

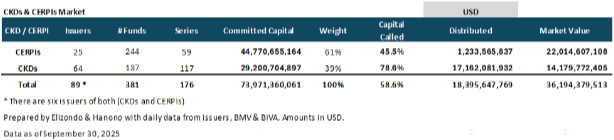

If the capital commitments of the CKDs and CERPIs are taken into account, the AFOREs’ equivalent exposure rises from 7.9% (market value) to 16.9% of the total portfolio. Together, these instruments reach a market value of 36.194 billion dollars and commitments of 73.971 billion, a difference explained by the participation of other institutional investors, such as insurance companies.

As of September 30, there are 244 CERPIs and 137 CKDs in operation. The CERPIs account for a market value of 22.015 billion dollars and commitments of 44.771 billion, while the CKDs register 14.180 billion in market value and 29.201 billion in commitments. Cumulative distributions amount to 17.162 billion dollars for CKDs and 1.234 billion for CERPIs.

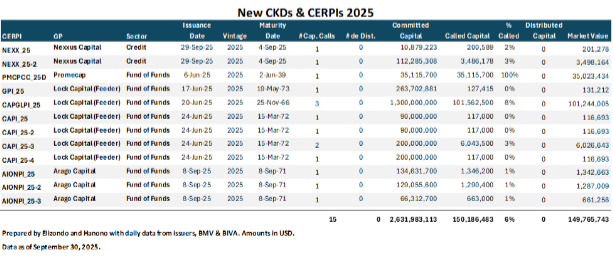

So far in 2025, two credit CKDs and ten CERPIs have been issued, which together represent commitments totaling 2.632 billion dollars.