At Its October Meeting, the U.S. Federal Reserve (Fed) Cut Rates by 25 Basis Points, as Expected, Setting the Target Range for Federal Funds at 3.75%-4.0%.

For experts, the most relevant point was that the statement accompanying this decision reiterated concern about the labor market’s development, noting that “the risks to employment have increased in recent months,” while maintaining more moderate language regarding inflation, describing it only as “slightly elevated.”

Powell has emphasized data dependence in 12 unique speeches in 2025. For Alexandra Wilson-Elizondo, global co-CIO of Multi-Asset Solutions at Goldman Sachs Asset Management, the conclusion of this meeting is clear: policy has been set on “autopilot,” following the trajectory outlined by the dot plot, unless new reliable data changes the outlook.

“A single moderate inflation release, well-anchored expectations, and anecdotal signs of cooling support a cautious stance toward rate cuts. If conditions hold, another 25 basis point cut is likely at the December meeting,” says Wilson-Elizondo.

In the view of Jean Boivin, Head of the BlackRock Investment Institute, the Fed reaffirmed that the softening of the labor market remains a key factor. “We see a weaker labor market as helping to reduce inflation and allowing the Fed to lower interest rates. U.S. private sector indicators and state-level unemployment claims point to greater moderation in the labor market, although without a sharp deterioration that would raise concerns about a more pronounced slowdown. We are monitoring alternative data sources while we await the end of the government shutdown to analyze the September and October data for confirmation,” notes Boivin.

Upcoming Cuts

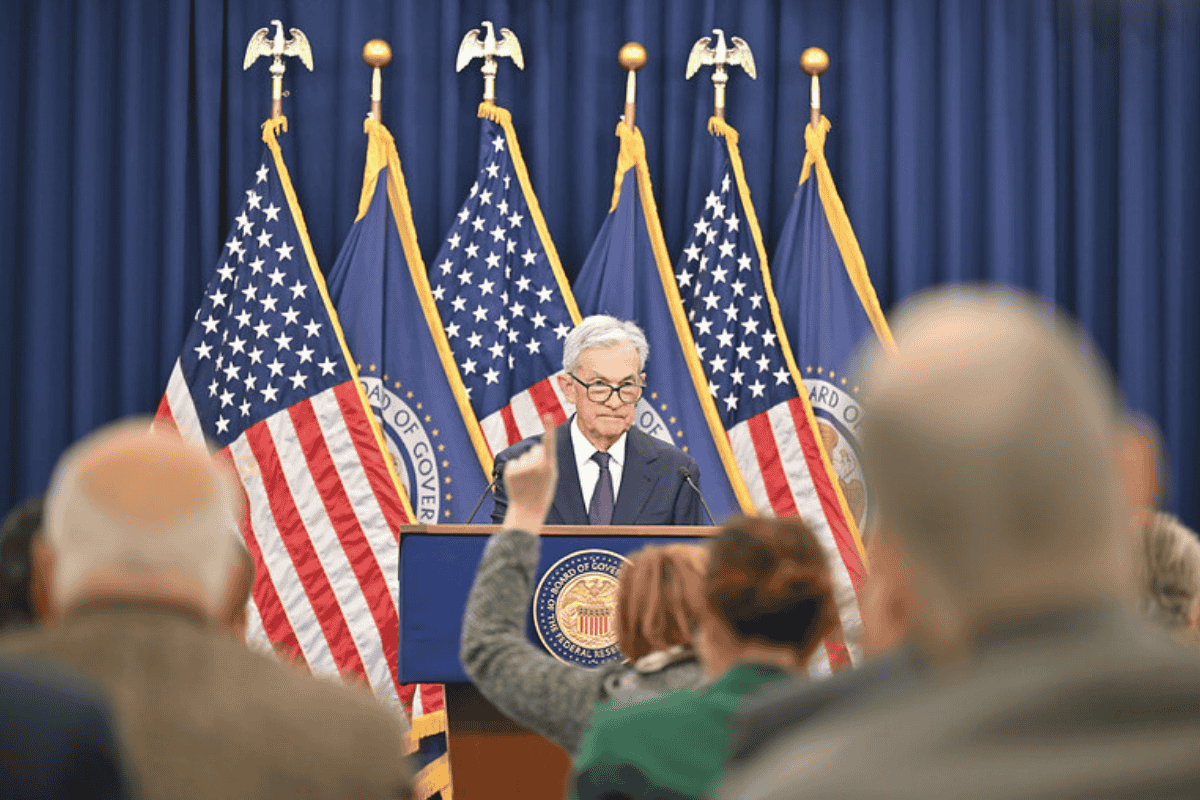

With this cut, justified by economic conditions, the Fed underlined its independence from political pressures. And despite having restarted the rate-cutting cycle, Powell was cautious during his remarks at the press conference following the meeting, stating that a rate cut in December is “far from a foregone conclusion,” which rattled markets that had already fully priced in a new cut.

“At the same time, the Fed acknowledged that the current government shutdown has limited access to economic data. This lack of visibility led the Fed to refrain from offering clear guidance on whether another cut will occur at the December 2025 meeting. Powell’s statements suggest that the Fed assumes the shutdown could extend through December 2025. Once the shutdown ends and macroeconomic data becomes available, we expect it to support a rate cut in December 2025,” adds Ray Sharma-Ong, Deputy Global Head of Multi-Asset Bespoke Solutions at Aberdeen Investments.

Tiffany Wilding, economist at PIMCO, interprets Powell’s clear statements on the December meeting as an effort to push back against market pricing. “Just before the October meeting, shorter-term federal funds futures contracts priced in a probability above 90% for a December cut. Powell’s comments worked. At the time of writing, the market-implied probability of a December cut has dropped to about 70%. A cut in December remains our base case, but with less certainty,” she explains.

Even with the Fed’s narrative around lack of data visibility, investment firms are confident that further rate cuts are coming. For example, UBS Global Wealth Management maintains its forecast of two additional cuts between now and early 2026—with improved liquidity continuing to support risk assets. For David Kohl, Chief Economist at Julius Baer, the October rate cut is a prelude to further reductions in the cost of money. “The FOMC reduced its benchmark interest rate and opened the debate about another cut at the next meeting. The differing stances within the FOMC and the lack of labor market data due to the government shutdown make it difficult to determine the interest rate path at this time. We continue to expect additional 25 basis point cuts at future FOMC meetings amid slower job growth,” he states.

“Powell also highlighted the two dissents in the FOMC decision as evidence that the Committee is not following a preset course. He reinforced this more hawkish tone by suggesting that data uncertainty. Looking ahead, we expect this lack of information to result in a more dovish stance. We foresee an additional cut before year-end, in line with this dynamic and with the revealed preference for a more accommodative stance, evidenced in the early end to QT,” adds Max Stainton, Senior Global Macro Strategist at Fidelity International.

The End of QT

In the view of Max Stainton, Senior Global Macro Strategist at Fidelity International, this accommodative (or dovish) stance was reinforced by the announcement of an early end to Quantitative Tightening (QT), now scheduled for December 1, with reinvestments in MBS to be redirected to Treasury bills starting on that same date.

“Although most analysts expected this announcement at the December FOMC meeting, recent tensions in funding markets appear to have unsettled the Committee about the possibility of increased interest rate volatility, caused by a slight shortage of reserves. Taken together, this continues to demonstrate the Fed’s shift toward greater attention to labor market developments,” he explains.

According to Eric Winograd, Chief U.S. Economist at AllianceBernstein, today’s decision to stop reducing Treasury holdings was not a surprise and should not have significant implications for markets or the economy. “The Fed will continue reducing its holdings of mortgage-backed securities (MBS), but maturities of these will be reinvested in Treasury bills, thus helping the Fed move toward a balance sheet composed solely of Treasury securities, as is its goal,” he indicates.

Regarding QT, he explains that it has largely proceeded as the Fed expected: in the background, with about $5 billion over recent months, and the change now announced is trivial. “Under the current framework for implementing monetary policy, the Fed seeks to maintain bank reserves at ample levels, which means not testing the lower bounds of the market’s tolerance for balance sheet reduction. In fact, the Fed’s balance sheet has already been reduced from a peak of approximately $9 trillion to the current $6.5 trillion,” he clarifies.

In essence, the end of quantitative tightening mainly affects the reserve structure and the functioning of the money market and says little about the future path of official interest rates. That said, the timetable outlined by the Fed disappointed markets, which were expecting earlier implementation in November 2025. “Equity and interest rate markets reacted negatively to Powell’s hawkish tone during the press conference, reinforcing the framework that bad news is good news: weaker economic data would likely lead to greater easing, which could support equity markets,” notes Sharma-Ong.