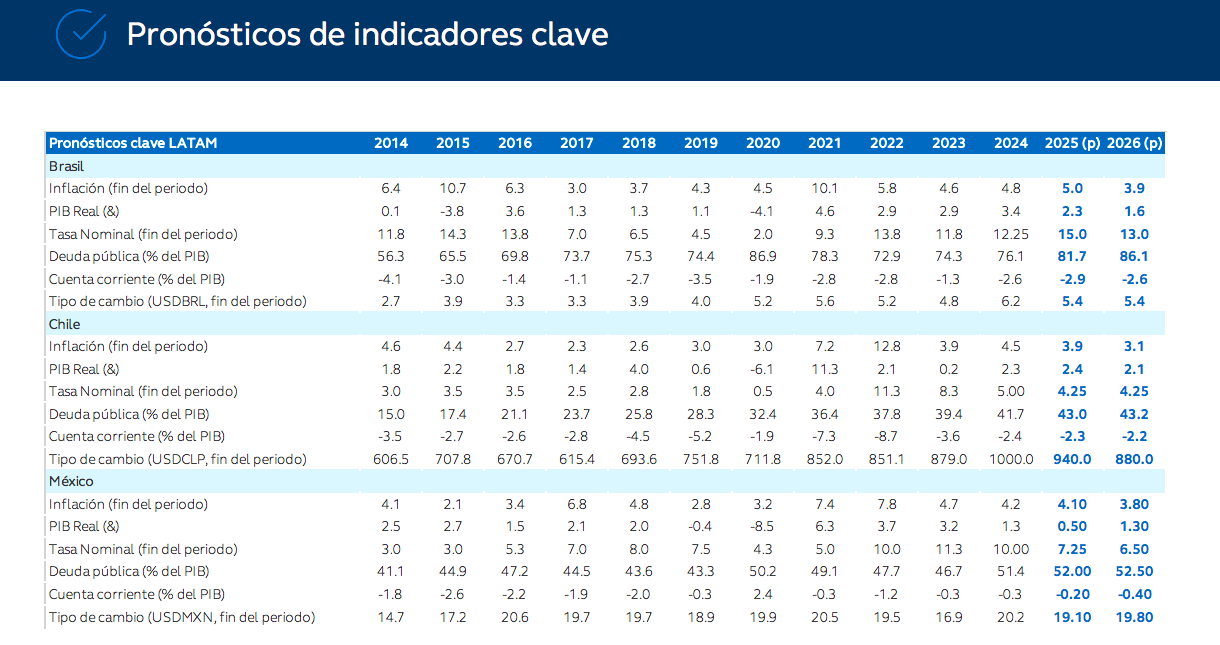

One of the most frequently repeated observations among experts from international asset managers is that Latin American countries are in a relatively advantageous position regarding tariff risks compared to other regions. However, according to Principal AM in its economic outlook, this reality could be changing, especially for Brazil and Chile.

“Although the impact on growth could be limited, uncertainties about the effects of tariffs could generate greater volatility in the region, precisely at a time when discussions around local elections are gaining importance. The good news could be related to inflation. With slower economic activity, if currencies remain stable thanks to a weaker dollar (DXY), tariff announcements could have a disinflationary effect in the region,” they point out.

Brazil: Maintaining the Pace

According to the asset manager, the most recent economic data confirmed that growth is slowing in Brazil. “Although second-quarter GDP surprised positively by growing 0.4% quarter-on-quarter, the underlying details point to a broader economic slowdown, with weakening in both consumption and investment. More importantly, preliminary data from July and August suggest a more pronounced slowdown in the third quarter,” they comment.

Looking ahead, they highlight that the short-term inflation outlook remains favorable. As a result, they maintain that the good performance of the exchange rate and the sharp slowdown in wholesale inflation point to a downward bias for inflation in the coming months. “As a result, inflation expectations for 2025 have continued to decline in recent weeks, while long-term expectations remain unanchored. In this scenario, the likelihood increases that the Central Bank will begin a monetary easing cycle in the coming months. Despite the need to maintain tight monetary restrictions, the slowdown in activity and the behavior of inflation allow some room for initial easing. We adjusted our projection for the start of rate cuts to the first quarter of 2026, with a terminal rate of 13% by year-end,” they add.

Chile: Contraction Due to Temporary Factors

In the case of Chile, the report from Principal AM highlights that economic activity grew 1.8% year-over-year in July, slightly below the market’s median expectation of 1.9%, marking the weakest expansion since February. Meanwhile, in August, inflation posted a monthly variation of 0.0%, surprising on the downside relative to expectations. As a result, headline inflation dropped from 4.3% in July to 4% year-over-year, accumulating 2.9% so far in 2025.

“Activity grew 1% compared to the previous month and 2.3% year-over-year, reflecting some resilience but also signs of a slowdown. The decline in the mining sector was one of the main factors behind the result; however, much of this contraction is linked to temporary factors, such as the effects of international tariffs and the accident at the El Teniente mine, suggesting that recovery in the sector may take longer, although the medium-term outlook remains favorable,” it explains.

According to the asset manager’s view for Chile, although headline inflation remains on track to converge to the 3% target by the third quarter of 2026, “the process will be slower and will depend on the evolution of domestic demand and labor costs, leaving monetary policy in a neutral and data-dependent stance in the coming months.”

Mexico: Expansion Continues

Lastly, in the case of Mexico, the asset manager highlights in its outlook that the final estimate for second-quarter 2025 GDP confirmed that the economy expanded for the second consecutive quarter, with a 0.6% quarterly growth (seasonally adjusted) and 1.2% year-over-year (adjusted). “Although slightly below the preliminary estimate (0.7% quarterly), the result still points to a stronger transition into the second half of the year. GDP growth in the second quarter was driven mainly by heterogeneous dynamics within the services sector, supported by stable real wages and household incomes. Cumulative growth so far this year stands at 0.9% for the first half of 2025, suggesting that the economy has managed to avoid a mild contraction despite persistent challenges,” the report notes.

On inflation, the document indicates that the rebound seen in August was due to “base effects.” It observes that inflation in services remains elevated, reflecting a resilient tertiary sector, while goods prices continue to face cyclical and supply chain pressures, as recent business surveys suggest.

“Looking ahead, if headline and core inflation remain near current levels, it is likely that the easing cycle will continue, especially considering that the slowdown in the U.S. labor market gives the Fed room to resume its own rate cuts,” the document concludes.