After ten years of U.S. equity dominance, asset managers emphasize that this year’s resurgence in European equities remains intact. In their view, the factors that make it attractive are still valid: more reasonable valuations, a favorable monetary policy from the European Central Bank (ECB), and unprecedented fiscal stimulus measures.

According to Aneeka Gupta, Director of Macroeconomic Research at WisdomTree, we’ve seen a paradoxical first half of the year. In her analysis, 2025 was the year in which U.S. stock markets underperformed their international rivals by the widest margin since 1993. “Suddenly, it became fashionable to talk about how the era of American exceptionalism was coming to an end, as uncertainty rose around Trump’s tariff policies, along with the growing fiscal deficit, a weakening U.S. dollar, and the unveiling of DeepSeek,” she notes.

As a result, Europe emerged as the region making a major comeback in 2025. “Eight of the most profitable stock markets in the world were European, thanks to lower energy costs and the loosening of fiscal rules in Germany. The U.S. had outperformed Europe over the past five years by nearly 23.5% (measured in dollars), due to stronger earnings growth,” Gupta points out.

With this context in mind, the WisdomTree expert believes that equity risk premiums now show a wide gap: “Approximately 2% in the United States, 6% in Europe, and 7% in Japan and the broader emerging markets universe. Over the next twelve months, asset allocation decisions will depend on these valuation cushions, policy divergences, and the evolution of trade alliances.”

Don’t Overlook Europe

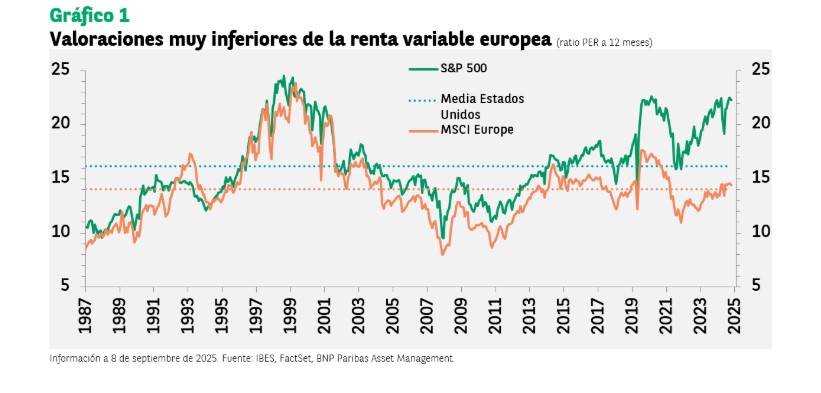

“In our view, attractive valuations make a strong case for European equities: they are currently trading at a substantial discount compared to the U.S. market. The twelve-month forward price-to-earnings ratio of the MSCI Europe index is currently at 14.6, slightly above its average since 1980, which is 14. By contrast, in the United States, valuations are approaching historic highs, with an expected earnings ratio of 22 times. In addition, the average dividend yield in Europe is approaching 3.3%, which far exceeds the U.S. average of around 1.3%,” argues BNP Paribas AM.

Despite Europe’s greater prominence this year, Hywel Franklin, Head of European Equities at Mirabaud Asset Management, believes it remains “a forgotten opportunity” on a structural level. According to his analysis, for much of the past decade, investors have overlooked this market, distracted by the extraordinary momentum of high-growth U.S. stocks. “Today, the difference between the two is quite striking. A single large-cap U.S. company now carries more weight in global indices than the entire stock market of any individual European country. That imbalance in attention is precisely what makes Europe so interesting,” Franklin comments.

Even after its strong performance so far this year, the Mirabaud AM executive considers that valuations remain attractive, both in absolute terms and relative to the U.S., reflecting the extreme levels of skepticism that have already been priced into European equities. “And here’s the key point: in the small and mid-cap (SMID) market, one in three companies is still trading more than 60% below its historical high. That’s not a market that’s ‘gone too far’; it’s a market with enormous recovery potential,” he argues.

Not Ignoring the U.S.

That said, the S&P 500 index continues to reach new all-time highs almost daily, despite the macroeconomic slowdown. “The U.S. equity market is experiencing a strong upswing, driven primarily by its tech giants and supported by solid fundamentals, an upcoming easing cycle, and a resilient global economic outlook,” notes Yves Bonzon, CIO of Julius Baer.

In his view, the fundamentals of U.S. companies also showed a strong earnings season and, on the other hand, the AI boom is gaining momentum, with both startups and established giants making bold bets on the growth and reach of this revolutionary technology.

“In addition to earnings optimism, U.S. companies continue to be models in capital return to shareholders. Share buyback authorizations in the United States reached one trillion dollars by the end of August 2025, compared to less than 900 billion dollars at the same time last year,” Bonzon comments.

Equities: Unstoppable?

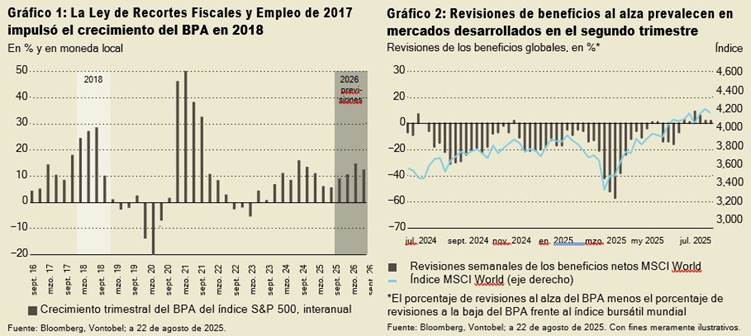

What is clear for asset managers is that equities continued to climb the “wall of worry” during what is usually a quiet summer period in the Northern Hemisphere, with most regional indices hitting all-time highs in local currencies. As explained by Mario Montagnani, Senior Investment Strategist at Vontobel, the bullish sentiment is based on a strong second-quarter earnings season, optimistic forecasts, relief from tariff uncertainty, rate cuts, anticipated leadership changes at the Fed, and expected 2026 stimulus measures that could boost earnings per share (EPS) as in 2018.

“The earnings season delivered solid surprises with minimal tariff effects, marking a turning point in momentum and suggesting that previous revisions may have been too pessimistic. Looking ahead, earnings surprises are likely to play a key role in stock performance, given high valuations,” adds Montagnani.

However, the Vontobel strategist acknowledges that inflation remains the main driver of equity market developments. “Billions in tariffs now impact the U.S. economy each month, but who really bears the cost? The pass-through to consumer prices is more nuanced than many assume. Tariffs do not automatically get passed on to consumers. Their impact depends on factors such as a company’s competitive position, demand elasticity, distribution model, time lags, and supply chain structure,” he notes.

In his view, this is evident in “the U.S. Producer Price Index (PPI28) data, where importers often absorb the initial impact through margin pressure, and the historical correlation between the PPI and the U.S. Consumer Price Index (CPI29) has been weak, suggesting that producer prices are not a reliable predictor of consumer inflation.”