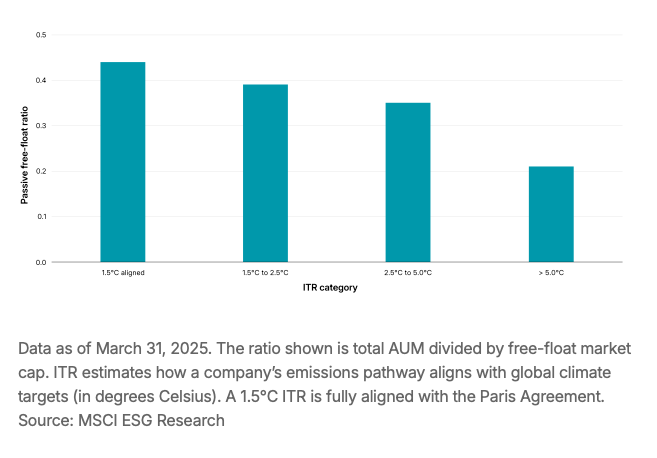

Similarly, companies within the MSCI S&C Indexes that exhibited a lower “MSCI Implied Temperature Rise (ITR)” were associated with higher indexed flows, again adjusted for company size. Companies with an ITR aligned to 1.5 °C attracted more than twice the passive flows compared to those with a misaligned ITR above 5.0 °C.

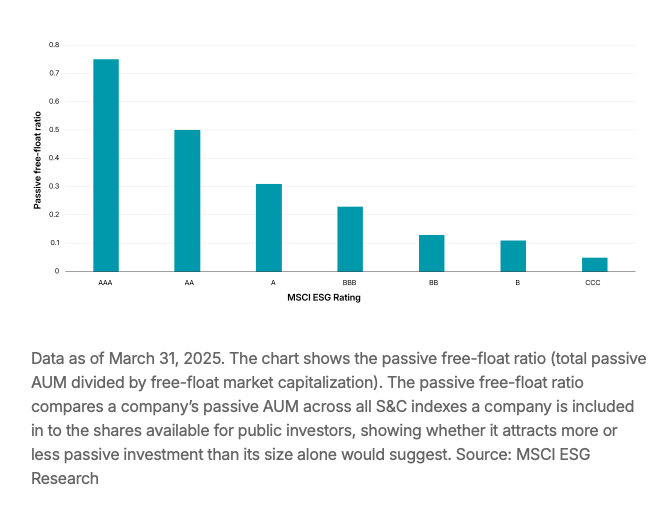

MSCI has long noted empirical, long-term evidence of the financial benefits for companies that effectively manage their sustainability risks, including outperformance in equity markets, lower option-adjusted credit spreads, and more stable revenues and cash flows. With over one trillion dollars in assets under management (AUM) now benchmarked to MSCI’s S&C Indexes, these reference indices are increasingly shaping actual capital flows.